Content

- Blockchain Payments: 5 Advantages Of Using Blockchain For B2b Payments

- What Is Blockchain Technology?

- Understanding Blockchain And Its Impact On Accounting

- How Will Blockchain Technology Affect The Accounting Industry?

- Cryptio Launches New Version Of Crypto Accounting Software Platform

- Essential Features Of Crypto Accounting Software

- How Will Blockchain Technology Transform The Profession?

As all listings are decentralized and sealed using cryptography, the possibilities of tampering with them to conceal activity are practically unattainable. This is precisely the same as the transaction being validated by an attorney — exclusively in a computerized way. This will enable audit professionals to validate a vast amount of data in a short period. Blockchain also used in accounting services that are concerned with the transfer of ownership of assets and maintaining a ledger of certain financial transactions. SARA Technologies offers the most accessible and most efficient blockchain accounting software to manage your organization accounts and ledgers, without the risk of data tampering. To have the suite of skills needed in 2021 and beyond, having an understanding of how blockchain technology affects audits is important.They will serve as the link between those who develop and apply the blockchain technology and their business stakeholders. With blockchain there is no need to confirm accuracy or existence of transactions with external sources. This means the auditor’s focus can shift to how those transactions are recorded and recognized in financial statements and how elements such as valuations are decided. The value of its blockchain-based cash flow management and analytics platform will be in single-ledger accounting.Our reputation lies in building lasting relationships with our clients, and a focus on delivering value in all we do. Let us apply our world-class capabilities to your fiscal and business goals. Tax is a crucial and inevitable part of business, and all the business owners, either big or small, need to pay the stipulated amount as per the local tax governing authority or IRS. We all are aware of the complexities of the tax world and know handling tax filing complexitiesis not everyone’s cup of tea… It often put the business models and customers in a dilemmatic situation whether their information is in safe hands or it is in on the edge of threshold to get stolen or at the risk of getting attacked digitally… Upon its enactment in March, the American Rescue Plan Act introduced many new tax changes, some of which retroactively affected 2020 returns.Bitcoin wallets present unique challenges due to the UTXO structure where a single transaction can have multiple outputs. And Ethereum can be even more complex, due to internal transactions and smart contract transactions where there may be multiple inputs and outputs. Automatically track your realized and unrealized crypto gains and losses, with cost basis details, live market rates, and more. I’m thinking also about what I learned from the IT part of the BEC section of the CPA Exam about internal controls and really wanting to learn more about that. I think there is still a great amount of fear about blockchain or the machines kind of taking over the role of the CPA, and that’s not going to happen.

Blockchain Payments: 5 Advantages Of Using Blockchain For B2b Payments

An ideal crypto accounting solution should also provide a way to send invoices to customers, record bills from vendors, and link payment transactions to the invoice or bill. You might think you’ll be able to easily manage my crypto transactions in QuickBooks or Xero.The money is then transferred from company X to company Y, and the transaction is complete. The security of the blockchain prevents a hacker from acting as an authorized member of the network. Another way that blockchain technology-based accounting will create new jobs is by increasing the industry’s scope. Now that reconciliations and uncertainty over accounting history won’t be major problems, other service opportunities will arise. Accounting firms could perhaps make more complex calculations as part of this expansion of scope. They may even be able to ascertain the value of data that a company owns, providing greater forecasting and additional opportunities for funding.

How is Bitcoin useful to accountants?

Cryptocurrency Basics Cryptocurrencies are recognized as being safer than traditional payment methods, especially when so many financial transactions are taking place online. They also allow for easier international transactions that are not subject to fluctuating exchange rates, Investopedia noted.Before the power of crypto accounting software, it was difficult to see all of your outgoing and incoming transactions in one place. They might be scattered across many different wallets, exchanges, or within these various organizations. Transfers between multiple wallets and exchanges, with cost basis automatically tracked. For on-chain transactions, add hash IDs for linking to the relevant block explorer. With smart contracts, transactions automatically go through when certain conditions are met. This helps accounting professionals and organizations automate jobs like payroll and reconciliations.This would save organizations on costs linked to manual entry errors such as administrative expenses.

What Is Blockchain Technology?

It records transactional data in a way that’s almost impossible to manipulate. Because blockchains are resistant to modification and can efficiently and permanently record information between two parties, it is an excellent system for audits, which are basically dominated by large accounting firms. For smaller firms, blockchain must prove capable in accounting, bookkeeping and tax and client services. That’s a niche PayPie, Gilded and other blockchain developers seek to fill, the Accounting Today article said. For example, Arrowsmith says Gilded recently released an accounting and finance platform built around blockchain that handles invoicing, payments, and accounting and tax reporting for cryptocurrency. It is one of the first blockchain applications that can be used today by accountants.

Understanding Blockchain And Its Impact On Accounting

• Being a service auditor for a blockchain used by a consortium of companies to ensure the controls on a blockchain. The Ionic update marks a huge technical innovation in indexing and processing on-chain data. The key to this has been Cryptio’s direct relationships with the Layer 1 blockchain foundations. Thousands of applications are being built on top these foundational blockchains, especially in the DeFi and NFT space, and Cryptio is building the back-office infrastructure in tandem with this growing ecosystem. The improved traceability of blockchain will make auditing faster and easier. This article and related content is the property of The Sage Group plc or its contractors or its licensors (“Sage”).

How Will Blockchain Technology Affect The Accounting Industry?

Think of a token as a digital version of a vehicle that is used to record and track transactions from the ERP system to the blockchain accounts and ledger; the same process is undertaken for each transaction. A smart contract can be encoded with an obligation token to execute a payment once certain conditions are met (e.g., the payment due date has been reached). The distributed ledger created using blockchain technology is unlike a traditional network, because it does not have a central authority common in a traditional network structure . Decision-making power usually resides with a central authority, who decides in all aspects of the environment. Access to the network and data is subject to the individual responsible for the environment. Blockchain technology can help reduce the costs of the maintenance and reconciliation of various ledgers. Since it provides certainty over the ownership and history of any assets, it could eventually bypass the need to keep records as accountants do today.

What is the biggest blockchain company?

What it does: As mentioned earlier, IBM is the largest company in the world embracing blockchain. With over $200 million invested in research and development, the tech giant is leading the way for companies to integrate hyperledgers and the IBM cloud into their systems.It’s not clear how long organizations will take to adopt block-chain and alternative accounting information systems due to the numerous aforementioned challenges. In the interim, CPAs should commit to learn about the technology, experiment with it and participate in its innovation. Each account in the double-entry system will have a corresponding blockchain account. Basically, when a company purchases inventory from a supplier on account, a journal entry debiting inventory and crediting accounts payable for “X” amount is entered in the ERP system. A corresponding entry is made simultaneously to the blockchain accounts and ledger using a token.

Cryptio Launches New Version Of Crypto Accounting Software Platform

Please do not copy, reproduce, modify, distribute or disburse without express consent from Sage. This article and related content is provided as a general guidance for informational purposes only. This article and related content is not a substitute for the guidance of a lawyer , tax, or compliance professional.

- These often require the implementation of regulatory requirements, which are sometimes hard to implement but necessary for compliance.

- We have handled more than 80% of blockchain development projects in both domestic and international operations.

- Contrary to what may be supposed of tech erasing opportunities, the automation of auditing allows for bookkeepers and accounting professionals to increase their advisory services to interpret results and train clients.

- This is done securely using a consensus protocol, or a set of rules based on mutual agreement.

- Think of a token as a digital version of a vehicle that is used to record and track transactions from the ERP system to the blockchain accounts and ledger; the same process is undertaken for each transaction.

- I think there is still a great amount of fear about blockchain or the machines kind of taking over the role of the CPA, and that’s not going to happen.

It could also be the tool to provide absolute certainty to the ownership of assets. For example, a debtor’s position could be all but guaranteed due to blockchain technology, which would serve as the middleman in place of a lawyer or other authorized professional to verify data. However, the recoverable value of the asset and its economic worth would still need to be ascertained. Similarly, the ownership of assets will be easily verifiable within the blockchain blocks, but its true worth, condition, and location would still need to be assured. Additionally, due to its ability to share and record data of all kinds, it’s a much better alternative to current standards. Entirely new applications and software can be created using blockchain technology, which can authenticate transactions better than existing applications. We’re a team of developers and CPAs who believe that the future of finance is global, open and powered by blockchain.

Essential Features Of Crypto Accounting Software

New technologies have traditionally faced adoption challenges (e.g., EDP and ERP systems). Therefore, it is not surprising that organizations have not yet embraced blockchain technology in general, and distributed ledger technology specifically.

Major Reasons To Join The Sage Accountants Network

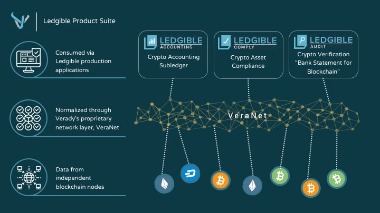

Today, the use of blockchain in the financial field is still largely in an investigative stage. Those who work in accounting don’t yet need to know all of the ins and outs of blockchain technology, but it’s definitely time to keep an eye on developments at least within your organization. Companies such as Verady have already created bridge technology between crypto assets, exchanges and accounting software.Software that utilizes blockchain technology would simply provide more efficiency, optimization, record permanence, and transparency. With more accounting firms looking to grow their advisory services or other specialties, blockchain technology might serve as a sort of catalyst toward that goal. Blockchain as technology is a database that is distributed across a network of computer nodes. All transactions are checked for validity by the nodes in the network then stored on a block with a unique code called a hash. Because each new block is built from the verification of previous blocks, it becomes impossible to change or tamper with information recorded.Drilling down to accounting specific applications, there are three major takeaways where blockchain will have the greatest impact that you need to be ready for. The first two are where we will see the disruptive change happen and the third is the transformation change that you need to position yourself to leverage.The company yet relies on mutual control mechanisms, balances, and checks to attain its everyday objectives. There is a duplication of efforts in a well-organized approach, periodical controls, and widespread documentation, among other concerns. A majority of them are labor-intensive, hand-operated tasks that are far away from being mechanized. Fraud will be reduced because the blockchain is difficult to penetrate and even harder to manipulate. Sage Intacct Construction Native cloud technology with real-time visibility, open API, AICPA preferred. Adoption time frame and rate.The technology requires substantive resources to implement and a lack of awareness and understanding undermine the rate of adoption. System design.Organizations will need to determine the number of roles and level of involvement of each role in the transaction validation process, given the voluminous amounts of transactions processed each year.Whatever your stance, it’s hard to ignore the growing number of organizations accepting cryptocurrency. This has made blockchain accounting a hot topic, especially for those in the accounting profession. Schools and big accounting firms like Deloitte are already educating on blockchain accounting. The implications of blockchain for the accounting profession are many, according to an article on the ICAEW website. It has the potential to reduce the costs of processing and maintaining ledgers.You may have heard or seen references to companies tracking supplies on the blockchain or smart contracts being executed on the blockchain. Blockchain technology has the potential to replace the 500-year-old double-entry accounting system. Blockchain distributed ledger technology would popularize the triple-entry accounting system. Though mainstream adoption isn’t happening any time soon, it’s becoming increasingly important to understand how blockchain technology can change many aspects of tax season preparation as you know it. Making changes to a record on a distributed ledger is highly impracticable as the performer would need to perform the same move on all the copies of the entire blockchain network – concurrently. Claiming that blockchain is a piece of tech that is based on accountancy wouldn’t be a stretch. Blockchain presents an approach for transactions and cash flow recording along with accounts storing assets.