Content

- How To Derive Financial Ratios

- Limits Of The Accounting Equation

- Other Liabilities

- Video Explanation Of The Balance Sheet

- What Are The 3 Elements Of The Accounting Equation?

- Understanding Total Liabilities

Gain the confidence you need to move up the ladder in a high powered corporate finance career path. Return on Invested Capital – ROIC – is a profitability or performance measure of the return earned by those who provide capital, namely, the firm’s bondholders and stockholders. A company’s ROIC is often compared to its WACC to determine whether the company is creating or destroying value.Treasury stock represents the cost of any shares you repurchased from investors. For example, assume your small business has $30,000 in accounts payable, $25,000 in unearned revenue and $95,000 in notes payable. Subtract total stockholders’ equity from total assets to calculate total liabilities. In this example, subtract $2,000 from $10,000 to get $8,000 in liabilities. This means that $8,000 of assets are paid for with liabilities, or debts, to the company. A company’s liabilities include every debt it has incurred. These may include loans, accounts payable, mortgages, deferred revenues, bond issues, warranties, and accrued expenses.This account includes the amortized amount of any bonds the company has issued. Companies will generally disclose what equivalents it includes in the footnotes to the balance sheet. Enter your name and email in the form below and download the free template now! You can use the Excel file to enter the numbers for any company and gain a deeper understanding of how balance sheets work.

How To Derive Financial Ratios

And finally, current liabilities are typically paid with Current assets. Add the items in the stockholders’ equity section of the balance sheet to calculate total stockholders’ equity.

Limits Of The Accounting Equation

A company’s financial risk increases when liabilities fund assets. Under the umbrella of accounting, liabilities refer to a company’s debts or financially-measurable obligations. Net Working Capital is the difference between a company’s current assets and current liabilities on its balance sheet. This line item includes all of the company’s intangible fixed assets, which may or may not be identifiable.

How is liquidity ratio calculated?

Current Ratio = Current Assets / Current Liabilities They are commonly used to measure the liquidity of a and current liabilities line items on a company’s balance sheet. Divide current assets by current liabilities, and you will arrive at the current ratio.The current ratio formula can be used to easily measure a company’s liquidity. Using the previous example, your total liabilities and stockholders’ equity equals $150,000 plus $450,000, or $600,000. If your total assets also equal $600,000, your balance sheet is properly balanced. Total liabilities and stockholders’ equity equals the sum of the totals from the liabilities and equity sections. Businesses report this total below the stockholders’ equity section on the balance sheet. To check that you have the correct total, make sure your result matches your total assets on the balance sheet. The accounting equation states that a company’s total assets are equal to the sum of its liabilities and its shareholders’ equity.

Other Liabilities

However, there are several “buckets” and line items that are almost always included in common balance sheets. We briefly go through commonly found line items under Current Assets, Long-Term Assets, Current Liabilities, Long-term Liabilities, and Equity. In a nutshell, your total liabilities plus total equity must be the same number as total assets. If both sides of the equation are the same, then your books “balance” and are said to be correct. To calculate total liabilities in accounting, you must list all your liabilities and add them together.In isolation, total liabilities serve little purpose, other than to potentially compare how a company’s obligations stack up against a competitor operating in the same sector. However, they are classified separately on the Balance Sheet because of the fact that external stakeholders look at both liabilities as well as the total debt position of the business. A very major component of total liabilities is considered to be debt. Debt can be defined as an amount that the company has undertaken from another organization for a specific purpose.”Accounts payable” refers to an account within the general ledger representing a company’s obligation to pay off a short-term debt to its creditors or suppliers. Other long-term liabilities are debts due beyond one year that are not deemed significant enough to warrant individual identification on the balance sheet. However, the total liabilities of a business have a direct relationship with thecreditworthinessof an entity. In general, if a company has relatively low total liabilities, it may gain favorable interest rates on any new debt it undertakes from lenders, as lower total liabilities lessen the chance ofdefault risk. Some of the major examples of liabilities include payments that need to be made to the suppliers, accrued utility bills, as well as long-term contractual loans that the company has taken on. Depending on the timeline of settlement, they are subsequently categorized as Current or Non-Current Liabilities.

Video Explanation Of The Balance Sheet

For example, assume that current assets are $3,000 and non-current assets are $7,000. Assets represent the valuable resources controlled by the company, while liabilities represent its obligations.For the particular year where the installment and the interest charge is supposed to be repaid, the part of the debt is classified as a Current Liability. The remaining portion of the debt, which is due after a period of 12 months, is still categorized as Non-Current Liability. Depending on the agreement between the debt holder and the bank, repayment of the debt can vary from situation to situation. However, generally, the debt is repaid in the form of installments and an interest charge every year. He is also the author of Narrative Generation, a book on narrative design and strategy for businesses, NGO’s, nonprofits, and more. Owner contributions and income result in an increase in capital, whereas withdrawals and expenses cause capital to decrease. Being an inherently negative term, Michael is not thrilled with this description.

- However, they are looked at individually, as well as from an aggregated perspective.

- This means that $8,000 of assets are paid for with liabilities, or debts, to the company.

- In this example, subtract $2,000 from $10,000 to get $8,000 in liabilities.

- Accounts receivableslist the amounts of money owed to the company by its customers for the sale of its products.

- Total assets will equal the sum of liabilities and total equity.

Both liabilities and shareholders’ equity represent how the assets of a company are financed. If it’s financed through debt, it’ll show as a liability, but if it’s financed through issuing equity shares to investors, it’ll show in shareholders’ equity. Equity refers to the owner’s value in an asset or group of assets.

What Are The 3 Elements Of The Accounting Equation?

It is mostly long-term in nature, but this amount is representative of something that is owned by the company. Current Liabilities mainly include the payments that the company has to make over the period of 1 year.

How is your net worth calculated?

Calculate your net worth and more. Net worth is the value of all assets, minus the total of all liabilities. Put another way, net worth is what is owned minus what is owed. … The value of any other real estate you may own.This basic accounting equation “balances” the company’s balance sheet, showing that a company’s total assets are equal to the sum of its liabilities and shareholders’ equity. This formula, also known as the balance sheet equation, shows that what a company owns is purchased by either what it owes or by what its owners invest .As companies recover accounts receivables, this account decreases, and cash increases by the same amount. The asset is equal to the sum to all assets, i.e., cash, accounts receivable, prepaid expense, and inventory, i.e., $234,762 for the year 2014. Accounts ReceivableAccounts receivables refer to the amount due on the customers for the credit sales of the products or services made by the company to them. It appears as a current asset in the corporate balance sheet.Identifiable intangible assets include patents, licenses, and secret formulas. Unidentifiable intangible assets include brand and goodwill. Balance sheets, like all financial statements, will have minor differences between organizations and industries.A general ledger is the record-keeping system for a company’s financial data, with debit and credit account records validated by a trial balance. Think of retained earnings as savings, since it represents the total profits that have been saved and put aside (or “retained”) for future use. Assets include cash and cash equivalentsor liquid assets, which may include Treasury bills and certificates of deposit. Financing through debt shows as a liability, while financing through issuing equity shares appears in shareholders’ equity. A liability is something a person or company owes, usually a sum of money. Debt is mostly interest-bearing, unlike other liabilities of the company.The shareholders’ equity number is a company’s total assets minus its total liabilities. On the balance sheet, total liabilities plus equity must equal total assets.The three primary sections of a balance sheet are assets, liabilities and stockholders’ equity. Liabilities and equity are the two sources of financing a business uses to fund its assets. Liabilities represent a company’s debts, while equity represents stockholders’ ownership in the company. Total liabilities and stockholders’ equity must equal the total assets on your balance sheet in order for the balance sheet to balance. You can calculate this total and review your liabilities and equity to see how you finance your small business.

More Definitions Of Adjusted Total Liabilities

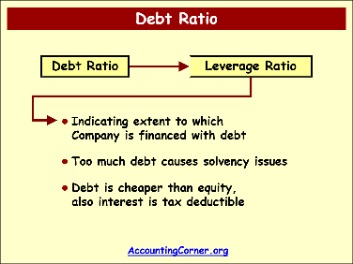

Debt Ratio is a financial ratio that indicates the percentage of a company’s assets that are provided via debt. It is the ratio of total debt (long-term liabilities) and total assets (the sum of current assets, fixed assets, and other assets such as ‘goodwill’).