Content

- Analyze Transactions

- The Journal In Investing And Trading

- Software Features

- What Is Double Entry Bookkeeping And How’s It Fit In General Ledger?

- How To Write A Journal Entry

- Journal Entries

- Other Types Of Accounting Journal Entries

Single-entry accounting is more like using a checkbook than an accounting journal, although businesses will still want to keep receipts and the details about their financial transactions. Since there are so many different types of business transactions, accountants usually categorize them and record them in separate journal to help keep track of business events.Reconciliation is an accounting process that compares two sets of records to check that figures are correct, and can be used for personal or business reconciliations. Journaling is an essential part of objective record-keeping and allows for concise reviews and records-transfer later in the accounting process. Journals are often reviewed as part of a trade or audit process, along with the general ledger. These are a few examples of common journal entries for a typical small business. A compound journal entry occurs when more than two accounts are involved in a journal entry.

- A journal states the date of a transaction, which accounts were affected, and the amounts, usually in a double-entry bookkeeping method.

- Journal entries list vital data, such as how much was credited and debited, when and from which accounts.

- The above information is an overview of how journal entries work if you do your bookkeeping manually.

- This will go on the debit side of the Supplies T-account.

- T-accounts are a visual representation of the general ledger account.

For example, Payroll may entail a large number of journal entries, which can be simplified into compounded form as a summary. You paid “on account.” Remember that “on account” means a service was performed or an item was received without being paid for. You made a purchase of gas on account earlier in the month, and at that time you increased accounts payable to show you had a liability to pay this amount sometime in the future.

Analyze Transactions

Apr. 25You stop by your uncle’s gas station to refill both gas cans for your company, Watson’s Landscaping. 26You record another week’s revenue for the lawns mowed over the past week. 27You pay your local newspaper $35 to run an advertisement in this week’s paper.Apr.An expense accrual refers to an expense reported in an accounting period before it is actually paid. An example is electricity used by a plant in the month before the utility issues a bill for the company to pay. Accurate and complete journals are also essential in the auditing process, as journal entries provide detailed accounts of every transaction. Auditors, both internal and external, will look for entries or adjustments that lack the proper documentation, explanations or approvals or that are outside the norm for the business. The purpose of a journal entry is to physically or digitally record every business transaction properly and accurately. If a transaction affects multiple accounts, the journal entry will detail that information as well.

The Journal In Investing And Trading

Nominal accounts consist of all those accounts which are related to expenses, losses, Income and Gains. Real accounts consist of all those accounts which are related to assets. Intangible assets are also considered as Real Accounts. QuickBooks Online also lets you delete a previously posted journal entry, but in order to maintain an audit trail, any journal entry posted in error should be reversed, not deleted. The banking feature in QuickBooks Online lets you easily record your expenses. The Sage 50cloud Accounting dashboard offers a summary view of account balances. Accounting software also automatically calculates and posts closing entries, ensuring that opening balances are correct for the new year.Expenses increase on the debit side; thus, Salaries Expense will increase on the debit side. Cash was used to pay for salaries, which decreases the Cash account. Skip a space after the description before starting the next journal entry. Journaling the entry is the second step in the accounting cycle. The journal typically has a record of profitable trades, unprofitable trades, watch lists, pre- and post-market records, notes on why an investment was purchased or sold, and so on.Here are numerous examples that illustrate some common journal entries. The first example is a complete walkthrough of the process.Bench assumes no liability for actions taken in reliance upon the information contained herein. On the way back from meeting with your client, you stopped to pick up $100 worth of office supplies. Description includes relevant notes—so you know where the money is coming from or going to. Financial statements are the key to tracking your business performance and accurately filing your taxes. They let you see, at a glance, how your business is performing.

Software Features

It can also be the place you record adjusting entries. If you’re totally new to double-entry accounting and you don’t know the difference between debits and credits, pause here. Then check out our visual guide to debits and credits.

What Is Double Entry Bookkeeping And How’s It Fit In General Ledger?

Recall that the general ledger is a record of each account and its balance. Reviewing journal entries individually can be tedious and time consuming.Examples of temporary accounts include expense and loss accounts; revenue, income and gain accounts; income summary accounts; and dividend or withdrawal accounts. In the case of accounting periods, the closing entry reflects the ending balance for that account at the end of that accounting period. That value is then transferred as the opening entry for the next accounting period. In that case, it is the accounting period for that account, which is closed. MyToys Manufacturing Co. buys $100,000 worth of raw materials. It pays $10,000 in cash and uses credit for the balance. The company would record a debit, or increase, of $100,000 in raw materials.

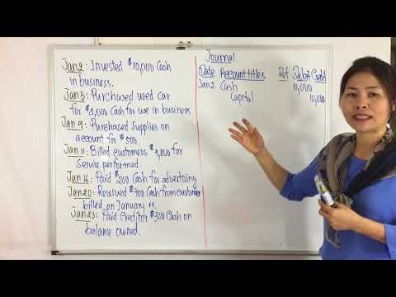

How To Write A Journal Entry

A journal is a detailed record of all the transactions done by a business. Most businesses use double-entry accounting systems for accuracy in balancing the books. Thus, a wage accrual in the preceding period is reversed in the next period, to be replaced by an actual payroll expenditure. A memo field is also available for you to enter a description of the journal entry.

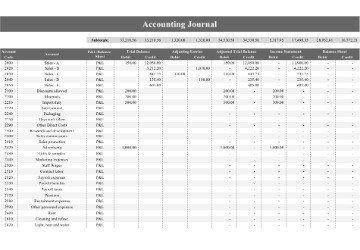

What is worksheet in accounting?

An accounting worksheet is a document used within the accounting department to analyze and model account balances. A worksheet is useful for ensuring that accounting entries are derived correctly. It can also be helpful for tracking the changes to an account from one period to the next.The balance in this account is currently $20,000, because no other transactions have affected this account yet. You can see at the top is the name of the account “Cash,” as well as the assigned account number “101.” Remember, all asset accounts will start with the number 1. The date of each transaction related to this account is included, a possible description of the transaction, and a reference number if available. There are debit and credit columns, storing the financial figures for each transaction, and a balance column that keeps a running total of the balance in the account after every transaction. When the company issues stock, stockholders purchase common stock, yielding a higher common stock figure than before issuance. The common stock account is increasing and affects equity.

How To Create An Accounting Journal Entry

In the next column, list each account affected by the transaction on a separate line, and enter a short description of the transaction immediately below the list of accounts. The accounts being debited always appear above the accounts being credited, which are indented slightly. The posting reference column remains blank until the journal entry is transferred to the accounts, a process called posting, at which time the account’s number is placed in this column. Finally, enter the debit or credit amount for each account in the appropriate columns on the right side of the journal. A journal entry is used to record a business transaction in the accounting records of a business. A journal entry is usually recorded in the general ledger; alternatively, it may be recorded in a subsidiary ledger that is then summarized and rolled forward into the general ledger. The general ledger is then used to create financial statements for the business.An adjusting journal entry is made at the end of an accounting period to take care of anything that was unresolved during that accounting period. An example is when a vendor ships goods to your business, but that vendor’s invoice wasn’t processed by the end of the accounting period.Larger grocery chains might have multiple deliveries a week, and multiple entries for purchases from a variety of vendors on their accounts payable weekly. So, you credited your cash account and debited your equipment account. If you then sold the same system for $5,000, you would credit your equipment account and debit your cash account. While this may not sound correct, your chart of accounts tells you that an equipment account decreases with a credit and a cash account increases with a debit. DebitCreditUtilities Expense1,200Cash1,200All the journal entries illustrated so far have involved one debit and one credit; these journal entries are calledsimple journal entries.

Other Types Of Accounting Journal Entries

So, when it’s time to close, you create a new account called income summary and move the money there. In the expense journal, we record a debit for the amount that went towards interest separately from the amount that reduces the balance. Finally, you stop at the bank to make your loan payment. When you make a payment on a loan, a portion goes towards the balance of the loan while the rest pays the interest expense. You’re going to meet up with a client, pick up some office supplies, and stop by the bank to make a loan payment. Going through every transaction and making journal entries is a hassle. But with Bench, all of your transaction information is imported into the platform and reviewed by an expert bookkeeper.A Chart of Accounts, which lists the accounts for a business, tells you if a journal entry is a debit or a credit. There is always a general journal for a business, but there can also be specialized journals depending on the business.Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. Now that these transactions are recorded in their journals, they must be posted to the T-accounts orledger accountsin the next step of theaccounting cycle.We now return to our company example of Printing Plus, Lynn Sanders’ printing service company. We will analyze and record each of the transactions for her business and discuss how this impacts the financial statements. Some of the listed transactions have been ones we have seen throughout this chapter. More detail for each of these transactions is provided, along with a few new transactions. Notice that for this entry, the rules for recording journal entries have been followed. If you purchased a computer system and printer for $5,000, cash is withdrawn from your bank account and transferred to the business you bought it from.Many business transactions, however, affect more than two accounts. The journal entry for these transactions involves more than one debit and/or credit.