Content

- Intuit,

- Trademarks Of Intuit Inc Terms And Conditions, Features, Support,

- Banking Transactions

- Can You List Down The Process Steps Of Entering Opening Balance Equity In Quickbooks Online?

- 6 5 Reports

- Opening Balance Equity 10

- 6 3 Additional Transaction Examples

From the Account column, select the account you want to enter. Create checks and deposits by using Opening Balance Equity and enter all the outstanding transactions. This button will only be available if you have not entered any transaction yet. As soon as you enter a transaction, the button will change to Change Opening Balance button. Also, you must not enter the opening balance, if you do not have balance prior to the QuickBooks start date. Clear the balance in this account to make your balance sheet look more professional and clean.Without adjusting the date, view the Equity section of the report to see whether a balance exists in the account. Please touch base with us if you any concerns about transferring your data to QBO. Remember, we’re here to make things run smoothly for your business. In the message that says’s “When do you want to start tracking your finances from this account in QuickBooks?This is done to ensure that you receive a good balance sheet for your company. When your setup of all Balance Sheet balances is complete, the balance in Opening Balance Equity should equal Retained Earnings. When you clear the balance in Opening Balance Equity and offset it to Retained Earnings, the data file setup is complete; the problem is that many QuickBooks users fail to take this step. The best practice is to close opening balance equity accounts off to retained earnings or owner’s equity accounts.Now, reconcile the opening balance journal entry for each account through mini reconciliation, a process to do it. Now, choose the bank or credit card account from the Account column and enter the amount calculated in step 2 in the Debit column. To ensure that all your future reconciliation is accurate, you would be required to account for all the outstanding transactions in the credit card or bank. QuickBooks debits the Inventory Asset account and credits the Opening Balance Equity account. Opening balance equity should only be used for a limited time. The presence of a balance on your opening balance equity account makes your balance sheet appear unprofessional.

Intuit,

As you enter each beginning balance into QuickBooks the entry is offset to Opening Balance Equity. Opening balances can be entered into the company file in the form of a General Journal Entry for most Balance Sheet accounts using Opening Balance Equity as the offset account. Once all of the beginning balances are entered, the remaining balance in Opening Balance Equity can be apportioned between the proper equity accounts using another journal entry. If the company is a sole proprietorship Opening Balance Equity will be closed to the Owner’s Equity account.

Trademarks Of Intuit Inc Terms And Conditions, Features, Support,

I’m glad to share with you the other way to edit the opening balance of your liability account in QuickBooks Online . We can only zero out the Opening Balance Equity if all accounts doesn’t have any beginning balance when they were created. Our error free add-on enables you to focus on your work and boost productivity.You can use the Opening Balance Equity as the offset to check any difference noticed between the two columns. The Opening Balance Equity Account is one of the most commonly misunderstood accounts created by QuickBooks. Hi Courtney, yes you would zero out opening balance equity account and adjust it to retained earnings. Because balance sheet numbers roll over from year to year, the last years balances, will already be in the balance you are adjusting in the current year, so use a more recent date and adjust it as a whole.

- Primarily because users all too often do not understand the purpose or proper uses for this QuickBooks’ created Account.

- Opening balances entered when New Customers or Vendors are set up.

- Also, you must not enter the opening balance, if you do not have balance prior to the QuickBooks start date.

- Hi Courtney, yes you would zero out opening balance equity account and adjust it to retained earnings.

- This account should be closed out to retained earnings and not carry a balance.

Now, enter ending date and ending balance from your credit card statement or last bank statement. It is considered a good option to contact the accounting professional always before entering the opening balance. While setting up the account, you can press F1 key or you can simply click on the link that says- ‘Should I enter an opening balance? In this way, you can get information about the opening balances.

Banking Transactions

Dancing Numbers is SaaS-based software that is easy to integrate with any QuickBooks account. With the help of this software, you can import, export, as well as erase lists and transactions from the Company files.

Can You List Down The Process Steps Of Entering Opening Balance Equity In Quickbooks Online?

Opening balance equity is the offsetting entry used when entering account balances into the Quickbooks accounting software. This account is needed when there are prior account balances that are initially being set up in Quickbooks. It is used to provide an offset to the other accounts so that the books are always balanced.

6 5 Reports

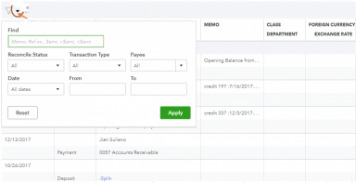

Primarily because users all too often do not understand the purpose or proper uses for this QuickBooks’ created Account. You or your bookkeeper can close this account in a variety of ways by making journal entries. One of the most important things to know about the Opening Balance Equity account is that when a file is completely and successfully set up, no balances should remain in the Opening Balance Equity account. To review the transactions in Opening Balance Equity account a report of the transactions is first created.You can also enter any other account that is not included on the first journal entry. Assume an asset account, such as a checking account, with a balance of $100 is added to accounting software. Another account must be affected by $100 in order for your balance sheet to be balanced. Sorry for the delay Kenneth, for some reason your post was marked as spam. I am sure you have found out by now, you can create a journal entry for the balance in that account and move it to retained earnings. I don’t know if the number that you have is a positive or negative number but try this; debit the balance you want to make to zero and put the credit to retained earnings. Check the balance sheet report after the entry, if the amount is not zero, go back in and edit the entry you made, by flipping the debit/credit columns.Now let’s have a look at corresponding transaction report for the Checking account. You could also set up a scheduled transaction to pay your rent, since the value of the rent is likely to be constant for the foreseeable future. Leave this field blank when entering Customers, Vendors and Accounts. In the Choose Filter pane, select Account; from the Account drop-down menu select the Opening Balance Equity account, as shown in the image below.She must enter a ‘specific’ Inventory Adjustment to reduce the “quantity on hand”. She will use Opening Balance Equity as the Adjustment Account for this adjustment-only. The Inventory Adjustment will credit the Inventory Asset account and debit the Opening Balance Equity Account. Since she is adjusting the quantity posted during the New Item Set-up which wasn’t assigned to any “class” her adjustment won’t need a class assigned to it. The company had transactions prior to the QuickBooks start date (i.e., it is not a new business).While entering an opening balance for Equity, Fixed Asset, other Asset, Current Asset, and Other Current Liability, be careful as it is possible that you may create a double accounting entry. In QuickBooks, both the Accounts Payable and Accounts Receivable are considered different.

6 3 Additional Transaction Examples

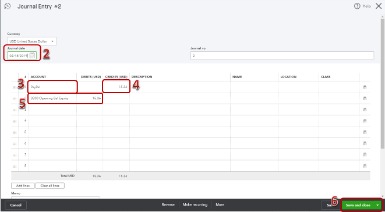

You’ll be routed to the Journal Entry page and from there you can edit the opening balance. What to do if you didn’t enter an opening balance in QuickBooks Online. At that point OBE should be zero, and it should stay that way.You need to click on the More button at the bottom of the deposit transaction screen and then click on Delete and after that click on Yes. You need to click on the Edit option at the right bottom corner. Change the date to your start date in the Account Quick Report. If you don’t know the exact start date, then you can choose ALL in the Dates drop-down. These are the profits that have not been distributed among the company’s owners. QuickBooks also computes your profit or loss at the end of your fiscal year. Verify that the Opening Balance Equity Account is now Zero by either a Transaction Detail Report for the account or QuickZoom to the account’s register from the Chart of Accounts.If it is a new business with no prior transactions, then simply begin entering typical QuickBooks transactions with no need for unusual start up entries. In this guide, we’ll go over what opening balance equity is, the reasons it’s created, and how to close it out so that your balance sheets are presentable to banks, auditors, and even potential investors.This feature allows you to share bills, payments, information, and much more. Furthermore, using Dancing Numbers saves a lot of your time and money which you can otherwise invest in the growth and expansion of your business. It is free from any human errors, works automatically, and has a brilliant user-friendly interface and a lot more.