Content

- Tax Savings Strategies

- Retirement Calculators

- Hsa Deduction

- States With The Highest Sales Taxes

- Subscribe To Kiplinger’s Personal Finance

- The Standard Deduction

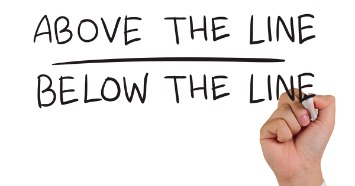

An above-the-line deduction is an adjustment to income that can be taken regardless of whether the individual taxpayer itemizes deductions. These adjustments are also sometimes called deductions from gross income, as opposed to itemized deductions that are deducted from AGI. An above-the-line deduction is taken out of income “above” the line on the tax form on which adjusted gross income is reported. You may be wondering what this so-called “line” is and why it’s so important. This important line refers to your adjusted gross income, or AGI. The amount of AGI you report is important because the Internal Revenue Service uses it as a threshold amount for assessing your eligibility to take other tax credits and below-the-line deductions.Above-the-line deductions are generally more advantageous for a high income taxpayer than so-called below-the-line deductions. Below-the-line deductions are subtracted from a taxpayer’s adjusted gross income.

Tax Savings Strategies

Legislation in 2017 changed the tax code, and the IRS redesigned the standard 1040. It shrunk the form down to approximately the size of a postcard, as promised during the Trump presidential campaign.

- Certain below the line deductions are also phased out for high income taxpayers pursuant to Internal Revenue Code Section 68.

- Contributions to a self-employed retirement plan are an above-the-line adjustment to income.

- The IRS publishes the income limitations each year, so check out the limits for the 2019 tax year and the 2020 tax year if you’re curious about qualifying.

- Home equity debt that was incurred for any other reason than making improvements to your home is not eligible for the deduction.

- After spending six years working for a large investment bank and an accounting firm, Marz is now self-employed as a consultant, focusing on complex estate and gift tax compliance and planning.

Taxpayers who take line-item deductions cannot also claim the standard deduction. Instead they claim a series of other deductions which collectively lower their overall taxable income.

Retirement Calculators

This also includes one-half of the self-employment tax that must be paid on this income. The good news is that above-the-line deductions go hand-in-hand with that massive standard deduction. In fact, the Republican party’s 2017 tax bill arguably made the U.S. tax code more complex by adding new rules concerning S-corporation and pass-through taxation.A married couple with a $50,000 household income can reduce their taxable income by almost half through the standard deduction. To a millionaire couple that same figure is virtually a rounding error. The higher your tax bracket, the more valuable deductions become. To someone in the second tax bracket, a deduction is only worth 12 cents per dollar because that’s the highest rate at which they pay taxes. To you, in this example, however, a tax deduction is worth almost twice as much because your highest tax bracket is worth much more. Depending on your income, you can deduct up to $2,500 a year in student-loan interest. For the current tax year, you’re not eligible for the deduction if your AGI exceeds $80,000 as a single tax filer, or $160,000 as a couple filing jointly.

Hsa Deduction

Numerous schedules have been introduced to include all the information that used to be entered on that first page. • Military Moving Expenses – Prior to the 2017 changes all taxpayers could deduct moving expenses above the line if they moved for work. However Congress created a specific carve-out for members of the military, who can still take this tax deduction when moving as part of their employment with the armed forces. In practice, above-the-line deductions are really more like adjustments to your gross income. But like below-the-line deductions, they serve the very important purpose of lowering your taxable income. The IRS offers a number of tax deductions that can help workers shave thousands of dollars off their tax bills. But in order to take advantage of most deductions, you’ll need to itemize on your return — which can not only be time-consuming, but may not make financial sense when you consider your standard deduction.

States With The Highest Sales Taxes

But at least you get to write off half of what you pay as an adjustment to income. You can also deduct contributions to a self-directed retirement plan such as a SEP or SIMPLE plan . The plan must be a high-deductible policy, and group policy coverage doesn’t qualify. Your contributions must be made with “after-tax” dollars—in other words, they weren’t deducted from your pay before taxes were withheld on the balance. If you were allowed to take deductions on “pre-tax” dollars, it would effectively give you two tax breaks on the same money.A tax benefit is a broadly encompassing term that refers to some type of savings for a taxpayer. You would pay 10 cents per dollar on each dollar earned up to $9,525, then 12 cents on each dollar earned between $9,701 and $38,700, and finally 22 cents on each dollar earned between $38,476 and $75,000.

What are above-the-line deductions 2020?

In response to the coronavirus crisis, the CARES Act (enacted in March 2020) added a new above-the-line deduction to encourage more charitable giving. If you take the standard deduction on your 2020 tax return, you can deduct up to $300 for cash donations to charity you made during the year.In other words, a tax credit is applied to your tax bill after your federal income tax has been calculated. The term tax deduction refers to any expense that can be used to reduce your taxable income. As an example, if your gross income is $80,000 and you have $20,000 in various tax deductions, you can use them to reduce your taxable income to $60,000. In addition to limiting deductions, your AGI can also impact your ability to take tax credits. The IRS frequently uses modified adjusted gross income, or MAGI, as an income threshold for tax credit eligibility. Your MAGI is essentially your AGI with certain items added to it.

Subscribe To Kiplinger’s Personal Finance

First, the distance between your old home and your new job needs to be at least 50 miles greater than what your previous commute to work entailed. Additionally, you must work for at least 39 weeks during the 52-week period after you move. Investment losses can be used to reduce capital gains from other investments. Short-term losses must be used to offset any short-term gains first, and the same is true with long-term investment losses.

Where can I find above-the-line deductions?

Since tax year 2018, above-the-line deductions are reported on Schedule 1 of IRS Form 1040.Moreover, a taxpayer that files as “married, filing separately” whose spouse itemizes cannot claim the standard deduction. Last, “itemized deductions are useful only when and to the extent that they exceed the standard deduction.”These deductions are important because your AGI determines your eligibility for many other tax credits and deductions. Adjusted gross income equals your gross income minus certain adjustments. A Roth IRA is a retirement savings account that allows you to withdraw your money tax-free. Learn why a Roth IRA may be a better choice than a traditional IRA for some retirement savers. Taxpayers with incomes above a certain level who contribute to both a traditional IRA and a qualified plan are subject to a graduated phaseout reduction on the deductibility of their IRA contributions.Since both types of accounts can be great tax shelters, here’s a quick guide to the HSA and FSA contribution limits for the 2019 and 2020 tax years. Each of these deductions has its own restrictions, rules, and qualifications, so let’s take a closer look at each one. Michael Marz has worked in the financial sector since 2002, specializing in wealth and estate planning. After spending six years working for a large investment bank and an accounting firm, Marz is now self-employed as a consultant, focusing on complex estate and gift tax compliance and planning. Florida is one of only nine states that doesn’t charge an income tax.Check IRS Pub 560 for more information about this deduction and how much you can deduct. You’re a performing artist making less than $16,000 (sorry Beyoncé, not for you). The IRS will expect you to show that at least two employers paid you $200 each for your services and that the expenses you intend to deduct are more than 10% of what you made from performing.