Content

- What It Means To Take The Standard Deduction

- Itemized Deductions: A Beginners Guide

- Deductions For Individuals

- Do You Qualify For Itemize Deductions?

- Miscellaneous Deductions

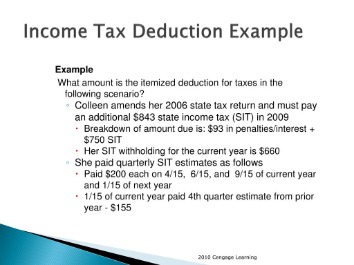

- Taxes Paid

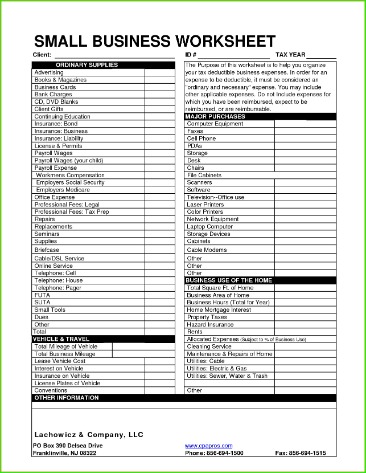

Supporting Identification Documents must be original or copies certified by the issuing agency. Original supporting documentation for dependents must be included in the application. Price for Federal 1040EZ may vary at certain locations. Wave self-serve accounting Financial software designed for small businesses. Finances Emerald Advance Access to a line of credit, with no W-2 required to apply. You made a cash contribution to a Private Charity for $1,110.Taxpayers who itemize add up all of their deductible expenses and subtract the total from their adjusted gross income to reach their taxable income. As of the 2020 tax year , the standard deduction is $12,400 for single taxpayers and for those who are married but filing separate returns. This goes up to $24,800 if you’re married and filing jointly with your spouse or if you’re a qualifying widow or widower with a dependent child.

What It Means To Take The Standard Deduction

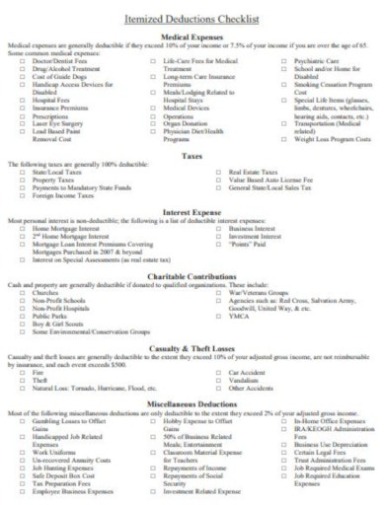

In addition, foreign real estate taxes are not tax deductible. Miscellaneous itemized deductions are subject to a 2% floor, a.k.a. the “2% Haircut.” A taxpayer can only deduct the amount of miscellaneous itemized deductions that exceed 2% of their adjusted gross income. For example, if a taxpayer has adjusted gross income of $50,000 with $4,000 in miscellaneous itemized deductions, the taxpayer can only deduct $3,000, since the first $1,000 is below the 2% floor. For example, you would be better off itemizing if you had total itemized deductions of $13,000 in 2020.

Itemized Deductions: A Beginners Guide

When you file your taxes each year, you have the choice of taking the standard deduction or itemizing your deductions. Itemized deductions used to be limited in the past when a taxpayer’s AGI exceeded certain limits. These thresholds were called Pease limitationsafter Representative Donald Pease, who authored the legislation that established the limits. The mortgage interest deduction is capped at debts of $750,000. If you’re married and file separately, the cap is $375,000.

Deductions For Individuals

Here is a list of our partners and here’s how we make money. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider. Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit. For a full schedule of Emerald Card fees, see your Cardholder Agreement..

Do You Qualify For Itemize Deductions?

Both cardholders will have equal access to and ownership of all funds added to the card account. Line balance must be paid down to zero by February 15 each year.

- You can claim the standard deduction, or you can itemize individual deductions that you qualify to claim—line by line by line—but you can’t do both.

- M1 Finance gives you the benefits of a robo-advisor with the control of a traditional brokerage.

- Fees apply if you have us file an amended return.

- CAA service not available at all locations.

- Available at participating offices and if your employer participate in the W-2 Early AccessSM program.

We believe everyone should be able to make financial decisions with confidence. This is a friendly notice to tell you that you are now leaving the H&R Block website and will go to a website that is not controlled by or affiliated with H&R Block. This link is to make the transition more convenient for you. You should know that we do not endorse or guarantee any products or services you may view on other sites. For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block.

Miscellaneous Deductions

Just to be clear, you can only deduct the interest you paid on your mortgage debt, not on the debt amount. The interest amount is reported to you on Form 1098 provided for the year by your mortgage company. You can trust the integrity of our balanced, independent financial advice. We may, however, receive compensation from the issuers of some products mentioned in this article. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below.

What is better itemized or standard deductions?

Generally speaking, itemizing is a good idea if the value of your itemized expenses is more than the value of the standard deduction.Any Retail Reload Fee is an independent fee assessed by the individual retailer only and is not assessed by H&R Block or MetaBank®. Available at participating offices and if your employer participate in the W-2 Early AccessSM program. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents.

Taxes Paid

Deductions can reduce the amount of your income before you calculate the tax you owe. Typically, you can deduct charitable donations up to 60% of AGI, but for the 2020 tax year, the CARES Act temporarily suspended that limit, meaning you can deduct up to 100% of AGI for the 2020 tax year. Itemized deductions must be listed on Schedule A of Form 1040. Taxable income is the portion of an individual’s or a company’s income used to calculate how much tax they owe the government in a given tax year.See Online and Mobile Banking Agreement for details. The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. Small Business Small business tax prep File yourself or with a small business certified tax professional.