Content

- Accountingtools

- Direct Vs Indirect Costs

- Direct Vs Indirect Labor Cost

- Direct Labor And Overhead Allocation

- Cost Of Labor

- Direct Labor Vs Indirect Labor Costs: What Is The Difference?

Beginner’s Guides Our comprehensive guides serve as an introduction to basic concepts that you can incorporate into your larger business strategy. Alternatives Looking for a different set of features or lower price point? Check out these alternative options for popular software solutions. Appointment Scheduling 10to8 10to8 is a cloud-based appointment scheduling software that simplifies and automates the process of scheduling, managing, and following up with appointments.Companies should understand the importance of indirect labor because they help calculate the company’s profitability and aid with setting prices on products and services. Product managers and supervisors who are directly involved in overseeing the assembly line activities of a specific product may also be included in direct labor. Cost accounting is a method of accounting that aims at determining the cost of business activities by allocating inputs as accurately as possible. To accurately account for the price for all of each unit of output, a manager must take all of these costs into consideration.

What is direct and indirect manpower?

Manpower Direct Costs include wages for the employees that produce a product, including workers on an assembly line, while indirect costs are associated with support labor, such as employees who maintain factory equipment.Applicant Tracking Zoho Recruit Zoho Recruit combines a robust feature set with an intuitive user interface and affordable pricing to speed up and simplify the recruitment process.

Accountingtools

Although both of your employees play a vital supporting role in keeping your practice running, both are considered indirect labor, as neither provides services directly to the customer. Direct labor refers to any employee that is directly involved in the manufacturing of a product.Save money without sacrificing features you need for your business. John Smith, for example, may be overseeing the machines in a production process that is completely automated.

- This article looks at meaning of and differences between two types of labor relevant cost – direct and indirect labor cost.

- Appointment Scheduling 10to8 10to8 is a cloud-based appointment scheduling software that simplifies and automates the process of scheduling, managing, and following up with appointments.

- In order to have an accurate estimate of labor costs, you’ll need to track both direct and indirect labor costs.

- However, they do not play an active part in the conversion of materials into finished goods.

- For example, in a small carpentry business, the efforts of individuals who cut, join, polish, or handle wood are classified as direct labor.

- Both direct and indirect labor are essential for the proper functioning of the entity.

Bear in mind that labor costs arenot the only expensescontractors and owners must contemplate. Indirect materials and overhead costs also play a factor in a company’s success. The direct costs include only the employees who will work directly on the project. Support staff (human resources, administration, etc.) are categorized differently. Indirect labor cost is categorized under overheads cost and is allocated after all direct costs are allocated in the cost sheet.

Direct Vs Indirect Costs

This can be helpful if the costs of your materials fluctuate in the course of production. Indirect costs are expenses that apply to more than one business activity.For example, counting the number of nails and staples required for a project would take more time than it would be worth. It can seem overwhelming, but many new software programs and platforms are available to help contractors and businesses keep tabs on costs. Incorporate company policies that clarify production expectations, breaks, and clock-in and out times. Furthermore, tracking and comprehending labor is an easy way to make higher profits. The average construction company only earns 2% to 3% in profits annually, and by reducing labor even 5%, companies and contractors can improve this net profit to 4% or 5%. Indirect labor can be engaged in any part of the entity’s location, be it the factory, office or on-field. Get up and running with free payroll setup, and enjoy free expert support.

Direct Vs Indirect Labor Cost

Tracking down all the numbers is the hardest bit of this equation, but it’s necessary for a company’s success. Additionally, the Luxury Sedan department is a premium segment and thus employs an exclusive QC manager who is dedicated to high precision quality checks of the luxury sedan cars. We may receive compensation from partners and advertisers whose products appear here.

Direct Labor And Overhead Allocation

With indirect labor, though, the expense is tracked as overhead, not as cost of goods sold. Sometimes it may be appropriate to use direct labor as a cost driver to allocate indirect costs to a production process.

Cost Of Labor

If your employee worked 180 hours in June, his total direct labor cost would be $4,050. However, an accountant that provides services to clients would be considered direct labor because they are directly involved in providing the services that the business offers.And, the employee must use wood glue, which is a manufacturing supply. Variable costs are expenses that change based on how many items you produce or how many services you offer. For example, you would spend more money producing 200 toys as opposed to 100 toys. Direct costs are business expenses you can directly apply to producing a specific cost object, like a good or service.

Accounting

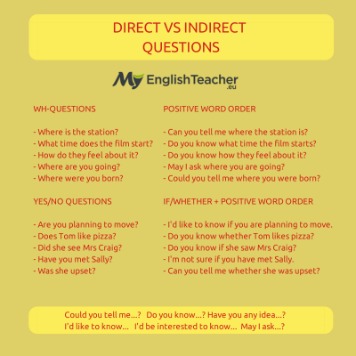

For example, effort of employees in the packing department is clearly reflected in a packaged product. Conversely, indirect costs encompass costs not directly related to the development of your business’s product or service. Direct costs are expenses that a company can easily connect to a specific “cost object,” which may be a product, department or project. It can also include labor, assuming the labor is specific to the product, department or project.It is sometimes difficult to distinguish between indirect and direct labor costs. A company may incur some labor costs during the production process. Just like direct labor costs, it’s important to track indirect labor costs.

Identify The Number Of Hours Employees Worked

Product Reviews Unbiased, expert reviews on the best software and banking products for your business. Best Of We’ve tested, evaluated and curated the best software solutions for your specific business needs. Accounting Accounting software helps manage payable and receivable accounts, general ledgers, payroll and other accounting activities.This would include a receptionist at the corporate headquarters or the company chief executive officer. These employees serve the company generally and are not directly devoted to any specific product or service. Indirect costs, such as overhead costs, are not directly traceable to the final product; however they are necessary for the production of the process. As a result, they must be incorporated in the overall cost of the product. In addition, allocate indirect costs to the final product by way of a cost driver.