Content

- Balance Sheet Aging Of Receivables Method For Calculating Bad Debt Expenses

- Balance Sheet Impact

- Understanding The Allowance For Doubtful Accounts

- Who Uses Allowance For Doubtful Accounts?

- 2 Accounting For Uncollectible Accounts

- Income Statement Method For Calculating Bad Debt Expenses

- Allowance For Doubtful Accounts And Bad Debt

In the journal entry, it debits bad debt expenses while crediting the amount it expects to be paid. The final point relates to companies with very little exposure to the possibility of bad debts, typically, entities that rarely offer credit to its customers. Assuming that credit is not a significant component of its sales, these sellers can also use the direct write-off method.

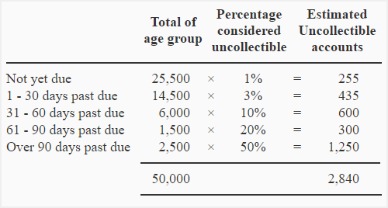

Balance Sheet Aging Of Receivables Method For Calculating Bad Debt Expenses

They might accept this reality, for instance, when the customer goes out of business or declares bankruptcy. Using the allowance for doubtful accounts enables you to create financial statements that offer a more accurate representation of your business. The risk classification method assumes that you have prior knowledge of the customer’s payment history, either through your initial credit analysis or by running a credit report. Analyzing the risk may give you some additional insight into which customers may default on payment. For example, if 3% of your sales were uncollectible, set aside 3% of your sales in your ADA account. Say you have a total of $70,000 in accounts receivable, your allowance for doubtful accounts would be $2,100 ($70,000 X 3%).

- The projected bad debt expense is properly matched against the related sale, thereby providing a more accurate view of revenue and expenses for a specific period of time.

- When it comes to your small business, you don’t want to be in the dark.

- It’s only when a customer defaults on their balance owed that you‘ll need to adjust both the ADA balance and the accounts receivable balance with the following journal entry.

- The sales method applies a flat percentage to the total dollar amount of sales for the period.

Bad Debt Expense increases , and Allowance for Doubtful Accounts increases for $48,727.50 ($324,850 × 15%). Let’s consider that BWW had a $23,000 credit balance from the previous period. Estimates bad debt during a period, based on certain computational approaches. The calculation matches bad debt with related sales during the period. When the estimation is recorded at the end of a period, the following entry occurs.Remember that the allowance for doubtful accounts is just an estimate. It’s only when a customer defaults on their balance owed that you‘ll need to adjust both the ADA balance and the accounts receivable balance with the following journal entry. Perhaps the most effective method, the historical percentage uses past bad debt totals to predict your ADA for the current year. For example, if last year your accounts receivable balance was $40,000, and you had $4,000 in bad debt, you could use this information to predict bad debt totals for the current year. Accountants, business owners and managers use allowance for doubtful accounts to estimate payments that might remain unpaid. Companies that regularly provide services and goods on credit and have informed insight into the likelihood of collecting payment use this system to predict and prevent inaccurate financial statements.

Balance Sheet Impact

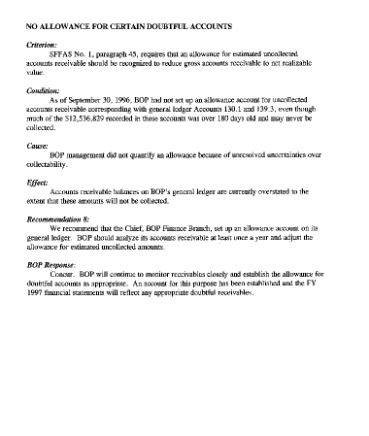

When customers buy products on credit and then don’t pay their bills, the selling company must write-off the unpaid bill as uncollectible. Allowance for uncollectible accounts is also referred to as allowance for doubtful accounts, and may be expensed as bad debt expense or uncollectible accounts expense. With the account reporting a credit balance of $50,000, the balance sheet will report a net amount of $9,950,000 for accounts receivable. This amount is referred to as the net realizable value of the accounts receivable – the amount that is likely to be turned into cash. The debit to bad debts expense would report credit losses of $50,000 on the company’s June income statement. Continuing our examination of the balance sheet method, assume that BWW’s end-of-year accounts receivable balance totaled $324,850. This entry assumes a zero balance in Allowance for Doubtful Accounts from the prior period.Companies have been known to fraudulently alter their financial results by manipulating the size of this allowance. Auditors look for this issue by comparing the size of the allowance to gross sales over a period of time, to see if there are any major changes in the proportion.Experience might be one of the more reliable ways to calculate an allowance for doubtful accounts. Using the percentage of accounts receivable that turned into bad debts in the past can help you inform predictions for the future. This information can help you have more accurate accounts and be more prepared if you need an allowance for doubtful accounts.

Understanding The Allowance For Doubtful Accounts

The Allowance for Doubtful Accounts is a balance sheet contra asset account that reduces the reported amount of accounts receivable. The use of this allowance account will result in a more realistic picture of the amount of the accounts receivable that will be turning to cash, since some customers may not pay the full amount owed to the company. The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company’s balance sheet, and is listed as a deduction immediately below the accounts receivable line item. The allowance represents management’s best estimate of the amount of accounts receivable that will not be paid by customers. It does not necessarily reflect subsequent actual experience, which could differ markedly from expectations. If actual experience differs, then management adjusts its estimation methodology to bring the reserve more into alignment with actual results. When a doubtful debt turns into bad debt, businesses credit their account receivable and debit the allowance for doubtful accounts.To create a standard allowance, have those financial records that indicate how many accounts have not been collected. Then create an average amount of money lost over the number of years measured. Once done, a company can compare these to the records of other companies or industry statistics. The company can use this information to attempt to bring this amount to an equal level, as compared to common industry best practices. Company ABC has found 10% of accounts receivable are more than 30 days late and 5% of accounts receivable are under 30 days late, which typically remain uncollected. They’re currently waiting on payment for $2,000 worth of credit that’s more than 30 days late and $10,000 worth that’s under a month old. Bad debt expense is an expense that a business incurs once the repayment of credit previously extended to a customer is estimated to be uncollectible.Bad debt is an expense that a business incurs once the repayment of credit previously extended to a customer is estimated to be uncollectible. For example, a company has $70,000 of accounts receivable less than 30 days outstanding and $30,000 of accounts receivable more than 30 days outstanding. Based on previous experience, 1% of accounts receivable less than 30 days old will be uncollectible, and 4% of those accounts receivable at least 30 days old will be uncollectible. Let’s consider a situation where BWW had a $20,000 debit balance from the previous period. T the end of an accounting period, when financial accounting reports are prepared and published, the sum of receivable accounts appears on the Balance Sheet as Accounts receivable. However, the account Allowance for doubtful accounts also appears along with Accounts receivable to adjust its value downwards, as shown in Exhibit 2 below. Firstly, the firm debits a non-cash expense account, Bad debt expense.

Who Uses Allowance For Doubtful Accounts?

The customer who filed for bankruptcy on August 3 manages to pay the company back the amount owed on September 10. The company would then reinstate the account that was initially written-off on August 3. Peggy James is a CPA with over 9 years of experience in accounting and finance, including corporate, nonprofit, and personal finance environments. She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals.

2 Accounting For Uncollectible Accounts

Because the focus of the discussion here is on accounts receivable and their collectability, the recognition of cost of goods sold as well as the possible return of any merchandise will be omitted. In the case of the allowance for doubtful accounts, it is a contra account that is used to reduce the Controlling account, Accounts Receivable. All legitimate business benefits belong in your business case or cost/benefit study. Find here the proven principles and process for valuing the full range of business benefits. If you’re using the accrual method of accounting, you should be using the allowance for doubtful accounts in your business. As a small business owner, you take a giant leap of faith every time you extend credit to your customers.Know that bad debt expenses must be anticipated and recorded in the same period as the related sales revenue to conform to the matching principle. Delays recognition of bad debt until the specific customer accounts receivable is identified. Once this account is identified as uncollectible, the company will record a reduction to the customer’s accounts receivable and an increase to bad debt expense for the exact amount uncollectible. If you don’t sell to customers on credit, there’s no need to use the allowance for doubtful accounts. But if you do, you’re bound to have some bad debt, and the most accurate way to properly account for that bad debt is to use a contra asset account to estimate what you think your totals will be for the year. A month later, after the funds have been written off, one of your customers makes a $1,500 payment. The first journal entry reduces the allowance for doubtful accounts while increasing your accounts receivable balance.

What Is Allowance For Doubtful Accounts?

However, the customers sometimes pay the amount written off as bad debts. When this happens, the balance sheet manager reverses the account by debiting the accounts receivable. If the following accounting period results in net sales of $80,000, an additional $2,400 is reported in the allowance for doubtful accounts, and $2,400 is recorded in the second period in bad debt expense. The aggregate balance in the allowance for doubtful accounts after these two periods is $5,400. An allowance for doubtful accounts is a contra account that nets against the total receivables presented on the balance sheet to reflect only the amounts expected to be paid. The allowance for doubtful accounts estimates the percentage of accounts receivable that are expected to be uncollectible. However, the actual payment behavior of customers may differ substantially from the estimate.

Allowance For Uncollectible Accounts

In this example, the $85,200 total is the net realizable value, or the amount of accounts anticipated to be collected. However, the company is owed $90,000 and will still try to collect the entire $90,000 and not just the $85,200. In some cases, you may write off the money a customer owed you in your books only for them to come back and pay you. If a customer ends up paying (e.g., a collection agency collects their payment) and you have already written off the money they owed, you need to reverse the account. Use an allowance for doubtful accounts entry when you extend credit to customers.Sales and the ultimate decision that specific accounts receivable will never be collected can happen months apart. During the interim, bad debts are estimated and recorded on the income statement as an expense and on the balance sheet through an allowance account, a contra asset. In that way, the receivable balance is shown at net realizable value while expenses are recognized in the same period as the sale to correspond with the matching principle. When financial statements are prepared, an estimation of the uncollectible amounts is made and an adjusting entry recorded. Thus, the expense, the allowance account, and the accounts receivable are all presented properly according to U.S.Located on your balance sheet, the allowance for doubtful accounts is used to offset your accounts receivable account balance. Because the allowance for doubtful accounts account is a contra asset account, the allowance for doubtful accounts normal balance is a credit balance. So for an allowance for doubtful accounts journal entry, credit entries increase the amount in this account and debits decrease the amount in this account.The allowance for doubtful accounts account is listed on the asset side of the balance sheet, but it has a normal credit balance because it is a contra asset account, not a normal asset account. The credit balance in this account comes from the entry wherein Bad Debts Expense is debited.This basic portrait provides decision makers with fairly presented information about the accounts receivables held by the reporting company. Here, the allowance serves to decrease the receivable balance to its estimated net realizable value. As a contra asset account, debit and credit rules are applied that are the opposite of the normal asset rules.