Content

- What Is The Lifetime Learning Credit Llc?

- Going Back To School: Can I Afford To Go Back To School?

- Who Is Eligible To Claim The Lifetime Learning Tax Credit?

- Credits & Deductions

- Qualified Expenses

- Tuition And Fees Deduction

- Coordinating The Lifetime Learning Tax Credit With 529 Plan Distributions

When evaluating offers, please review the financial institution’s Terms and Conditions. Pre-qualified offers are not binding.E-file fees do not apply to NY state returns. Qualified expenses for the Lifetime Learning Credit also include the cost of courses that aren’t part of a degree or certificate program. So, working adults who take occasional courses to strengthen their job skills are eligible to claim this credit. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty.

What Is The Lifetime Learning Credit Llc?

The information contained in this article is not intended as tax advice and it is not a substitute for tax advice. The LLC may be claimed when a student is enrolled in undergraduate, graduate, or professional degree courses. The credit may also be used for courses in specific career-related skills. This credit can help pay for undergraduate, graduate, and professional degree courses, including courses to acquire or improve job skills.You should know that we do not endorse or guarantee any products or services you may view on other sites. For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block. Bank products and services are offered by MetaBank®, N.A. Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. The American Opportunity Credit applies only to the first four years of post-secondary school education (university, college, vocational school, nonprofit and for-profit institutions). Up to 40% of the American Opportunity credit is refundable up to $1,000.

Going Back To School: Can I Afford To Go Back To School?

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Here is a list of our partners and here’s how we make money.The form will have an amount in Box 1 to show the amounts received during the year. To research qualified education expenses, see the IRS factsheet Qualified Education Expenses for more information on what amount to claim.

Who Is Eligible To Claim The Lifetime Learning Tax Credit?

The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. Most state programs available in January; release dates vary by state. Small Business Small business tax prep File yourself or with a small business certified tax professional. The American opportunity credit cuts the amount of taxes you pay. If you owe $3,000 in taxes and get the full $2,500 credit, for example, you’ll have to pay only $500 to the IRS.

Why am I not getting the Lifetime Learning credit?

In order to qualify for the Lifetime Learning credit, you must have made tuition and fee payments to a post-secondary school (after high school) during the year. … If you earn too much income during the year, you may not be eligible to claim the credit.During the tax year, if either you or your spouse qualified as a nonresident alien the person so qualifying must be treated as a resident alien for tax purposes. Timing is based on an e-filed return with direct deposit to your Card Account. Applicants must be 18 years of age in the state in which they reside (19 in Nebraska and Alabama, 21 in Puerto Rico.) Identity verification is required. Both cardholders will have equal access to and ownership of all funds added to the card account. See Cardholder Agreement for details. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards.

Credits & Deductions

You may not take the credit for yourself if you are claimed as someone else’s dependent. You can use tuition paid to the school for claiming the Lifetime Learning credit if the learning institution is eligible to participate in federal student aid programs through the U.S. All accredited colleges, universities, vocational schools, and other post-secondary institutions qualify as eligible educational institutions. H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns. Personal state programs are $39.95 each (state e-file available for $19.95).

- Additional training or testing may be required in CA, MD, OR, and other states.

- For example, if your professor recommends that you purchase a textbook but you can still enroll in the class without one, then you cannot include the cost of the textbook in the credit.

- The American opportunity credit cuts the amount of taxes you pay.

- Peggy James is an expert in accounting, corporate finance, and personal finance.

- Each student for which you claim the credit must have been enrolled at least half-time for at least one academic period which began during the 2021 Tax Year when filing in 2021.

- The American Opportunity Tax Credit was an expansion of the Hope credit passed as part of the 2009 stimulus package .

For example, if you qualified for a refund, this credit could increase the amount you’d receive by up to $1,000. That’s why the American opportunity credit is typically the best education tax break for students and their families. The AOTC is a credit specifically for education expenses during the first four years of higher education. The AOTC offers a maximum annual credit of $2,500 per eligible student.

Qualified Expenses

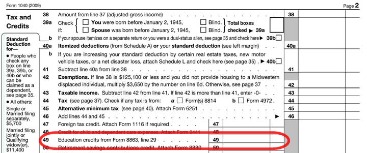

You can include the cost of tuition, fees and any books or supplies you are required to purchase directly from the school, so long as it’s a condition of enrollment. You can claim the credit for any post-secondary classes you take; you don’t have to be working towards a degree. Some limitations do exist though. Conclusions are based on information provided by you in response to the questions you answered. Answers do not constitute written advice in response to a specific written request of the taxpayer within the meaning of section 6404 of the Internal Revenue Code. The tool is designed for taxpayers who were U.S. citizens or resident aliens for the entire tax year for which they’re inquiring.Be sure to attach Form 8863 to your tax return before sending to the IRS. The maximum credit you can claim is 20% of up to $10,000 in eligible costs or $2,000. Academic Period can be semesters, trimesters, quarters or any other period of study such as a summer school session. Academic periods are determined by the school. For schools that use clock or credit hours and do not have academic terms, the payment period may be treated as an academic period. Be taking higher education course or courses to get a degree or other recognized education credential or to get or improve job skills. Finally, AOTC states that you must not have completed your first four years of higher education as of the beginning of the tax year.

Tuition And Fees Deduction

We believe everyone should be able to make financial decisions with confidence. Taxpayers with a MAGI of over $69,000, or $138,000 for joint filers, cannot claim the credit.Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc. The lifetime learning credit is for qualified tuition and related expenses paid for eligible students enrolled in an eligible educational institution.If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. Hope Credit, or the Hope Scholarship Tax Credit, is a nonrefundable higher education tax credit offered to some American taxpayers. Form 8917 is the Internal Revenue Service tax form that a taxpayer must fill out to receive a tax deduction called the tuition and fees deduction. Taxpayers may claim the Lifetime Learning Tax Credit in the same year a tax-free distribution is made from a 529 plan or Coverdell Education Savings Account as long as there is no double-dipping. Different expenses must be used to justify the Lifetime Learning Tax Credit and a tax-free distribution from a 529 plan. For example, families who claim the maximum Lifetime Learning Tax Credit and have $16,000 in qualified education expenses in a given tax year may withdraw $6,000 tax-free from a 529 plan.Fees apply to Emerald Card bill pay service. See Online and Mobile Banking Agreement for details.You can’t claim both the American opportunity credit and the lifetime learning credit in the same year. H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file.ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services. Availability of Refund Transfer funds varies by state.