Content

- Accountingtools

- Fixed Costs

- Formula For Fixed Costs

- Fixed Costs: Definition, Formula & Examples

- What Are Some Examples Of Fixed Costs?

- Low Vs High Fixed Cost Companies

- Are All Fixed Costs Considered Sunk Costs?

- What Does Fixed Cost Mean?

For instance, if the factory was to last 10 years, there would be an annual depreciation of $1 million per year. So rather than having a one-off fixed cost of $10 million, the costs are amortized so the cost is split out through the 10 years. Fixed costs include any number of expenses, including rental lease payments, salaries, insurance, property taxes, interest expenses, depreciation, and potentially some utilities. A company’s break-even analysis can be important for decisions on fixed and variable costs. Break-even analysis also influences the price at which a company chooses to sell its products. Depreciation is one common fixed cost that is recorded as an indirect expense.As an example of a fixed cost, the rent on a building will not change until the lease runs out or is re-negotiated, irrespective of the level of activity within that building. Examples of other fixed costs are insurance, depreciation, and property taxes. Fixed costs tend to be incurred on a regular basis, and so are considered to be period costs. The amount charged to expense tends to change little from period to period. For instance, someone who starts a new business would likely begin with fixed costs for rent and management salaries. All types of companies have fixed cost agreements that they monitor regularly. While these fixed costs may change over time, the change is not related to production levels but are instead related to new contractual agreements or schedules.

Accountingtools

The fixed cost ratio is a simple ratio that divides fixed costs by net sales to understand the proportion of fixed costs involved in production. Fixed costs are allocated in the indirect expense section of the income statement which leads to operating profit.In recent years, fixed costs gradually exceed variable costs for many companies. Firstly, automatic production increases the cost of investment equipment, including the depreciation and maintenance of old equipment. Secondly, labor costs are often considered as long-term costs.

- Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

- Fixed costs can be direct or indirect and may influence profitability at different points on the income statement.

- However, fixed costs will increase when a certain level of output is reached.

- The loan repayment amount is fixed as long as there is a balance to be paid on that loan.

- It must be paid by an organization on a recurring basis, even if there is no business activity.

- This distinction is crucial in forecasting the earnings generated by various changes in unit sales and thus the financial impact of proposed marketing campaigns.

- The resulting data is analyzed to see where businesses can save.

For example, John Doe’s $180,000 annual lease spread over 1.8 million door-handles produced in one year means that each unit carries with it $0.10 or ten cents in fixed cost. The utilities cost would also be considered fixed, as it is a regular payment made within a given range. Although this amount can fluctuate slightly , it’s generally considered a fixed cost as it is an expected amount that can be predicted fairly accurately. Labor CostCost of labor is the remuneration paid in the form of wages and salaries to the employees. The allowances are sub-divided broadly into two categories- direct labor involved in the manufacturing process and indirect labor pertaining to all other processes.Like him, they identified the Airbus A320 as an airplane extremely well fitted to low cost airline operations in Asia. “The sensation these objects presented receded as their cost increased,” notes Rabinowitz. Fixed costs are huge in relation to its refining capacity.

Fixed Costs

He is a CFA charterholder as well as holding FINRA Series 7 & 63 licenses. He currently researches and teaches at the Hebrew University in Jerusalem.Well, a fixed cost is a cost that a business must pay whether it produces one good or a million. In other words, it is a cost that does not change – even at higher levels of output. It must be paid by the business regardless of how many goods it makes and sells. Low fixed cost companies can earn a profit with much lower sales volume levels than high fixed cost businesses. However, their profits are not so huge when sales increase. It can be seen from the above explanations that “fixed cost” is very stable and does not change over a period of time. However, a higher volume of production or sales can result in better absorption of fixed cost, which then results in improved profitability.

Is R&D a fixed cost?

Under the GAAP, firms are required to expense research and development (R&D) in the year they are. Fixed and Variable Costs. One of the most popular methods is classification according. Depreciation Expense.Thus, there can be a delay in the recognition of those fixed costs that are allocated to inventory. When a company has a large fixed cost component, it must generate a significant amount of sales volume in order to have sufficient contribution margin to offset the fixed cost. An example of this situation is an oil refinery, which has massive fixed costs related to its refining capability. If the cost of a barrel of oil drops below a certain amount, the refinery loses money. However, the refinery can be wildly profitable if the price of oil increases beyond a certain amount. It is important to note that fixed costs are not always the same. Like the price of anything, they can change – sometimes unpredictably and sometimes on a regular schedule, but they do so based on some other factor, not the level of production.

Formula For Fixed Costs

Companies create a depreciation expense schedule for asset investments with values falling over time. For example, a company might buy machinery for a manufacturing assembly line that is expensed over time using depreciation. Another primary fixed, indirect cost is salaries for management. On the other hand, if a business has low fixed costs, its break-even point is much lower. Simply put, industries with high fixed costs have a much higher break-even point than those with purely variable costs. Just taking the airline example again – with over $300 million in fixed costs, it will take thousands, if not millions of customers to break-even.New entrants may find it hard to raise the necessary capital, or, may be put off trying in the first place. Trying to find $10,000 for a new startup is much easier than $10 million. It is for that reason that industries with high fixed costs tend to consolidate and create oligopolies. Generally, the higher the fixed cost, the easier it is to increase production rapidly. Effectively, all you have to do is turn the tap onto full. The variable cost per unit may decline slightly if the company can get discounts from suppliers.

What happens when fixed costs increase?

An increase in fixed cost will increase total cost, so the profit will decrease. … When the fixed cost of a firm increases, the best thing the firm can do is to increase its price in order to compensate for the cost increase.When a business invests $10 million in a new factory, it counts as a fixed cost. In accounting terms, it is the depreciation that is considered a fixed cost.

Fixed Costs: Definition, Formula & Examples

Companies have some flexibility when it comes to breaking down costs on their financial statements, and fixed costs can be allocated throughout their income statement. The proportion of fixed versus variable costs that a company incurs and its allocations can depend on its industry. Let us take the example of company ABC Ltd which is a toy manufacturing unit. According to the production manager, the number of toys manufactured in April 2019 is 10,000. The total cost of production for that month as per the accounts department stood at $50,000. Calculate the fixed cost of production if the variable cost per unit for ABC Ltd is $3.50.

What Are Some Examples Of Fixed Costs?

His home office is 10 percent of his house so so 10 percent of his mortgage, home insurance, property taxes, water bill and electricity bill are fixed costs for his company. His van depreciates at a rate of 15 percent per year, which is a fixed cost. He also has to pay for general liability insurance and a contractors licence via his state. A fixed cost is a cost that doesn’t change much in value regardless of factors like sales revenue or output.

Low Vs High Fixed Cost Companies

When taking out a loan, there are a number of fixed-rate options available. If a business takes up such an option, this can count as a fixed cost. A charge on the loan is due every month or year, independent of how much goods the business produces and sells. Fixed costs are usually established by contract agreements or schedules. These are the base costs involved in operating a business comprehensively. Once established, fixed costs do not change over the life of an agreement or cost schedule. Companies have interest payments as fixed costs which are a factor for net income.

Are All Fixed Costs Considered Sunk Costs?

A fixed cost is set over a period of time and does not vary depending on output. It’s easy to imagine a scenario where fixed costs are not sunk. For example, equipment might be re-sold or returned at thepurchase price. Also, the high fixed costs discourage the new entrants from entering the market, thereby limiting the competition. Companies with a large fixed cost component have to generate a considerable amount of sales volume. The high sales volume must have sufficient contribution margin to offset the fixed cost. Businesses can achieve economies of scale when they produce enough goods to spread fixed costs.

What Is A Fixed Cost

Fixed costs tend to be ongoing costs, like insurance, wages, depreciation, rent and interest. Businesses with high fixed costs such as printing operations and manufacturers have higher margins than other companies, according to Business Dictionary. Rent is an annual or monthly charge which is a fixed cost – as a business has to pay regardless of how many customers it serves. For example, a barber will have to pay rent whether they cut one persons hair or twenty people. This may increase in line with inflation, but is fixed for a set period of time.

What Does Fixed Cost Mean?

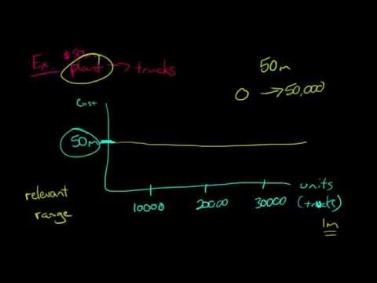

Health insurance for a business is fixed as the recurring costs to the insurer are fixed. This is a tax charged to a business by the local government, which is based on the cost of its assets. For example, someone might drive to the store to buy a television, only to decide upon arrival to not make the purchase. Is done based on the profitability of each division, which can result in wrong financial productivity measurement. Production output and costs typically remain the same for a relevant range of output.