Content

- Instructions For Schedule A

- Who Can File Schedule A Form 1040 Or 1040

- Key Irs Forms, Schedules & Tax Publications For 2021

- What Items Can Be Deducted On Schedule A?

- What Is Schedule A Form 1040 Or 1040

Installment sale gain reported on form FTB 3805E, Installment Sale Income. 1001, if you received interest income from the items listed above passed through to you from S corporations, trusts, partnerships, or LLCs.To determine the portion of income or loss from businesses engaged in multistate activities that you must report, use the apportionment formula described in Schedule R, Apportionment and Allocation of Income. California nonresident amounts – If you worked in California while a nonresident, enter the wages, salaries, tips, or other compensation received for those California services. If you are active duty military and not domiciled in California and your IRA deduction was limited because of a federal AGI limitation, recalculate your deduction excluding your active duty military pay. If the recalculated amount is larger than the amount on line 19, column A, enter the difference between the two amounts in column C, line 22.

Instructions For Schedule A

For more information on allocating interest, see Pub. You paid a yearly fee for the registration of your car.Net Operating Loss Suspension – For taxable years beginning on or after January 1, 2020, and before January 1, 2023, California has suspended the net operating loss carryover deduction. Taxpayers may continue to compute and carryover an NOL during the suspension period.

Who Can File Schedule A Form 1040 Or 1040

If you are married/RDP and file a separate tax return, you and your spouse/RDP must either both itemize your deductions or both take the standard deduction. Federal law has no equivalent deduction. Enter the difference as a positive number on line 27. Qualified charitable contributions – Your California deduction may be different from your federal deduction. California limits the amount of your deduction to 50% of your federal AGI. If you claimed the excess deduction on termination of an estate or trust for federal purposes, include that amount in the total you enter in column B, line 22.To be contemporaneous, you must get the written acknowledgment from the charitable organization by the date you file your return or the due date for filing your return, whichever is earlier. Don’t attach the contemporaneous written acknowledgment to your return.There is a finding that they took the deduction unlawfully. Gain on the sale or disposition of a qualified assisted housing development to low-income residents or to specified entities maintaining housing for low-income residents.

Key Irs Forms, Schedules & Tax Publications For 2021

Military pay of a servicemember domiciled outside of California cannot be used to reduce the amount of this deduction. Modify your federal AGI used to compute this limitation by subtracting your military pay from federal AGI. Unreimbursed Impairment-Related Work Expenses – If you completed federal Form 2106, prepare a second set of forms reflecting your employee business expense using California amounts (i.e., following California law). California does not allow a deduction for mortgage insurance premiums. Enter the amount from column A, line 8d on column B, line 8d. Generation Skipping Transfer Tax – Tax paid on generation skipping transfers is not deductible under California law. Part-year resident amounts – Multiply the alimony paid while a nonresident by the California ratio to determine the nonresident portion.

Is Schedule D self employed?

Self Employed / Sole Trader / Schedule D – These are all names describing a contract where the individual is engaged under a contract to provide services and is paid gross. … As they are self-employed, they can be taxed under schedule D meaning they are responsible for their own tax.If they do not, click the tax links to drill down to, and view the names of, the employees for whom those taxes apply. CS Professional Suite Integrated software and services for tax and accounting professionals. The remaining $600 of your credit card interest is not deductible because it is a personal expense.

What Items Can Be Deducted On Schedule A?

List the type and amount of each expense from the following list next to line 16 and enter the total of these expenses on line 16. If you are filing a paper return and you can’t fit all your expenses on the dotted lines next to line 16, attach a statement instead showing the type and amount of each expense.

- Remember to use the California tax rate in your computations.

- Online AL, DC and TN do not support nonresident forms for state e-file.

- If there are differences, use Schedule D , California Capital Gain or Loss Adjustment, to calculate the amount to enter on line 6.

- Federal estate tax paid on income in respect of a decedent is not deductible for California.

- COVID-19 updates for California taxpayers affected by the pandemic.

- New Golden State Stimulus II information now available.

Add parking and tolls to the amount you claim under either method. But don’t deduct any amounts that were repaid to you. If your home mortgage interest deduction is limited, see Pub. 936 to figure the amount of mortgage interest and points reported to you on Form 1098 that are deductible.H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file. All prices are subject to change without notice. Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. Can you deduct the cost of your tax software? Learn more from the tax experts at H&R Block. For mortgages taken out after December 15, 2017, only interest on the first $750,000 of mortgage debt is deductible.

What Is Schedule A Form 1040 Or 1040

Schedule C, also known as “Form 1040, Profit and Loss,” is a year-end tax form used to report income or loss from a sole proprietorship or single-member limited liability company . You must file a Schedule C if the primary purpose of your business is to generate revenue or profit and if you’re regularly involved in your business’s activities. Changing the Tax Exempt status for specific taxes for payroll items enables you to update taxable wages for all payroll checks entered after the change and to update existing payroll checks as well. Note that this may affect previously filed payroll tax forms. The Payroll Journal with Taxable Wages Report contains detailed information for all or selected payroll checks for the specified date or range of dates.

Schedules & Maps

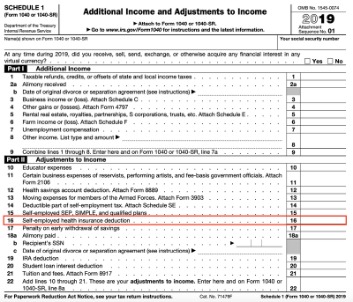

Federal law no longer allows a charitable deduction for amounts paid to an institution of higher education in exchange for college athletic seating rights. Enter the amount on line 11, column C.Casualty and theft losses of property used in performing services as an employee from Form 4684, line 32 and 38b, or Form 4797, line 18a. IRC Section 965 deferred foreign income. If you included IRC 965 deferred foreign income on your federal Schedule 1 (Form 1040 or 1040-SR), enter the amount on line 8f, column B and write “IRC 965” on line 8f and at the top of Form 540. Federal NOL from federal Schedule 1 (Form 1040 or 1040-SR), line 8.