Content

- How To File A State Tax Extension

- More Time To File, Not More Time To Pay Usually

- Combat Zone Extension

- Extension Of Time To File Your Tax Return

- Tax Extensions For Overseas Taxpayers And Military Members

- Potential Late Filing Or Late Payment Penalties

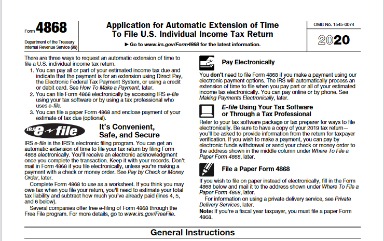

Tax deadlines have a way of creeping up on you, so filing for a tax extension might be something you need to do at some point in your life. Some folks don’t necessarily need to worry about applying for tax extensions at all. You can also apply for a tax extension by filling out Form 4868 on paper and sending it via snail mail (it’s less than a page long), but just get proof that you mailed it. File IRS Form 4868 — but remember that getting an extension doesn’t give you more time to actually pay your taxes.

How To File A State Tax Extension

Legislative BulletinsAnnual summaries of Minnesota tax law changes enacted during each legislative session. This is an archived article and the information in the article may be outdated. Please look at the time stamp on the story to see when it was last updated.Forbes Advisor adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website.

More Time To File, Not More Time To Pay Usually

If you have the funds now to pay, do so as that would reduce any late tax payment penalties. The question is, how do you know what you owe in taxes without filing a return? Thus, preparing a return now would get you that answer. You can still just prepare return to get an estimate of taxes owed and e-File an extension if you do not have all information at hand to file the return. A tax extension only postpones your time to file a return, not your time to pay your taxes! In addition, you may face late filing penalties for each month your return is not filed. It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation.

What happens if you file taxes late but don’t owe?

Failure-to-pay penalty: If you don’t pay the taxes you owe by the deadline, the IRS can penalize you 0.5% of the unpaid balance every month, up to a total of 25%. Interest: On top of the failure-to-pay penalty, interest accrues on your unpaid taxes.Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled. Applies to individual tax returns only. Offer valid for tax preparation fees for new clients only. A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return.

Combat Zone Extension

The potential IRS fees and penaltiesfor not e-filing anything are going to be larger than on the taxes owed. Therefore, pay as much or as little as you can, but do e-file a Tax Extension or Return. The IRS will most likely add penalties and/or interest to the late payments. Learn about your tax payment options.

Extension Of Time To File Your Tax Return

If you can’t file by the automatic two-month extension date, you can file a Form 4868 to request an additional extension to Oct. 15. You have until June 15 to file this form. The May 17 tax deadline is just around the corner.

- Although it may sound tempting, there are a few things to keep in mind.

- For many states, paying your taxes online serves also as state tax extension, thus you do not have to also file a state tax extension form.

- Revenue AnalysesResearch estimates of how state House and Senate bills could affect revenues and the Minnesota tax system.

- Thus, preparing a return now would get you that answer.

- That will also avoid penalties and interest accumulating if you underestimate your taxes due.

- See Peace of Mind® Terms for details.

- Adjusted gross incomeaccess to free, name-brand tax-prep software.

Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc.

Tax Extensions For Overseas Taxpayers And Military Members

The department cannot disclose your private data to another government entity or third party without your written consent, authorization by law, or court order. He encourages filing electronically with direct deposit for the quickest way to get refunds. He said it can help some taxpayers more quickly receive any remaining stimulus payments entitled to them. You will then need to verify your identity by providing your account number from a credit card, student loan, mortgage, or auto loan. Members of the military or those serving in a combat zone generally have 180 days after leaving the area to file returns and pay taxes.

Can I file tax after deadline?

The tax filing deadline has come and gone. … There is no penalty for filing a late return after the tax deadline if a refund is due. If you didn’t file and owe tax, file a return as soon as you can and pay as much as possible to reduce penalties and interest.You can file your tax return any time before the extension expires and you do not need to attach a copy of Form 4868 to the return. Having extra time to gather, review, prepare, and submit your tax return can ease stress and allow you to be more thorough on your return. Requesting an extension is fairly simple, and you do not need to explain to the IRS why you want one. If your estimate is on the high side and you end up overpaying, you will get a refund when you eventually file your return. That will also avoid penalties and interest accumulating if you underestimate your taxes due. You will still have to pay your taxes by that year’s original due date of the return , even if the IRS grants an extension to file later than that.If you owe taxes and you didn’t pay them on Tax Day this year , you likely already owe fees and penalties. However, missing the Oct. 15 filing deadline can add to your financial woes.If you do not have the funds to pay taxes – but you have all documents ready to file a return – that is not a reason to e-File an extension. You can eFile an extension in this case as it would eliminate the missed filing deadline line penalty, but it will not eliminate the late tax payment penalty. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required.

Business And Corporations

The student will be required to return all course materials, which may be non-refundable. Discount is off course materials in states where applicable. Discount must be used on initial purchase only. CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. Form 4868 is the IRS document you complete to receive an automatic extension to file your return.