Content

- Itin Renewals

- Starting A Business?

- What Documents Are Needed To Apply For An Itin?

- What Is An Individual Taxpayer Identification Number Itin?

- Legal

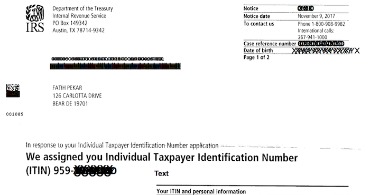

For a summary of those rules, please see the new Form W-7 and its instructions.Eligibility for claiming the CTC depends on the status of your children. You can only claim the CTC if your qualifying children have Social Security Numbers. Any individual who is eligible to be legally employed in the U.S. must have an SSN. If you have an ITIN you should not provide it to an employer in place of an SSN, since this would indicate to your employer and to the Social Security Administration that you are not authorized to work. To check rates and terms Stilt may be able offer you a soft credit inquiry that will be made. However, if you choose to accept a Stilt loan offer, a hard inquiry from one or more of the consumer reporting agencies will be required. Submit federal income tax documents like Form 1040, Form 1040A, or Form 1040EZ, whichever applies to you.Like an SSN, an ITIN number is nine digits in the format xxx-xx-xxx. But the first digit will always be a 9, and the second section of the number will be in the range of (e.g., 9xx-88-xxxx). As of 2012, the IRS had issued 21 million ITINs to taxpayers and their dependents. You also must submit evidence of your identity, age, and U.S. citizenship or lawful alien status. For more information please see the Social Security Administration website.

Itin Renewals

You can avoid having to mail your identification documentation by making an appointment with an IRS-authorized Certifying Acceptance Agent in-person. An Individual Taxpayer Identification Number or ITIN is a tax processing number generated by the Internal Revenue Service for those who need to file US taxes but do not qualify for a Social Security Number .To answer that question, we have to know what an ITIN is and how it differs from an SSN or an EIN. Benefits Get access to a variety of high-quality health insurance plans. You can confirm if your ITIN is active by visiting an IRS-authorized Certified Acceptance Agent . The Form W-7 and instructions are available on the IRS website at Ich educates students to make meaningful contributions as citizens of a complex world.

Starting A Business?

If you already have an ITIN, then the IRS has your information, unless you moved recently. You are not increasing your exposure by renewing an ITIN or filing taxes with an ITIN. To file a tax return, you must enter your ITIN in the space for the SSN on the tax form, complete the rest of the return, and submit the tax return to the IRS. The ITIN is used in place of an SSN on a tax return to identify you, your spouse, or dependent without an SSN, on the tax return. For example, if you are an immigrant in the U.S. who has applied for legal status to work or reside in the U.S., you would need an ITIN to file a tax return while waiting for a decision.

What Documents Are Needed To Apply For An Itin?

As a newcomer to the United States, having a national ID number, whether SSN or ITIN, is essential to work, file taxes, obtain a driver’s license and even open a U.S. bank account. Hopefully this guide has provided some insight into how to obtain either or both. This includes undocumented aliens and nonresident aliens that conduct business in the United States. Foreign entities that operate in the United States, including foreign corporations, partnerships, trusts and estates would also require an ITIN. Newcomers to the United Statesmust possess a form of national I.D.

- Many of the tasks like opening a bank account, getting a driving license, and applying for a visa requires SSN for identification and processing.

- Maine residents will fall into one of three tax brackets.

- This non-refundable credit is worth up to $2,000 per household.

- As opposed to SSN, it does not provide legal immigration status or work authorization.

SSN is issued to citizens and certain noncitizens residents. ITIN is issued to undocumented aliens and nonresident aliens who work or conduct business in the US. In certain cases where there’s a partnership, trust, and real estate involved, the foreign entities would be issued an ITIN for paying their taxes.Undocumented immigrants contribute over $11 billion in taxes every year. If you use an expired ITIN on a U.S. tax return, it will be processed and treated as timely filed, but without any exemptions and/or credits claimed and no refund will be paid at that time. You will receive a notice explaining the delay in any refund and that the ITIN has expired.

What Is An Individual Taxpayer Identification Number Itin?

While used interchangeably by some individuals, there’s a sharp distinction between SSN and ITIN which everyone should know. Before learning about the differences, it’s better to get acquainted with the two numbers first and their usage in the US. You may also make an appointment at your closest IRS Taxpayer Assistance Center. Simply find the nearest center and call to make an appointment.

Can an undocumented person get an ITIN?

While undocumented individuals may not qualify to file and pay taxes with a social security number, they can obtain an Individual Taxpayer Identification Number (ITIN). An ITIN works like a social security number for the purpose of filing taxes only.The Get It Back Campaign helps eligible individuals claim tax credits and use free tax filing assistance to maximize tax time. A project of the Center on Budget and Policy Priorities, the Campaign partners with community organizations, businesses, government agencies, and financial institutions to conduct outreach nationally. For 30 years, these partnerships have connected lower and moderate-income people to tax benefits like the Earned Income Tax Credit , the Child Tax Credit , and Volunteer Income Tax Assistance . The ITIN program was created by the IRS in July 1996 to help foreign nationals and other individuals who are not eligible for a Social Security number to pay the taxes they are legally required to pay.

Legal

If you have any legal or tax questions regarding this content or related issues, then you should consult with your professional legal or tax advisor. Make an appointment at a designated IRS Taxpayer Assistance Center. This will also prevent you from having to mail your proof of identity and foreign status document. Applicants who meet one of the exceptions to the requirement to file a tax return (see the Instructions for Form W-7) must provide documentation to support the exception. Acceptance Agents are entities (colleges, financial institutions, accounting firms, etc.) who are authorized by the IRS to assist applicants in obtaining ITINs. They review the applicant’s documentation and forward the completed Form W-7 to IRS for processing. In general, privacy laws prevent the IRS from sharing personal taxpayer information with other government agencies.Send all the documents to the IRS office via mail or walk into the office directly. Supplement it with other documents like passport, US or other government-issued ID cards, proof of US residency. Please note that only original documents will be accepted for verification. Once issued, it will be mailed to your mailing address. If you’re a student or J-visa holder, then submit the DS-2019 Certificate of Eligibility for Exchange Visitor Status and I-20 certificates. By 2007, the Social Security Trust Fund had received up to $240 billion from ITIN filers—up to 10.7 percent of the trust fund’s total assets of $2.24 trillion.

Credits & Deductions

They do not accept walk-ins, so don’t forget to bring all your paperwork and documents with you to your appointment. Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products. Maine residents will fall into one of three tax brackets. People wondered if it means that an individual’s Social Security Number or a business’s Employer Identification Number will expire if it is never used.

National Immigration Law Center

Also, immigrants want to file their taxes because they see it as an opportunity to contribute and to prove their economic contribution to the U.S. and to document their residency. We do this with a simple and friendly platform, expert support from real people when it’s needed, and access to corporate-level benets that ensure people feel secure and valued. SSNs are nine digits (xxx-xx-xxxx) and belong to US citizens and authorized residents. Referral Program Know any companies that could benefit from seamless payroll, access to affordable benefits, and HR support? Parents or guardians may complete and sign a Form W-7 for a dependent under age 18 if the dependent is unable to do so, and must check the parent or guardian’s box in the signature area of the application.So, as a non-citizen, if you’re not eligible for SSN, you should get an ITIN. ITIN is issued by the IRS and is used for tax filing purposes. An ITIN is issued to those who, for some reason, aren’t allowed to have an SSN but have to pay their taxes. So ITIN is only issued to nonresident aliens and not to the citizens .However, if you file another US tax return in the future, it will have to be renewed at that time. The IRS will also issue ITINs to dependents who can be claimed on a tax return, but who do not qualify for social security numbers. Designated school officials should be aware of new IRS requirements effective January 2013 that affect ITINs applicants and certifying acceptance agents . This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, legal or tax advice.