Content

- Taxes On 401k Withdrawals & Contributions

- Merchant Services

- Overpaying Fica Taxes

- What Is Income Tax?

- How To Do Payroll Without Tax Tables

SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now. Just about everyone pays FICA taxes, including resident aliens and many nonresident aliens. But there’s an Additional Medicare Tax that high-income individuals must pay.Here’s a breakdown of the taxes that might come out of your paycheck. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research.

Taxes On 401k Withdrawals & Contributions

In total, the Additional Medicare Tax is 2.35% (1.45% plus 0.9%). Employers are not required to match the additional Medicare levy. The amount of FICA tax withheld from your paycheck depends on your gross wages. A withholding is the portion of an employee’s wages that is not included in their paycheck because it is sent to federal, state, and local tax authorities. Before the withholding system was implemented, income taxes were due at a specific time of year, initially in March.

Merchant Services

Form W-4 asks about your marital status, dependents and other factors to help you calculate how much to withhold. The less you withhold, the less tax comes out of your paycheck. Sometimes referred to as the “hospital insurance tax,” this pays for health insurance for people who are 65 or older, younger people with disabilities and people with certain conditions. Employers typically have to withhold an extra 0.9% on money you earn over $200,000.Your company sends the money, along with its match (an additional 7.65% of your pay), to the government. In this article we’ll discuss what FICA taxes are, how they’re applied and who’s responsible for paying them. When your paycheck doesn’t match the number of hours you’ve worked times your hourly wage, it doesn’t automatically mean your employer is stealing from you. Instead, your employer is likely withholding money from your paycheck for a range of taxes, including the federal income tax and the payroll tax, which you can see in the tax breakdown on your pay stub.At the end of the year, you must prepare and file Form W-2, Wage and Tax Statement to report wages, tips and other compensation paid to an employee. Use Form W-3, Transmittal of Wage and Tax Statements to transmit Forms W-2 to the Social Security Administration. The amount of money you’ll receive in monthly Social Security benefits when you retire is based on a formula that looks at the average you earned during the 35 years in which you earned the most money. You can use the Social Security Administration’scalculatorto estimate your benefits.

Overpaying Fica Taxes

We believe everyone should be able to make financial decisions with confidence. Based in the Kansas City area, Mike specializes in personal finance and business topics.Chase’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you’re about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. Based in Atlanta, Georgia, W D Adkins has been writing professionally since 2008.

What Is Income Tax?

Once the threshold is reached, the tax applies to all wages that are currently subject to Medicare tax, to the Railroad Retirement Tax Act or to the Self-Employment Compensation Act. Unlike the other FICA taxes, the 0.9 percent Medicare surtax is imposed on the employee portion only. You withhold this 0.9 percent tax from employee wages and you do not pay an employer’s portion. Also, unlike the other FICA taxes, you withhold the 0.9 percent Medicare surtax only to the extent that wages paid to an employee exceed $200,000 in a calendar year. You begin withholding the surtax in the pay period in which you pay wages in excess of this $200,000 “floor” to an employee and you continue to withhold it each pay period until the end of the calendar year. The difference between payroll tax and income tax also comes down to what the taxes fund.

What is the difference between income tax and FICA?

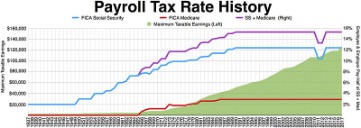

Payroll tax consists of Social Security and Medicare taxes, otherwise known as Federal Insurance Contributions Act (FICA) tax. FICA tax is an employer-employee tax, meaning both you and your employees contribute to it. … Income tax is made up of federal, state, and local income taxes.If you have more than one job, you may underpay the amount of FICA taxes you owe. If that happens, you’ll have to make separate estimated tax payments (unless you asked for additional withholding on your W-4 form). Both SECA and FICA tax rates have increased since they were introduced. Social Security tax rates remained under 3% for employees and employers until the end of 1959. FICA is often referred to as payroll tax because typically employers deduct FICA tax from employee paychecks and remit the money to the IRS on behalf of the employee. Payroll taxes, including FICA tax or withholding tax, are what your employer deducts from your pay and sends to the IRS, state or other tax authority on your behalf. Here are the key factors, and why your tax withholding is important to monitor.

How To Do Payroll Without Tax Tables

Chase Merchant Services provides you with a more secure and convenient ways to do business. Our payments solutions give your customers the flexibility to make purchases however they choose with added security to protect their accounts. On March 27, 2020, former President Donald Trump signed a$2 trillion coronavirus emergency stimulus package into law. Under the CARES Act, employers were allowed to defer their share of Social Security taxes through Dec. 31, 2020—50% of the deferred amount will be due Dec. 31, 2021, and the other half by Dec. 31, 2022. The Federal Insurance Contributions Act is a U.S payroll tax deducted to fund the Social Security and Medicare programs. As there is no ceiling on the 1.45 percent portions of the Medicare tax, you must continue to withhold and to pay the Medicare tax regardless of how much you pay an employee.

- However, for Social Security contributions there’s a maximum wage base, after which no contributions are levied on additional income.

- Asa business, you don’t actually pay this tax for your employees, but you are required to withhold it from their pay and remit it to the IRS or the applicable state or local tax authorities.

- No matter what part of the year the F-1 or J-1 visa holder originally entered the country, it is counted as a full calendar year when determining the exemption for FICA withholding.

- Social Security and Medicare are not withheld at the state level and state withholdings vary state-by-state.

- Social Security tax is applied only up to a certain wage base, currently $142,800.

Taxes from FICA and SECA do not fund Supplemental Security Income benefits, even though that particular program is run by theSocial Security Administration. Social Security and Medicare are not withheld at the state level and state withholdings vary state-by-state. Our solutions for regulated financial departments and institutions help customers meet their obligations to external regulators.

Payroll

The breakdown for the two taxes is 6.2% for Social Security (on wages up to $142,800) and 1.45% for Medicare (plus an additional 0.90% for wages in excess of $200,000). Also known as payroll taxes, FICA taxes are automatically deducted from your paycheck.However, none of their employers are required to withhold the 0.9 percent surtax because neither spouse earned over $200,000 from any one employer. Richard, your employee, earns $220,000 from you during 2013. He is married, but his wife does not have any earned income. You must start withholding the additional 0.9 percent Medicare tax when Richard’s earnings exceed $200,000. Richard will be over-withheld because the couple’s combined income is beneath the married, filing jointly threshold of $250,000. In making this determination, you do not consider wages paid by other employers or earnings of the individual’s spouse. Also, the “ignore the spouse’s earnings” rule applies even if both spouses work for the same company.