Content

- The Balance Sheet

- Things You Need To Know About Financial Statements

- Owners’ Equity

- Us Small Business

- Video Explanation Of The Balance Sheet

- Terms Similar To Balance Sheet

These are the financial obligations a company owes to outside parties. Cash, the most fundamental of current assets, also includes non-restricted bank accounts and checks. Cash equivalents are very safe assets that can be readily converted into cash; U.S.It is important to note that a balance sheet is a snapshot of the company’s financial position at a single point in time. A liability is any money that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries. Current liabilities are due within one year and are listed in order of their due date. Long-term liabilities, on the other hand, are due at any point after one year. The balance sheet provides an overview of the state of a company’s finances at a moment in time. It cannot give a sense of the trends playing out over a longer period on its own. For this reason, the balance sheet should be compared with those of previous periods.

- And though the subject of finances is tedious for many health professionals, it is crucial to be informed and to monitor the financial pulse of your practice.

- Preferred stock is assigned an arbitrary par value that has no bearing on the market value of the shares.

- Amount after accumulated depreciation, depletion and amortization of physical assets used in the normal conduct of business to produce goods and services and not intended for resale.

- Although balance sheets can be very important for investors, analysts, and accountants, they do have a couple of drawbacks.

- Marketable securities are unrestricted short-term financial instruments that are issued either for equity securities or for debt securities of a publicly listed company.

You may also want to review the balance sheet with your accountant after any major changes to your business. Although the balance sheet represents a moment frozen in time, most balance sheets will also include data from the previous year to facilitate comparison and see how your practice is doing over time.

The Balance Sheet

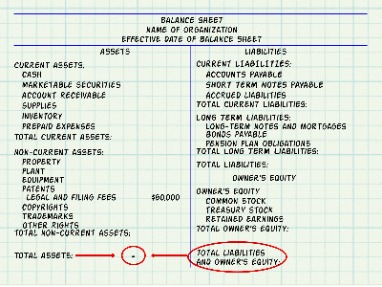

But there are a few common components that investors are likely to come across. The balance sheet is one of the three core financial statements that are used to evaluate a business. Retained earnings are used to pay down debt or are otherwise reinvested in the business to take advantage of growth opportunities. While a business is in a growth phase, retained earnings are typically used to fund expansion rather than paid out as dividends to shareholders. Remember —the left side of your balance sheet must equal the right side (liabilities + owners’ equity). Total liabilities and owners’ equity are totaled at the bottom of the right side of the balance sheet.

What is difference between journal and ledger?

The key difference between Journal and Ledger is that Journal is the first step of the accounting cycle where all the accounting transactions are analyzed and recorded as the journal entries, whereas, ledger is the extension of the journal where journal entries are recorded by the company in its general ledger account …This excludes temporary equity and is sometimes called permanent equity. We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. We’re here to take the guesswork out of running your own business—for good.

Things You Need To Know About Financial Statements

This can sometimes make it difficult to understand what is listed in each section. Amount after unamortized premium and debt issuance costs of long-term debt classified as noncurrent and excluding amounts to be repaid within one year or the normal operating cycle, if longer.

How do you calculate cash on a balance sheet?

Add the total amount of current non-cash assets together. Next, find the total for all current assets at the bottom of the current assets section. Subtract the non-cash assets from the total current assets. This number represents the amount of cash on the balance sheet.If the company does not list dividends, obtain their income statement. Calculate the difference between retained earnings for the last two periods. Because the two sides of this balance sheet represent two different aspects of the same entity, the totals must always be identical. Thus, a change in the amount for one item must always be accompanied by an equal change in some other item. For example, if the company pays $40 to one of its trade creditors, the cash balance will go down by $40, and the balance in accounts payable will go down by the same amount. One side represents your business’s assets and the other shows its liabilities and shareholders equity. A balance sheet summarizes an organization or individual’s assets, equity and liabilities at a specific point in time.

Owners’ Equity

Multiple copies of balance sheets should be kept at all times and updated regularly. This will ensure that balance sheets have the same information and don’t contain discrepancies.Examples include, but are not limited to, land, buildings, machinery and equipment, office equipment, and furniture and fixtures. Amount of investment in debt security measured at fair value with change in fair value recognized in other comprehensive income (available-for-sale), classified as noncurrent.

Us Small Business

If the company takes $8,000 from investors, its assets will increase by that amount, as will its shareholder equity. All revenues the company generates in excess of its expenses will go into the shareholder equity account. These revenues will be balanced on the assets side, appearing as cash, investments, inventory, or other assets. A balance sheet helps business stakeholders and analysts evaluate the overall financial position of a company and its ability to pay for its operating needs. You can also use the balance sheet to determine how to meet your financial obligations and the best ways to use credit to finance your operations. Compare the current reporting period with previous ones using a percent change analysis.Capital employed, also known as funds employed, is the total amount of capital used for the acquisition of profits. Lastly, inventory represents the company’s raw materials, work-in-progress goods and finished goods. Depending on the company, the exact makeup of the inventory account will differ. For example, a manufacturing firm will carry a large number of raw materials, while a retail firm carries none. The makeup of a retailer’s inventory typically consists of goods purchased from manufacturers and wholesalers.

Video Explanation Of The Balance Sheet

From the income statement, use the net profit figure from the latest period. If the net change in retained earnings is less than the latest net profit, there was a dividend payout.The Federal Accounting Standards Advisory Board is a United States federal advisory committee whose mission is to develop generally accepted accounting principles for federal financial reporting entities. Balance sheets, like all financial statements, will have minor differences between organizations and industries. However, there are several “buckets” and line items that are almost always included in common balance sheets. We briefly go through commonly found line items under Current Assets, Long-Term Assets, Current Liabilities, Long-term Liabilities, and Equity. Data from your balance sheet can also be combined with data from other financial statements for an even more in-depth understanding of your practice finances. Additional resources for managing your practice finances will appear in future issues of the PracticeUpdate E-Newsletter and on APApractice.org. It is not possible to calculate dividends from a balance sheet by itself.Amount after valuation and LIFO reserves of inventory expected to be sold, or consumed within one year or operating cycle, if longer. Amount, after allowance for credit loss, of right to consideration from customer for product sold and service rendered in normal course of business, classified as current. Many of these ratios are used by creditorsand lendersto determine whether they should extend credit to a business, or perhaps withdraw existing credit. This includes all raw materials, work in process, and finished goods items, less an obsolescence reserve. This includes any prepayment that is expected to be used within one year. Equity can also drop when an owner draws money out of the company to pay themself, or when a corporation issues dividends to shareholders. Just like assets, you’ll classify them as current and long-term .

What Are Retained Earnings On A Balance Sheet?

It’s usually thought of as the second most important financial statement. A balance sheet at its core shows the liquidity and the theoretical value of the business. The income statement and statement of cash flows also provide valuable context for assessing a company’s finances, as do any notes or addenda in an earnings report that might refer back to the balance sheet. Because the balance sheet reflects every transaction since your company started, it reveals your business’s overall financial health.Understanding the different types of financial documents and the information each contains helps you better understand your financial position and make more informed decisions about your practice. This article is the first in a series designed to assist you with making sense of your practice’s financial statements. It can be easy to get confused when looking over balance sheets from different companies. It helps to read the corporate reports and the Form 10-K. The 10-K is required to be filed with the SEC and summarizes financial decisions, internal controls, investment strategies, and much more.Finally, total assets are tabulated at the bottom of the assets section of the balance sheet. The equity section generally lists preferred and common stock values, total equity value, par values , and retained earnings. The three parts of a balance sheet follow the accounting formula.Non-current assets are assets that are not turned into cash easily, are expected to be turned into cash within a year, and/or have a lifespan of more than a year. They can refer to tangible assets, such as machinery, computers, buildings and land. Non-current assets also can be intangible assets, such as goodwill, patents or copyright. While these assets are not physical in nature, they are often the resources that can make or break a company—the value of a brand name, for instance, should not be underestimated. The balance sheet adheres to an equation that equates assets with the sum of liabilities and shareholder equity. Balance sheets can be used with other important financial statements to conduct fundamental analysis or calculating financial ratios.It is also a condensed version of the account balances within a company. In essence, the balance sheet tells investors what a business owns , what it owes , and how much investors have invested . Investors also use financial ratios generated from these three statements to help them valuate a business and determine if it fits their investment strategy and risk tolerance. Publicly-owned businesses must file standardized reports to the Securities and Exchange Commission to ensure the public has access to their financial performance.