Content

- Calculating Inventory Cost Using Fifo

- Fifo Vs Other Valuation Methods

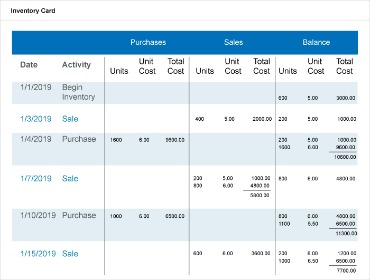

- Fifo Perpetual

- Fifo Method And Inventory Valuation

- What Is First In, First Out Fifo?

- Fifo Vs Lifo

- How Lifo And Fifo Affect A Company’s Inventory Outlook

- Accounting Basics For Inventory

The company purchases another snowmobile for a price of $75,000. For the sale of one snowmobile, the company will expense the cost of the older snowmobile – $50,000. It stands for “First-In, First-Out” and is used for cost flow assumption purposes. Cost flow assumptions refers to the method of moving the cost of a company’s product out of its inventory to its cost of goods sold.The beginning inventory of 195 units is composed of 4 batches shown in the order they arrived . Whether you need an eagle eye into the hundreds of items you sell or if you just want to stay on top of your stock, there’s an inventory management solution that’s right for you. If you sell online, most POS systems like Shopify will track inventory for you. If you’re wanting to try it for yourself, there are free templates available online. If you’re ready to try out a dedicated inventory system, Zoho Inventory is free to start. The company would report a cost of goods sold of $1,050 and inventory of $350.You would need to keep these in a separate category for refurbished goods. If you need help with other Managerial Accounting Topics check out our archive or check out our list if youNeed help with your accounting classes through the links to see our other offerings. Make sure to check out our videos on FIFO inventory calculations video and FIFO inventory journal entries at the end of the post. When I think of FIFO, it reminds me of milk being sold at the grocery store.

- Those who favor LIFO argue that its use leads to a better matching of costs and revenues than the other methods.

- If you need help with other Managerial Accounting Topics check out our archive or check out our list if youNeed help with your accounting classes through the links to see our other offerings.

- This means that the ending inventory balance tends to be lower, while the cost of goods sold is increased, resulting in lower taxable profits.

- FIFO can be a better indicator of the value for ending inventory because the older items have been used up while the most recently acquired items reflect current market prices.

Thus, the cost of goods sold in the first quarter amounts to $37,765,000. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace.

Calculating Inventory Cost Using Fifo

When calculating any inventory method under periodic, it is best to separate the purchases from the sales. The price of inventory can be affected to a great extent by inflation, especially if the inflation rate is high. Since the oldest batches with the lowest price are assigned to the cost of goods first, the cost of goods sold is understated. In other words, it is lower than inventories that would have been assigned by the current market price. The consequence of understated cost of goods sold is overstated gross profit because inventories are sold at their current market price. Let’s assume that the company uses a periodic inventory system.The FIFO (“First-In, First-Out”) method means that the cost of a company’s oldest inventory is used in the COGS calculation. LIFO (“Last-In, First-Out”) means that the cost of a company’s most recent inventory is used instead. When doing this by hand, I always cross out the number of units and write in the remaining amount. Keeping track of the number of units remaining will help to ensure that you take your units from the correct date and calculate ending inventory properly. It helps to reduce obsolete inventory write-off because the oldest batches are assigned to the cost of goods sold first. Let’s assume that a company has bought 55 units to replenish stock . A southeastern Ohio native, Justin Johnson is a finance professional with accounting and financial planning experience in various manufacturing industries.

Fifo Vs Other Valuation Methods

If inventories have slow turnover, the FIFO method is not a good choice. Let’s calculate the inventory balance on 31st of March and cost of goods sold using the FIFO inventory method. FIFO and LIFO are merely methods for recording and reporting the cost of inventory and have nothing to do with the actual flow of physical inventory.

Does Tesla use FIFO or LIFO?

Tesla uses LIFO method to value inventories, which are valued at lower cost of market.Accounting isn’t just a necessary evil; sometimes the methods used can be a key part of your business strategy. If we add the cost of goods sold and ending inventory, we get $3,394.00 which is our goods available for sale. The sale on January 31 of 80 units would be taken from the purchase on January 3rd and the purchase on January 12th.If we switch inventory methods, we must restate all years presented on financial statements using the same inventory method. But regardless of whether your inventory costs are changing or not, the IRS requires you to choose a method of accounting for inventory that’s consistent year over year. You must use the same method for reporting your inventory across all of your financial statements and your tax return. If you want to change your inventory accounting practices, you must fill out and submit IRS Form 3115. The LIFO method for financial accounting may be used over FIFO when the cost of inventory is increasing, perhaps due to inflation. Using FIFO means the cost of a sale will be higher because the more expensive items in inventory are being sold off first.

Fifo Perpetual

Often, in an inflationary market, lower, older costs are assigned to the cost of goods sold under the FIFO method, which results in a higher net income than if LIFO were used. FIFO assumes that the remaining inventory consists of items purchased last. Remember that under FIFO, periodic and perpetual inventory systems will always give you the same cost of goods sold and ending inventory. Each sale of inventory should be recorded in the journal by debiting the accounts receivable account and crediting the sales account. In turn, each purchase of inventory is recorded by debiting the purchases account and crediting the accounts payable account.Furthermore, it reduces the impact of inflation, assuming that the cost of purchasing newer inventory will be higher than the purchasing cost of older inventory. If you are preselling, then you cannot record cost of goods sold until you have purchased the items. The company would apply the correct inventory method at the time of shipment. The second criticism—that LIFO grossly understates inventory—is valid. A company may report LIFO inventory at a fraction of its current replacement cost, especially if the historical costs are from several decades ago. LIFO supporters contend that the increased usefulness of the income statement more than offsets the negative effect of this undervaluation of inventory on the balance sheet.FIFO assumes the first items acquired are the first sold, and the items acquired most recently remain in inventory. If a company wants to match sales revenue with current cost of goods sold, it would use LIFO. If a company seeks to reduce its income taxes in a period of rising prices, it would also use LIFO. On the other hand, LIFO often charges against revenues the cost of goods not actually sold.

Fifo Method And Inventory Valuation

The units are alike, so the customer does not care which of the identical units the company ships. However, the gross margin on the sale could be either $ 800, $ 700, or $ 600, depending on which unit the company ships. Advantages and disadvantages of LIFO The advantages of the LIFO method are based on the fact that prices have risen almost constantly for decades. LIFO supporters claim this upward trend in prices leads to inventory, or paper, profits if the FIFO method is used. During periods of inflation, LIFO shows the largest cost of goods sold of any of the costing methods because the newest costs charged to cost of goods sold are also the highest costs.

How do you calculate closing inventory?

The basic formula for calculating ending inventory is: Beginning inventory + net purchases – COGS = ending inventory. Your beginning inventory is the last period’s ending inventory.If inflation were nonexistent, then all three of the inventory valuation methods would produce the same exact results. Inflation is a measure of the rate of price increases in an economy. When prices are stable, our bakery example from earlier would be able to produce all of its bread loaves at $1, and LIFO, FIFO, and average cost would give us a cost of $1 per loaf. However, in the real world, prices tend to rise over the long term, which means that the choice of accounting method can affect the inventory valuation and profitability for the period. As products are sold, inventory costs move from the balance sheet to the income statement. Accountants have the option of valuing the items sold and the items remaining in inventory according to the oldest or the most recent costs of the inventory.

What Is First In, First Out Fifo?

Under LIFO the assumption is that the last items purchased are the items sold, meaning the more expensive items were used. The cost of goods sold is therefore relatively higher and the value of goods remaining on the balance sheet is lower since those are older items purchased at a lower price. (Again, assuming that prices have increased over time.) Under LIFO your profits are lower compared to FIFO accounting. Tax benefit of LIFO The LIFO method results in the lowest taxable income, and thus the lowest income taxes, when prices are rising. The Internal Revenue Service allows companies to use LIFO for tax purposes only if they use LIFO for financial reporting purposes.However, the higher net income means the company would have a higher tax liability. The FIFO method follows the logic that to avoid obsolescence, a company would sell the oldest inventory items first and maintain the newest items in inventory. The first-in, first-out or FIFO inventory method is used to compute the cost of goods sold and the inventory account balance at the end of the relevant period. The idea behind this method is that inventories bought first should be sold first. In other words, inventories have to be assigned to cost of goods sold in the order they entered the stock. The LIFO inventory method assumes the last items acquired are the first sold. The FIFO inventory method assumes the first items acquired are the first sold, and the items acquired most recently remain in inventory.

Fifo Vs Lifo

All periodic inventory systems calculate inventory at the end of the period. Therefore, we are not concerned about which units are on hand when a sale occurs.

How Lifo And Fifo Affect A Company’s Inventory Outlook

However, FIFO makes this assumption in order for the COGS calculation to work. The opposite of FIFO is LIFO , where the last item purchased or acquired is the first item out. Average cost inventory is another method that assigns the same cost to each item and results in net income and ending inventory balances between FIFO and LIFO.

Accounting Basics For Inventory

For example, fresh meats and dairy products must flow in a FIFO manner to avoid spoilage losses. In contrast, firms use coal stacked in a pile in a LIFO manner because the newest units purchased are unloaded on top of the pile and sold first. Gasoline held in a tank is a good example of an inventory that has an average physical flow.