Content

- How Currency Translation Works

- Which Of The Following General Types Of Transactions Could Be A Foreign Currency Transaction?

- Gain On Import Transaction

- Free Accounting Courses

- In Which The Subsidiary Maintains Its Accounting Records

- Transaction Denominated In

- Example Of Currency Translation

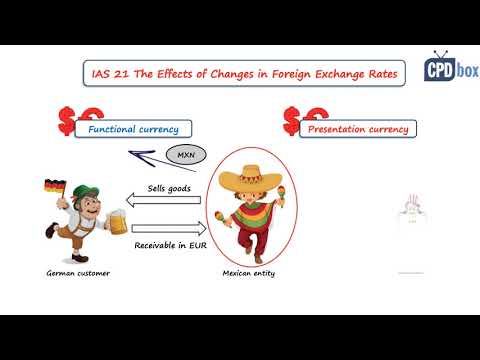

GAAP. Information on presentation in the financial statements may be obtained from sources such as Deloitte’s IAS Plus guide on IFRS model financial statements at /fs/2007modelfs.pdf . Currency translation risk occurs because the company has net assets, including equity investments, and liabilities “denominated” in a foreign currency. If the foreign entity being consolidated has a different balance sheet date than that of the reporting entity, use the exchange rate in effect as of the foreign entity’s balance sheet date. Translate revenues, expenses, gains, and losses using the exchange rate as of the dates when those items were originally recognized. Foreign currency exchange rates measure one currency’s strength relative to another. The strength of a currency depends on a number of factors such as its inflation rate, prevailing interest rates in its home country, or the stability of the government, to name a few.II. A difference between the spot rate and the forward rate when the forward exchange contract is executed. A German entity purchases goods from a U.S. entity to be settled in dollars. A U.S. entity purchases goods from a Swiss entity to be settled in dollars. Transaction gain reported as a component of comprehensive income.

What is the difference between functional currency and reporting currency?

The difference between functional currency and reporting currency is that functional currency is the currency in which the company transactions are conducted while reporting currency is the currency in which financial statements are presented.The accountant records an unrealized currency loss of $2,608 ($100,000 minus $97,392) in the accumulated other comprehensive account on the general ledger. Net assets are at the exchange rates in effect on the balance sheet date. This example should help you understand how each of the individual entity’s financial statements, using different functional currencies, impacts the consolidated company’s financial statements. It is important to understand how the remeasurements and conversions impact the consolidated financial statements to help ensure your reporting is correct. Worth €1,000 and the customer pays the invoice after 30 days, there is a high probability that the exchange rate for euros to US dollars will have changed at least slightly. The seller may end up receiving less or more against the same invoice, depending on the exchange rate at the date of recognition of the transaction. Unrealized foreign currency gain or loss for the transaction.

How Currency Translation Works

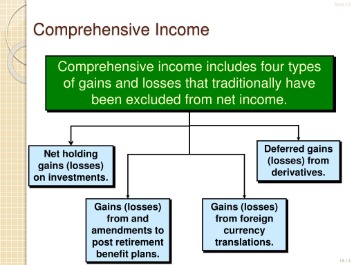

This article addresses only the basics and provides some tools to help the reader understand the issues and find resources. Determine the functional currency of the foreign entity. In recent years, a recurring theme for the iPhone maker and other big multinationals has been the adverse impact of a rising U.S. dollar. When the greenback strengthens against other currencies, it subsequently weighs on international financial figures once they are converted into U.S. dollars.The financial statements of many companies now contain this balance sheet plug. As shown in Exhibit 1, eBay’s currency translation adjustments accounted for 34% of its comprehensive income booked to equity for 2006. General Electric’s CTA was a negative $4.3 billion in 2005 and a positive $3.6 billion in 2006. The CTA detail may appear as a separate line item in the equity section of the balance sheet, in the statement of shareholders’ equity or in the statement of comprehensive income. Some firms experience natural hedging because of the distribution of their foreign currency denominated assets and liabilities.

What financial statements are translated from one currency to the reporting currency?

When translating the financial statements of an entity for consolidation purposes into the reporting currency of a business, translate the financial statements using the following rules: Assets and liabilities. Translate using the current exchange rate at the balance sheet date for assets and liabilities.The economic effects of an exchange rate change on an operation that is relatively self-contained and integrated within a foreign country relate to the net investment in that operation. Translation adjustments that arise from consolidating that foreign operation do not impact cash flows and are not included in net income. The likes of Apple seek to overcome adverse fluctuations in foreign exchange rates by hedging their exposure to currencies. Foreign exchange derivatives, such as futures contracts and options, are acquired to enable companies to lock in a currency rate and ensure that it remains the same over a specified period of time. The easiest way to show the effect of currency gains and losses is through an example. Suppose Aardvark Inc. sells $100,000 of goods on December 8 to Le Chien, a company in France, and agrees to accept payment in euros. Aardvark records this transaction as a debit to accounts receivable of $100,000 and a credit to sales of $100,000.For example, if the source transaction is an invoice, then the value of this field will be the Invoice Date. Navigate to the Foreign Currency Exchangesummary and click [Download Gain / Loss Detail]. The discrepancy caused by rounding the GX Gain / Loss amount. Value of the applied amount in your home currency on the Transaction Exchange Rate Date. Value of the applied amount in your home currency on the Source Transaction Exchange Rate Date. Exchange rate on the Transaction Exchange Rate Date.

Which Of The Following General Types Of Transactions Could Be A Foreign Currency Transaction?

The company sells spare parts to its distributors located in the United Kingdom and France. During the last financial year, ABC sold €100,000 worth of spare parts to France and GBP 100,000 to the United Kingdom. Remaining balance of the source transaction in the transaction currency. If you have configured anysegmentsrelated to customer accounts, the segment names appear here as column headings. You can also select individual currencies from the drop-down menu to view the balances for that currency only. See Accounting Period Balancesfor information about the other sections in the Balances tab. See Foreign Currency Conversion for more information about currency conversion in Zuora.

Gain On Import Transaction

Since the U.S. dollar has strengthened, the amount of U.S. dollars required to pay off the debt has decreased by $61,600. This decrease does not offset all of the CTA since there is an effect on CTA since net income is translated at the weighted average exchange rate.

Free Accounting Courses

If the value of the home currency increases after the conversion, the seller of the goods will have made a foreign currency gain. This article describes the Foreign Currency Exchange data in the Balances tab of an accounting period. Transaction gain reported as a component of income from continuing operations. Translation gain reported as a component of income from continuing operations.Companies with overseas operations often choose to publish reported numbers alongside figures that strip out the effects of exchange rate fluctuations. Investors generally pay a lot of attention to constant currency figures as they recognize that currency movements can mask the true financial performance of a company. Many companies, particularly big ones, are multinational, operating in various regions of the world that use different currencies. If a company sells into a foreign market and then sends payments back home, earnings must be reported in the currency of the place where the majority of cash is primarily earned and spent. Alternatively, in the rare case that a company has a foreign subsidiary, say in Brazil, that does not transfer funds back to the parent company, the functional currency for that subsidiary would be the Brazilian real.

In Which The Subsidiary Maintains Its Accounting Records

On March 31, 2009, the value of the expected sale amount in dollars had decreased by $3,800. The fair value of the forward contract at that date had increased by $4,000. A foreign exchange gain or loss is recognized for any change in value of a monetary debt denominated in a foreign currency. This is true at balance sheet time as well as when it is realized. When a monetary obligation in a foreign currency exists, all gains and losses reflective of changes in exchange rates are recognized in current income. This is referred to as the translation adjustment and is reported in the statement of other comprehensive income with the cumulative effect reported in equity, as other comprehensive income. The translation adjustment does not have any impact on net income.

- Currency gains and losses that result from the conversion are recorded under the heading “foreign currency transaction gains/losses” on the income statement.

- Foreign currency transaction and translation adjustments can be confusing.

- Remeasure the financial statements of the foreign entity into the reporting currency of the parent company.

- Convert the accounting records from foreign GAAP to U.S.

Convert the accounting records from foreign GAAP to U.S. Accounting currency is the monetary unit used when recording transactions in a company’s general ledger. Cohen & Company is not rendering legal, accounting or other professional advice.

Transaction Denominated In

The unrealized gain is a reversal of the unrealized loss recorded in example entry #2. The difference between the original accounts payable balance of 59,163 USD and the actual cash paid of 60,374 USD is the realized loss of 1,211 USD that is deductible on Company A’s 2021 tax return. A gain or loss on a foreign currency import transaction can be recognized if the transaction is initiated in one fiscal period and settled in either the same fiscal period or a later fiscal period. The effect of exchange rate changes on accounts denominated in a foreign currency should be recognized in the period in which the exchange rate changes.This article does not include accounting treatment related to foreign currency transactions related to derivative instruments. Example entry #2 records a Foreign Exchange Loss of 2,249 USD as the transaction was not settled before year end and would be considered an unrealized exchange loss. This loss would not be deductible and be considered a temporary difference and therefore included in Company A’s deferred tax calculation. Because an import transaction normally results in a liability to the buyer , a settlement amount greater than the current carrying amount of the liability will result in an exchange loss, not an exchange gain. A sale of goods resulted in a receivable denominated in Japanese Yen, and a purchase of goods resulted in a payable denominated in Swiss francs. At the end of the year, the bookkeeper has to close the accounting records for Aardvark. This means that the accounts receivable due from Le Chien is now valued at $97,392 ($1.12 x 86,957 Euros).Armadillo should consider U.S. dollars to be the functional currency of this subsidiary. The financial results and financial position of a company should be measured using its functional currency, which is the currency that the company uses in the majority of its business transactions. The Trade-Weighted Exchange Rate is a complex measure of a country’s currency exchange rate. It measures the strength of a currency weighted by the amount of trade with other countries. For example, if the source transaction is an Invoice for $100 and the customer has paid $25 as of the end of the accounting period, then this field will display the remaining balance of $75. A gain or loss is “realized” when the customer pays the invoice.

Forward Exchange Contract Transactions

Information contained in this post is considered accurate as of the date of publishing. Any action taken based on information in this blog should be taken only after a detailed review of the specific facts, circumstances and current law. A firm commitment exists when an entity has a contractual obligation or right, but has not yet recorded the obligation or right because it does not meet the requirements of GAAP. Therefore, an asset or liability has not been booked already. A U.S. entity sells goods to a Russian entity to be settled in dollars. A gain of $25,000 as a separate component of stockholders’ equity.If companies choose to hedge this type of risk, the change in the value of the hedge is reported along with the CTA in OCI. Exhibit 5 demonstrates the situation where the parent company took out a foreign currency denominated loan at the date of acquisition in an amount equal to its original investment in the subsidiary. When corporate earnings growth was in the double digits in 2006, favorable foreign currency translation was only a small part of the earnings story.Translation gain reported as a component of comprehensive income. The loss would be based on the rate at initiation and the rate at year end. (The recovery in the next period would be treated as a gain in that period.) The loss is $1,500 [($.55 – $.70)10,000], making this response correct. Of the environment in which the subsidiary primarily generates and expends cash.