Content

- Why Is The Net Profit Margin Important?

- Comparing Profit Margins

- How To Calculate Net Profit Margin: Definition & Formula

- Accountingtools

- What Are The Limitations Of The Net Profit Margin Formula?

- A Quick Primer On Net Profit Margin

- The Four Primary Financial Statements That Companies Use

Finally, companies try to take advantage of tax breaks, which can raise or lower net profit margins through tax carry forwards and other tax strategies. Knowing a company’s net profit margin gives a great snapshot into the profitability of a company.

What is a 40 profit margin?

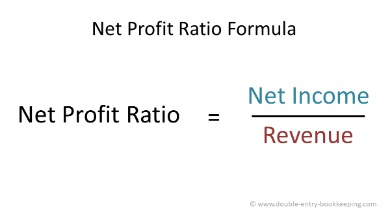

You can calculate profit margin to see profitability for a specific time period. In short, your profit margin or percentage lets you know how much profit your business has generated for each dollar of sale. For example, a 40% profit margin means you have a net income of $0.40 for each dollar of sales.Because companies express net profit margin as a percentage rather than a dollar amount, it is possible to compare the profitability of two or more businesses regardless of size. Before the net profit margin can be calculated, we need to know the net profit and revenue numbers. Revenue is the amount of money or income a company earns from normal business operations. Net profit is the amount of money left from the money that comes into the business after the general expenses, manufacturing costs, interests, and taxes are paid. Net profit margin is the percentage of revenue left after all expenses have been deducted from sales. The measurement reveals the amount of profit that a business can extract from its total sales. The net profit margin is intended to be a measure of the overall success of a business.

Why Is The Net Profit Margin Important?

It is the ratio of net profits to revenues for a company or business segment. Expressed as a percentage, the net profit margin shows how much profit is generated from every $1 in sales, after accounting for all business expenses involved in earning those revenues. Larger profit margins mean that more of every dollar in sales is kept as profit. Gross profit margin is the gross profit divided by total revenue and is the percentage of income retained as profit after accounting for the cost of goods.He writes about small business, finance and economics issues for publishers like Chron Small Business and Bizfluent.com. Adkins holds master’s degrees in history of business and labor and in sociology from Georgia State University. He became a member of the Society of Professional Journalists in 2009. Dummies has always stood for taking on complex concepts and making them easy to understand. Dummies helps everyone be more knowledgeable and confident in applying what they know. Let’s take a look at an example to see how this ratio is calculated. Minority owners are often people who hold a stake of 20% or less.

Comparing Profit Margins

Investors and analysts typically use net margin to gauge how efficiently a company is managed and forecast future profitability based on management’s sales forecasts. This is important, because gross profit margin may not give you the most accurate picture of your company’s profitability. For example, if your business’s revenues increase, you may be under the impression that profit is likely to increase as well.

- The higher a firm’s net profit margin is compared to its competitors, the better for the business.

- Finding a company’s net profit margin reveals how much after-tax profit it keeps for every dollar it earns in revenue or sales.

- While this is common practice, the net profit margin ratio can greatly differ between companies in different industries.

- Company X, Y, and Z all operate in the same industry and report the following numbers on their income statements during this period.

- They were even giving their products for free in exchange for advertising.

- This is because it considers the interest payment and the tax shield from interest payment.

One way to determine whether your company’s profit margin is healthy is to compare it to a benchmark index, such as the S&P 500. In 2017, the average operating profit margin for the S&P 500 was around 11 percent. So, if your business’s operating margin is more than 11 percent, you’re outperforming the overall market, a sign of a healthy operating profit margin. Company XYZ sold 50,000 units of its product in 2018 at a cost of $10 per unit.

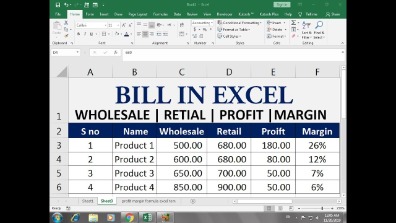

How To Calculate Net Profit Margin: Definition & Formula

It is the ratio of net profits torevenuesfor a company or business segment. Net profit margin is typically expressed as a percentage but can also be represented in decimal form.Learn financial modeling and valuation in Excel the easy way, with step-by-step training. Follow CFI’s guide on networking, resume, interviews, financial modeling skills and more.This negatively affects net profit, lowering the net profit margin for the company. A jewelry company that sells a few expensive products may have a much higher profit margin as compared to a grocery store that sells many cheap products. Agriculture-based ventures usually have low profit margins owing to weather uncertainty, high inventory, operational overheads, need for farming and storage space, and resource-intensive activities. In essence, the profit margin has become the globally adopted standard measure of the profit-generating capacity of a business and is a top-level indicator of its potential. It is one of the first few key figures to be quoted in the quarterly results reports that companies issue. Expressed as a percentage, profit margin indicates how many cents of profit has been generated for each dollar of sale.After doing some research, you find that the other bicycle shops have a profit margin in the 19% – 22% range. However, you aren’t sure if your business is more profitable than those shops are or not. First, it doesn’t give a clear picture of the operating profitability of the company. This is because it considers the interest payment and the tax shield from interest payment.

Accountingtools

As you can see from the table below, Wal-Mart had a net income of ~$14.7bn in 2016, but that only represents only 3.1% of the revenue. Hence, it is always important to look at the net margin in the context of the industry average and historical trend. An IT company might have a net margin of more than 10%, but that is driven by the industry structure. So we should not compare companies in the different industry on the basis of NPM. However, we need to look at their total dollar amount of profits in the context of how much revenue these companies generated.

What Are The Limitations Of The Net Profit Margin Formula?

The net profit margin can be radically skewed by the presence of unusually large non-operating gains or losses. For example, a large gain on the sale of a division could create a large net profit margin, even though the operating results of the company are poor. Profit margins can vary by sector and industry, but the outcome is the same. The higher a firm’s net profit margin is compared to its competitors, the better for the business.

How do you calculate net profit after tax?

To calculate net income after taxes (NIAT), take gross sales revenue and subtract the cost of goods sold. Then subtract business expenses, depreciation, interest, amortization and taxes.A look at stock returns between 2006 and 2012 indicate similar performances across the four stocks, though Microsoft and Alphabet’s profit margin were way ahead of Walmart and Target’s during that period. Since they belong to different sectors, a blind comparison solely on profit margins may be inappropriate.

A Quick Primer On Net Profit Margin

While comparing two or more ventures or stocks to identify the better one, investors often hone in on the respective profit margins. Profit margins are used by creditors, investors, and businesses themselves as indicators of a company’s financial health, management’s skill, and growth potential. Profit margin gauges the degree to which a company or a business activity makes money.One needs to be cautious about time series analysis, especially in case the business model of a company has evolved or the product mix has changed with time. In the above example, we can see that the margin for Wal-Mart remained stable at ~3.4% in 2014 and 2015 but dipped slightly to ~3.1% in 2016. While in the case of Costco, the margin improved from 1.8% to 2.0% during the same period.A key indicator of overall financial health, net margin is also an excellent metric to use to compare a company with its competitors. This metric can signal whether a business is doing a comparatively better or worse job of controlling its expenses. Gross profit is the direct profit left over after deducting the cost of goods sold, or cost of sales, from sales revenue. Profit margins often come into play when a company seeks funding. Individual businesses, like a local retail store, may need to provide it for seeking a loan from banks and other lenders. It also becomes important while taking out a loan against a business as collateral. The number has become an integral part of equity valuations in theprimary market forinitial public offerings .We’ve helped thousands of people become financial analysts over the years and know precisely what it takes. Businesses of luxury goods and high-end accessories often operate on high profit potential and low sales. Let’s look more closely at the different varieties of profit margins. Alternatively, locate net income from the bottom line of the income statement and divide the figure by revenue. Andy Smith is a Certified Financial Planner (CFP®), licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career. We can compare Company X and Company Y on a net income basis, but that doesn’t tell us the entire story of their profitability.Gain the confidence you need to move up the ladder in a high powered corporate finance career path. Boosting sales, however, often involves spending more money to do so, which equals greater costs.

The Four Primary Financial Statements That Companies Use

Companies typically post annual reports and interim reports on their investor relations websites where these documents are easily accessible to shareholders, potential investors and other stakeholders. Profit margin is one of the commonly used profitability ratiosto gauge the degree to which a company or a business activity makes money. Simply put, the percentage figure indicates how many cents of profit the business has generated for each dollar of sale. For instance, if a business reports that it achieved a 35% profit margin during the last quarter, it means that it had a net income of $0.35 for each dollar of sales generated.Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.Also, you can easily compare that performance to other businesses in the same or related industries. When you add together your other costs, operating expenses for the shop were $17,500 and interest and taxes were $21,200.Keep in mind that you’ll already have all of the variables calculated for you when you perform this math on a real income statement. In other cases, a low net profit margin might mirror a price war that’s bringing profits down. This was the case with the computer sector back in the year 2000.Learn about the definition and formula for calculating it, and see some examples. The net profit margin ratio equation will help us quantify the magnitude of profitability of the company. A higher margin is always better than a lower margin because it means that the company is able to translate more of its sales into profits at the end of the period.