Content

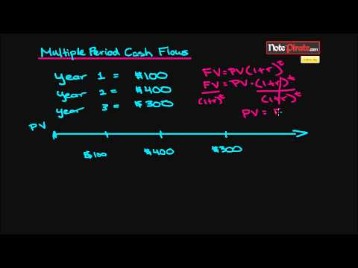

- Formula For Calculating Total Cash Flow

- How To Calculate Operating Cash Flow:

- Total Operating Cash Flow Formula

- Cash Flow Calculator

- Direct Method Versus Indirect Method

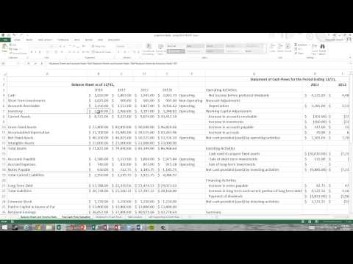

- Structure Of The Cash Flow Statement

- Manage Your Business Finances With Wave

- Operating Cash Flow Vs Net Income

The most common example of an operating expense that does not affect cash is depreciation expense. The most common example of an operating expense that does not affect cash is a depreciation expense. Investors use discounted cash flow to determine the value of a business and peg their rate of return. Loans aren’t just for when you’re starting a new business—they can also be a great option for expanding your operations or to fix cash flow issues. Cash flow problems are never fun (remember they’re responsible for a large majority of small business failures), so it’s important to ensure positive cash flow before you start spending. Cash Flow From Operating Activities indicates the amount of cash a company generates from its ongoing, regular business activities.The difference lies in how the cash inflows and outflows are determined. ‘Capital expenditures’ are the funds you used to acquire, upgrade and maintain physical assets such as property, buildings, technology or equipment. ‘Depreciation/Amortization’ are like scheduled expenses used to reduce the carrying or market value of some assets. Using a simple cash flow calculator can not only show where you are spending your money, but it can help you understand how much cash is available for those vital day-to-day obligations. Depreciation – This should be taken out since this will account for future investment for replacing the current PPE.

Formula For Calculating Total Cash Flow

If the result is a negative cash flow, that is, if you spend more than you earn, you’ll need to look for ways to cut back on your expenses. Similarly, if the result is a positive cash flow, but your spending nearly equals your earnings, it might be too soon to start investing right now. Most companies use the accrual basis accounting method, where revenue is recognized when it is earned rather than when it is received. This causes a disconnect between net income and actual cash flow because not all transactions in net income on the income statement involve actual cash items. Therefore, certain items must be reevaluated when calculating cash flow from operations. Free cash flow is a metric that investors use to help analyze the financial health of a company. It looks at how much cash is left over after operating expenses and capital expenditures are accounted for.

What is a good percentage of cash flow?

A cash flow margin ratio of 60% is very good, indicating that Company A has a high level of profitability.The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits. Capital Expenditure refers to fixed business assets like land and equipment.

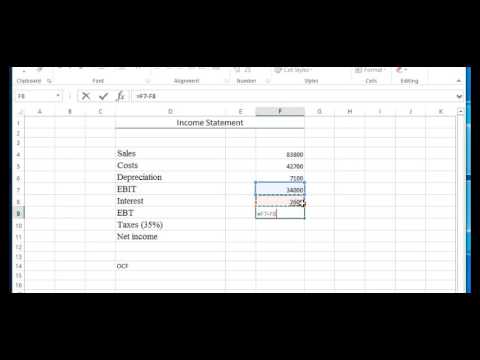

How To Calculate Operating Cash Flow:

To get an accurate picture of your current or future cash flow, you need to realistically consider all funds coming into your company as well as all expenses. Planning on adding a new piece of equipment, selling a company-owned investment, or changing employee insurance plans? Certain important cash flows aren’t generally considered to be ‘operating’ cash flows.Under the direct method, adjustments are made to the ” expense accounts ” themselves. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. When a long-term asset is purchased, it should be capitalized instead of being expensed in the accounting period it is purchased in.

- Free cash flow may be different from net income, as free cash flow takes into account the purchase of capital goods and changes in working capital.

- Since it may be a large number, maintenance capex’s uncertainty is the basis for some people’s dismissal of ‘free cash flow’.

- If something has been paid off, then the difference in the value owed from one year to the next has to be subtracted from net income.

- Investors use free cash flow to measure whether a company might have enough cash for dividends or share buybacks.

- He has been published in print publications such as Entrepreneur, Tennis, SI for Kids, Chicago Tribune, Sacramento Bee, and on websites such Smart-Healthy-Living.net, SmartyCents and Youthletic.

A cash flow statement is a financial statement that summarizes the amount of cash and cash equivalents entering and leaving a company. Value investors often look for companies with high or improving cash flows but with undervalued share prices. Rising cash flow is often seen as an indicator that future growth is likely. Cash flow management is essential to project future revenue and secure your business growth. Once you comprehend how to calculate cash flow, it’s easier to understand how to forecast future cash flows. They mean we are tying up more cash by investing in current assets. The cash manager will need to monitor the increase in net working capital.The three ways in which to calculate free cash flow are by using operating cash flow, using sales revenue, and using net operating profits. In corporate finance, free cash flow or free cash flow to firm is the amount by which a business’s operating cash flow exceeds its working capital needs and expenditures on fixed assets . It is that portion of cash flow that can be extracted from a company and distributed to creditors and securities holders without causing issues in its operations. When performing financial analysis, operating cash flow should be used in conjunction with net income, free cash flow , and other metrics to properly assess a company’s performance and financial health.If either – or both – of these aims is achieved, then the amount of cash tied up in working capital will be correspondingly smaller. This can result in a smaller additional amount of cash being absorbed into working capital, or even a net release of cash from working capital. Learn more about how you can improve payment processing at your business today. Net of all the above give free cash available to be reinvested in operations without having to take more debt. Current portion of LTD – This will be minimum debt that the company needs to pay in order to not default.

Total Operating Cash Flow Formula

It is also preferred over the levered cash flow when conducting analyses to test the impact of different capital structures on the company. Net income and earnings per share are two of the most frequently referenced financial metrics, so how are they different from operating cash flow? The main difference comes down to accounting rules such as the matching principle and accrual principle when preparing financial statements. The formulas above are meant to give you an idea of how to perform the calculation on your own, however, they are not entirely exhaustive.

Cash Flow Calculator

We can see that Macy’s has a large amount of free cash flow, which can be used to pay dividends, expand operations, and deleverage its balance sheet (i.e., reduce debt). Free cash flowis an important measurement since it shows how efficient a company is at generating cash.Project outflows are the expenses and other payments you’ll make in the given timeframe. For investors, the CFS reflects a company’s financial health, since typically the more cash that’s available for business operations, the better. Sometimes, a negative cash flow results from a company’s growth strategy in the form of expanding its operations. Of course, not all cash flow statements look as healthy as our example or exhibit a positive cash flow. However, negative cash flow should not automatically raise a red flag without further analysis.

Direct Method Versus Indirect Method

Increases in non-cash current assets may, or may not be deducted, depending on whether they are considered to be maintaining the status quo, or to be investments for growth. When a company has negative sales growth, it’s likely to lower its capital spending. Receivables, provided they are being timely collected, will also ratchet down. All this “deceleration” will show up as additions to free cash flow.

Structure Of The Cash Flow Statement

Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues. Facebook Business Tips for Small BusinessesJuly 8, 2021Facebook is a widely used platform for both the public and businesses. With such a saturated platform, no longer can you assume that most of your fans are seeing your content. And fluctuations in the level of debt that your business has taken on. If the net income category includes the income from discontinued operation and extraordinary income make sure it is not part of Free Cash Flow.

Manage Your Business Finances With Wave

Net earnings from the income statement are the figure from which the information on the CFS is deduced. The purchasing of new equipment shows that the company has the cash to invest in itself. Finally, the amount of cash available to the company should ease investors’ minds regarding the notes payable, as cash is plentiful to cover that future loan expense. Free cash flow can be spent by a company however it sees fit, such as paying dividends to its shareholders or investing in the growth of the company through acquisitions, for example. It’s important to note that an exceedingly high FCF might be an indication that a company is not investing in its business properly, such as updating its plant and equipment. Conversely, negative FCF might not necessarily mean a company is in financial trouble, but rather, investing heavily in expanding its market share, which would likely lead to future growth. Free cash flow can provide a significant amount of insight into the financial health of a company.

Operating Cash Flow Vs Net Income

This makes FCF a useful instrument for identifying growing companies with high up-front costs, which may eat into earnings now but have the potential to pay off later. Free cash flow is the money a company has left over after paying its operating expenses and capital expenditures.

Is The Indirect Method Of The Cash Flow Statement Better Than The Direct Method?

The payout ratio is a metric used to evaluate the sustainability of distributions from REITs, Oil and Gas Royalty Trusts, and Income Trust. Distributions may include any income, flowed-through capital gains or return of capital. Net free cash Flow definition should also allow for cash available to pay off the company’s short term debt. It should also take into account any dividends that the company means to pay. In addition, a company’s revenue recognition principle and matching of expenses to the timing of revenues can result in a material difference between OCF and net income.Pick a timescale – for example six months in the future – and estimate the value of your transactions over that period. A cash flow projection uses estimated figures to give you an idea of what’s in store over the coming weeks and months. Below are some common terms that may apply to your business, so be sure you are familiar with them before starting your cash flow calculations to make the most of your analysis. Capital generated through debt agreements or cash that’s been issued to pay off debts or pay out dividends. Calculating your monthly cash flow will help you evaluate your present financial status, so you know where you stand financially as you prepare to invest. Cash flow information is needed for a number of analyses, such as the computation of cash flow per share and the cash flow return on sales. Here Capex Definition should not include additional investment on new equipment.