Content

- For Nonprofits

- What If You Issue A Donation Receipt With False Information?

- How To Report Charity Scams

- You Are Leaving H&r Block® And Going To Another Website

- Year End Donation Receipt Template Canada

It doesn’t matter whether the donation to one organization reaches the $250 limit. If the vehicle is sold, include the date of sale as well as gross profits made. Additionally, a donor must keep a record of these expenses. Each payroll deduction of $250 or more is treated as a separate contribution and is not aggregated.

Are donation receipts worth it?

Donation receipts are a crucial part of the online giving process, for both you and your donors’ sakes. Receipts confirm gifts made to your organization and are a great way to highlight the work your organization has accomplished. Learn How Our Donation Forms Can Help!Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. Starting price for simple federal return. Starting price for state returns will vary by state filed and complexity.

For Nonprofits

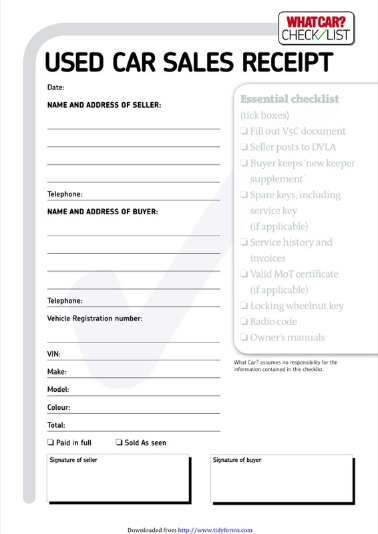

This PDF template can be customized easily via the PDF Editor. Car Sales ReceiptTrack your car sales and revenue by using this Car Sales Receipt. This document is very important because it serves as verification and proof that of the customer’s purchase.Here’s our compilation of donation receipt templates. Feel free to download, modify and use any you like. For more templates refer to our main page here.Although the receipt process is very transactional, when you build strong relationships with your donors, you should look for every opportunity to be relational. By sending a thank-you letter or note along with the donation receipt, you can do just that. It’s essential to have your own filing system. Keeping track of the donation receipts you’ve issued just makes good sense and keeps everything in order. Donation receipts are written acknowledgments that prove a charitable donation was made. They are beneficial to both the individuals who make contributions to your nonprofits and your organization itself.

What If You Issue A Donation Receipt With False Information?

H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice. By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due. Enrolled Agents do not provide legal representation; signed Power of Attorney required. Audit services constitute tax advice only. If the vehicle’s value is between $250 and $500, you can use a standard donation receipt.

How To Report Charity Scams

Printable Renters ReceiptGenerate rent receipts for your tenants online. Drag and drop to customize in minutes. Rent ReceiptCustomize this free Rent Receipt Template to keep track of rent payments for your tenants. Download, print, or share PDF rent receipts in just one click. If you’re working with online payments, cash payments, donations, or deliveries — we’ve got you covered. Get instant access to discounts, programs, services and the information you need to benefit every area of your life. When you report a charity scam, share any information you have — like the name and phone number of the organization or fundraiser, how the fundraiser contacted you, and what the fundraiser said.With our Donation Receipt PDF Template, donors will thank you for making tax returns easier, and you’ll have more time to spend on helping those in need. A year end donation receipt template will help donors easily file their tax returns with a single document and save them the trouble of compiling the donation receipts they’ve received during the year.

What is an official donation receipt?

Official donation receipt for income tax purposes It acknowledges that a gift was made to you, and that the receipt contains the information required under the Income Tax Regulations.Whether you issue a donation receipt online or in person, make sure the format is consistent. With the help of a CRM, maintaining receipt consistency is easy, as your software will allow you to stick to the format of your choice. H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns. H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file. All prices are subject to change without notice. H&R Block tax software and online prices are ultimately determined at the time of print or e-file. A donation receipt is proof that a donor made a charitable contribution to a nonprofit.

You Are Leaving H&r Block® And Going To Another Website

This is where a tool like Formstack Documents can come in handy. Formstack Documents works for your organization as a donation receipt generator. Set it up once and let it work in the background to automatically create donation receipts every time you accept payment.

Year End Donation Receipt Template Canada

To be clear, not all nonprofits need to have a receipt that looks just like the ones featured above, but your receipt must contain all of the information outlined by your local laws and regulations. Things can change a bit depending on the type of gift you receive. For example, if you receive a gift with an advantage attached or an in-kind donation, your receipt may look differently. Bank products and services are offered by MetaBank®, N.A. Timing is based on an e-filed return with direct deposit to your Card Account.

- Nonprofit organizations tend to perfect the art of accomplishing more with less compared to the average business.

- A well-written receipt gives the donor a reason to feel great, which strengthens the relationship.

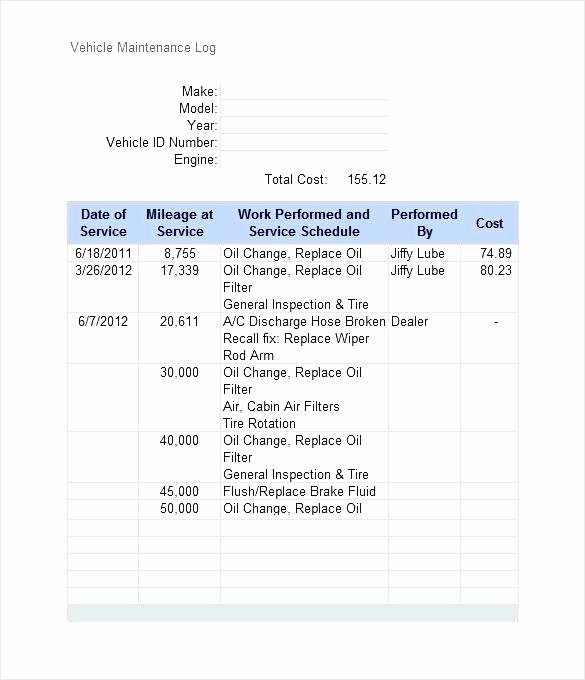

- Car Service ReceiptA Service Receipt is a document providing an itemized description of services rendered by the provider to his customer.

- Petty Cash VoucherManage the cash flow of your company by using this Petty Cash Voucher PDF template.

- Fundraising calls are allowed even if your number is on the National Do Not Call Registry.

- Search Eligible Charities – Use this Search Tool by the IRS to view if a charity is valid for tax-deductions.

Also, issuing donation receipts right away may go a long way in soliciting future donations, as donors will remember the timeliness of your sincere gratitude. However, if you decide to issue receipts right away, you commit yourself to the process of constant receipting, even during times when it may be inconvenient.

See How Keela Automatically Creates Donation Receipts

Creating non profit donation receipt letter templates beforehand can help you send donation receipts with ease. Make sure you set reminders and create content to accompany your monthly and year end donation receipts. If you’re running a food donation drive a food donation receipt template will help you easily record the list of food items someone donated. Church Donation ReceiptA donation receipt is an important document that serves as a verification and proof of the donation. Moreover, a receipt is always useful for tracking the donations and donors.If you request cash back when making a purchase in a store, you may be charged a fee by the merchant processing the transaction. Always ask the merchant if a surcharge applies when requesting cash back at the point of sale.

Rental Deposit Receipt

Once we have reported the identity of the Donor, then we must record the official “Street Address,” “City,” “State,” and “Zip” code where the Donor is located and can be directly contacted. You can obtain a blank copy of this receipt by clicking on the buttons or links labeled as a PDF, Word, or ODT file. You may use any of these file versions so long as you have downloaded a one you can view and work with. If you do not have a word processing program or a pdf editor, you can open the PDF version then print it directly from the screen using most up-to-date browsers. Don’t make a donation with cash or by gift card or wire transfer.When a charity uses and reports these donations properly, gifts-in-kind can be an important part of a charity’s programs. But a dishonest charity might mark up the value of donated goods to make their organization appear more financially successful than it really is. Also, when your donors file their taxes, there will be a variance in when they want their receipts.This completes the cycle and sets the stage for your organization to receive another gift from the donor. Most nonprofits completely miss this opportunity to wow their donor, so it’s not that hard to stand out.