Content

- Reports

- U S Tax: What Is An Irs 1099

- Freshbooks

- Freshbooks Pricing

- What Is A 1099 Form?

- Managing And Paying Bills With Freshbooks Vs Quickbooks

- Misc Vs W

Both FreshBooks and QuickBooks offer monthly plans that seem pretty affordable for any small business. If you click through and sign up for FreshBooks or QuickBooks, we thank you for supporting our efforts to bring you the best information possible. For example, if you’re a freelancer looking for a simple accounting tool with room to grow, then you should probably go with FreshBooks.

Reports

As a business owner / employer, it’s your responsibility to report payments you’ve made to Contractors (over $600) to the IRS. You’ll need to provide a copy of the 1099 to both the IRS and the Contractor. The 1099 form is a document that tells the IRS how much you’ve earned, who made that payment to you and the purpose of the payment. It essentially allows the IRS to ensure the income reported by the Contractor matches up with the amount the business paid the Contractor. According to Edelman Intelligence, the majority of the U.S. workforce will be freelancers by 2027.

U S Tax: What Is An Irs 1099

The winner of this FreshBooks vs QuickBooks battle was not easy to choose. The Best Tax Debt Relief Services of 2021 Looking for the best tax debt relief service? From there, the company should send you a copy of a 1099-K by January 31. If you need help figuring out who needs to receive a 1099-MISC, you should work with a tax professional to make sure you get it right.That way, you can rest assured that all your T’s are crossed come spring. Zoho Books is one of the best options available for your small business – whether you are solo or have just a few employees. You can use the software to keep track of all your outstanding invoices and collect customer payments. Xero uses double-entry accounting, and allows you to create a variety of financial reports.

- The Best Tax Debt Relief Services of 2021 Looking for the best tax debt relief service?

- It’s important to note that they use an integration with Bill to provide this service which allows you to pay and track a variety of vendors, contractors, and bills.

- Your 1099-MISC form will show how much you received from services, prizes and awards, rents and other income payments.

- With GoDaddy Bookkeeping (formerly “Outright”) that recurring process is automatic.

- But all double-entry accounting solutions designed for small businesses do all of that work in the background.

So for this next section on FreshBooks vs QuickBooks Premium Features, we’ll focus on the features you might need as your become more advanced in your small business. Once an estimate is accepted, you can convert that estimate into an invoice, which is a really cool feature to streamline your process and get you paid a bit faster. Since your first hire will likely be a fellow contractor, this is a really great feature they’ve included in their beginner plan. For starters, their cheapest plan—labeled for Freelancers—is called QuickBooks Self-Employed and starts at just $10/mo (with 30-day free trial).

Freshbooks

You just have to put in the client name, the retainer amount, and a few other details and you’re set. If your business has already grown, you’ll find the next section on FreshBooks vs QuickBooks premium features helpful. With QuickBooks Self-Employed , you’ll have the ability to automatically track miles with your smartphone . From there, you can separate business trips from personal trips and even add mileage manually if you didn’t have your phone with you. QuickBooks focuses on larger companies by integrating with fund-raising software like Fundera, human resource apps like HRweb, or inventory management apps like Webgility. And the range is pretty broad; from organization tools like G Suite to communication tools like Slack to payroll software like Gusto.

Can 1099’s be sent electronically?

The IRS authorizes businesses to furnish an electronic copy to recipient of form 1099s, instead of a paper copy. If a business is required to furnish a written statement (Copy B) to a recipient, then it may furnish the statement electronically instead of on paper.Below is a quick glance at FreshBooks vs QuickBooks when it comes to basic features. With QuickBooks, you can upgrade or downgrade anytime as long as you don’t start with the Quickbooks Self-Employed.

Freshbooks Pricing

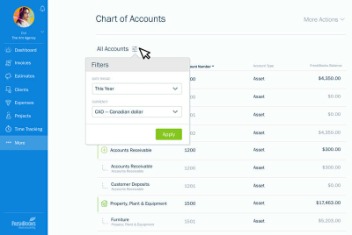

FreshBooks offers contractors at all levels and QuickBooks offers similar functionality beginning with their Simple Start plan. While both competitors had some nice premium features , QuickBooks snuck ahead in this category because it seems to be built more for mid-sized businesses. When you hire a contractor and add them to your FreshBooks account, they’re given their own private FreshBooks user account.

Does FreshBooks do 1099?

You can reach out to your employer to get a 1099 form. It’s important to report your income as accurately as possible because your employer will also provide a copy to the IRS. It may be helpful to send them these documents from your FreshBooks account to speed up the process.In Vermont, Massachusetts, Virginia and Maryland, the minimum reporting threshold is $600 in gross payment volume, regardless of how many transactions occurred. If your gross income falls below $20,000 and you have fewer than 200 transactions in a calendar year, you’ll file the 1099-NEC on your own. If you earn money from selling products or services through a third-party provider, like PayPal, you must report that money to the IRS. Greatland’s team of skilled W-2, 1099 and 1095 reporting advisers are the most experienced wage and income reporting advisers – period! In fact, our team employs more than 125 wage and income reporting experts dedicated towards W-2, 1099 and 1095 filing.In this section, we’ll take a look at FreshBooks’ vs QuickBooks’ ability to connect to the most important tools your company may need as it grows. QuickBooks, on the other hand, integrates with your bank to auto-pay important bills that keep your business moving forward. You can, of course see a breakdown of expenses and revenues by category , but that’s hardly the same.

What Is A 1099 Form?

If you’re working with an accountant, that may be important to you. In 2020, vast numbers of people joined the gig workforce, both by choice and out of necessity. The COVID-19 pandemic is responsible for the loss of millions of jobs. Many of the newly unemployed have taken work as independent contractors or started their own businesses, many of them working out of their own homes. For the first time, all of these people will need to deal with employment accounting and taxes that involve a Form 1099 instead of a W-2. Accounting software will help you accurately categorize your expenses and keep track of customer payments. And come tax season, you can give your accountant access to your accounting software.A 1099-R is also required for permanent and total disability payments . A 1099-K form is also required for debit, credit, and stored-value card transactions.For many small businesses who charge by the hour for the work they provide their clients, a simple-yet-effective time-tracking app is a must. Invoicing is perhaps one of the most common and basic needs of your service-based business. With “Advanced” you’ll get all the features of the other plans plus a lot of highly customizable reports and abilities for managing a sizable business. You can also set user permissions and you’ll get extra special customer service help with their “Priority Circle” customer care. In an effort to find the best accounting software for freelancers (because who wants to switch later!?), you may have found yourself asking what Freshbooks vs Quickbooks has to offer. Every time you open up a new feature, a step-by-step guide or video shows up, with the option to view more information. The knowledge base also has help pages, webinars, videos, and paid courses.

Managing And Paying Bills With Freshbooks Vs Quickbooks

The QuickBooks app has one distinct advantage over FreshBooks―it allows you access to reporting tools. It also gives you access to customer information, the ability to send invoices, record expenses, receive payments, and reconcile bank transactions. With QuickBooks, virtually every aspect of your business is covered.Xero is a cloud-based accounting software, and it’s one of the best options available for your expanding business. One of the unique things about Xero is that it allows account holders to add an unlimited number of users, regardless of their pricing tier.