Content

- Do Businesses File A W

- Field 6: Medicare Tax Withheld

- Instructions For Employers On Filling Out A W

- How Is Social Security Tax Calculated?

- Box 8

- Box 14

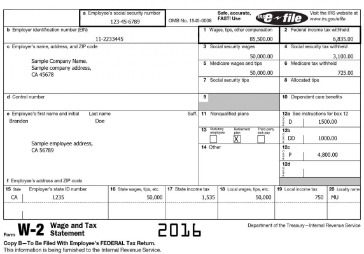

In general, you will receive a W-2 from an employer if you earned at least $600 in a given year. You will also receive a W-2 if you had taxes withheld earning any amount from your employer. Note that if you were a contracted individual and not an employee, you will likely receive a 1099 instead of a W-2. Students receive a 1098-E statement for any year in which they paid interest on a federal student loan. Students also receive a 1098-T statement reporting college tuition expenses that might entitle students to tax deductions or credits. The lettered boxes on a W-2 include the name and address of you and your employer, your Social Security number, and your employer’s EIN and state ID number. If you have too little tax withheld, you could owe a surprisingly large sum to the IRS in April, plus interest and penalties for underpaying your taxes during the year.

Do Businesses File A W

Check this box if you are a railroad employer sending Forms W-2 for employees covered under the RRTA. Do not show employee RRTA tax in boxes 3 through 7. These boxes are only for social security and Medicare information.

Field 6: Medicare Tax Withheld

The IRS also uses Form W-2 to track an employee’s income and tax liability. If the income reported on an employee’s taxes doesn’t match the income reported on the Form W-2, the IRS may audit the taxpayer. However, taxpayers are required to report all salary, wage, and tip income even if that income is not reported on a W-2. When the employee files taxes, the amount of tax withheld according to the W-2 form is deducted from their gross tax obligation. If more tax was withheld than the employee owes, a refund will be issued. The 2020 federal income tax filing due date for individuals has been extended from April 15, 2021, to May 17, 2021. Payment of taxes owed can be delayed to the same date without penalty.Enter the total of amounts reported with codes D through H, S, Y, AA, BB, and EE as “Previously reported” and “Correct information” from Forms W-2c. If your previous Form W-3 or W-3SS was checked incorrectly, report your prior incorrect employer type in the “Explain decreases here” area below boxes 18 and 19. If your previous Form W-3 or Form W-3SS was checked incorrectly, report your prior incorrect payer type in the “Explain decreases here” area below boxes 18 and 19. Check the boxes in box 13, under “Previously reported,” as they were checked on the original Form W-2. Under “Correct information,” check them as they should have been checked. For the items you are changing, enter under “Previously reported” the amount reported on the original Form W-2 or the amount reported on a previously filed Form W-2c.

Instructions For Employers On Filling Out A W

BSO lets you print copies of these forms to file with state or local governments, distribute to your employees, and keep for your records. BSO generates Form W-3 automatically based on your Forms W-2. You can also use BSO to upload wage files to the SSA, check on the status of previously submitted wage reports, and take advantage of other convenient services for employers and businesses. Visit the SSA’s Employer W-2 Filing Instructions & Information website at SSA.gov/employer for more information about using BSO to save time for your organization. Here you will also find forms and publications used for wage reporting, information about verifying employee social security numbers online, how to reach an SSA employer services representative for your region, and more. Check the Statutory employee box for statutory employees whose wages are subject to social security and Medicare taxes, but not subject to federal income tax withholding.

- Do not show titles or academic degrees, such as “Dr.,” “RN,” or “Esq.,” at the beginning or end of the employee’s name.

- Choosing this option makes sense if both earn about the same.

- Even if you request and are granted an extension of time to file Forms W-2, you still must furnish Forms W-2 to your employees by January 31, 2022.

- (Use box 14 if railroad retirement taxes apply.) An employee’s total contribution must also be included in box 12 with code D or S.

- For more information concerning Copy 1 , contact your state, city, or local tax department.

- All other employees have only nonqualified moving expenses and expense reimbursements subject to tax and withholding.

Fill out the Multiple Jobs Worksheet, which is provided on page three of Form W-4, and enter the result in step 4, which is explained below. Here’s a step-by-step look at how to complete the form. The W-4 form had a complete makeover in 2020 and now has five sections instead of seven to fill out.You must not include advertising on any copy of Form W-2, including coupons providing discounts on tax preparation services attached to the employee copies. Employers typically send out W-2 forms through the mail. It’s also common for your employer to make your W-2 available online.Conversely, if the amount deferred is overestimated, the employer can claim a refund or credit. If the employer chooses to treat the shortfall as wages in the first year, the employer must issue a Form W-2c. Also, the employer must correct the information on the Form 941 for the last quarter of the first year. In such a case, the shortfall will not be treated as a late deposit subject to penalty if it is deposited by the employer’s first regular deposit date following the first quarter of the next year. Enter the amount previously reported and the corrected amount of income tax withheld on third-party payments of sick pay. Although this tax is included in the box 2 amounts, it must be shown separately here.Enter the correct amount under “Correct information.” Complete this box if you are correcting an employee’s previously reported incorrect SSN and/or name.ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. When you use an ATM, in addition to the fee charged by the bank, you may be charged an additional fee by the ATM operator. See your Cardholder Agreement for details on all ATM fees. Available at participating offices and if your employer participate in the W-2 Early AccessSM program.

How Is Social Security Tax Calculated?

Do not include this amount in box 1, 3, 5, or 7. Example of how to report social security and Medicare wages. Cost of accident and health insurance premiums for 2%-or-more shareholder-employees paid by an S corporation, but only if not excludable under section 3121. Payments made to former employees while they are on active duty in the U.S. Employer contributions for qualified long-term care services to the extent that such coverage is provided through a flexible spending or similar arrangement. The cost of accident and health insurance premiums for 2%-or-more shareholder-employees paid by an S corporation. Total tips reported by the employee to the employer .

Box 8

It does ask how many dependents you can claim. It also asks whether you wish to increase or decrease your withholding amount based on certain factors like a second job or your eligibility for itemized deductions. If you want to have a specific number of extra dollars withheld from each check for taxes, you can put that on line 4. If you have more than one job, or you file jointly and your spouse works, follow the instructions below to get more accurate withholding. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.If you’re reporting for Household Employees for the tax year 2021, the sum of Medicare Wages and Tips must be equal to or greater than $2,200.00. If you’re reporting for Household Employees for the tax year 2021, the sum of Social Security Wages and Tips must be equal to or greater than $2,200.00. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below. Charlette has over 10 years of experience in accounting and finance and 2 years of partnering with HR leaders on freelance projects.15 , severance payments are also subject to income tax withholding and FUTA tax. You must notify employees who have no income tax withheld that they may be able to claim an income tax refund because of the EIC. You can do this by using the official Internal Revenue Service Form W-2 with the EIC notice on the back of Copy B or a substitute Form W-2 with the same statement. Write your state and employer state ID number in box 15 if your state requires you to do so. Box 16 is for an employee’s total earnings that are subject to state income tax withholding, while box 17 indicates the state income tax amount that’s been withheld.Fees apply if you have us file an amended return. Offer valid for tax preparation fees for new clients only. A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return. Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview. Offer period March 1 – 25, 2018 at participating offices only.