Zendesk automates the measurement of sales metrics so you can focus on keeping your top and bottom lines strong. Determine how much more revenue your company needs to hit sales targets, and set realistic quotas for reps based on those metrics. The buyer wound up being perfectly happy with the product it bought in lieu of the one they originally ordered. After receiving the Battery Operated Light Up Hooting Owl Pest Deterrent in the mail, they decided they didn’t need it. If they promptly returned it with a return authorization number issued by the company, they’d likely get a refund.

The difference between gross sales and net sales can be of interest to an analyst, especially when tracked on a trend line. If the difference between the two figures is gradually increasing over time, it can indicate quality problems with products that are generating unusually large sales returns and allowances. In total, these deductions are the difference between gross sales and net sales. If a company does not record sales allowances, sales discounts, or sales returns, there is no difference between gross sales and net sales. Gross sales isn’t a particularly accurate metric when considering the health of a business or its sales processes.

Use a CRM to track key sales metrics

From sales funnel facts to sales email figures, here are the sales statistics that will help you grow leads and close deals. Nurture and grow your business with customer relationship management software. Learn more about what a CRM database can do, how to set one up and pitfalls to avoid.

The difference between gross sales and net sales can also be a valuable indicator of the quality of a company’s product or service. If the discrepancy between the two figures is substantial or consistently growing, there may be issues or deficiencies with the product, making for considerable amounts of returns or allowances. Net sales is the sum of a company’s gross sales minus its returns, allowances, and discounts. They can often be factored into the reporting of top line revenues reported on the income statement. To calculate a company’s gross sales, add up the total sales revenue for a specified period of time—monthly, quarterly, or annually. Gross profit ratio is one metric that provides key insights as to the profitability of your specific products or services.

What Gross Sales Can Tell You?

As well as a general indication of your business’s financial health, net and gross sales can also be a benchmark for competitive analyses. For example, imagine that your customer ordered $3,000 worth of your product, but they receive the wrong color. While the product still functions correctly, the customer might ask for compensation given that the delivered goods weren’t as described. To keep the customer happy, your company might offer a partial refund of $300.

However, revenue may be calculated after deducting any returns, discounts or allowances. Accurately tracking and analyzing these metrics can help businesses identify areas for improvement, optimize their sales strategies and make informed decisions to drive growth and profitability. You’ll report your business’s gross revenue on your income or cash flow statement as top-line revenue. It’s equal to your gross sales – the total amount your company took in over a certain period of time.

It would be impossible to calculate important revenue metrics, such as net sales and gross profit margins, without gross sales. Net revenue, on the other hand, is great for tracking your profitability and provides considerably more insight than simple gross revenue. Without looking at your gross revenue over the same period, you can’t tell whether your business’s net income is changing because of fluctuations in sales or expenses. You’ll use this formula to calculate how much of your business’s gross income is left over after accounting for all of the company’s expenses. While still quite straightforward, net revenue is slightly more challenging to report because it involves a few more calculations.

While gross sales vs. net sales are terms that may be more familiar to accountants and investors, knowing what these mean as a salesperson or sales manager is still vital. It can give you a strong indicator of business performance and help identify any potential issues before they become serious problems. If you know the difference between gross and net sales company-wide, team-wide and individually, you can accurately measure and analyze performance. This means you can monitor sales performance and set goals that motivate your sales team to focus on the right targets. Gross sales incorporate all of these deductions, while net sales are a company’s gross sales minus these three deductions.

To calculate your gross sales, simply multiply the number of units you’ve sold by the unit price. So, if you sold 200 units in Q1 and the unit price is $40, your gross sales revenue (also called gross profit) is $8,000 for that quarter. In this post, we’ll show you how to calculate your net and gross sales so you can create accurate sales forecasts. We’ll walk you through the formulas, outline their differences and show you how to identify issues or opportunities within the sales process.

Net revenue reporting

Unless you offer tremendously specified goods or services, it’s always a balancing act. However, in spite of its product’s popularity, Battery Operated Light Up Hooting Owl Pest Deterrent LLC needs that money as soon as possible. In this case, the company might offer the retailer a 2% discount for paying off the invoice sooner. The price the company pays is an allowance and that partial refund is reflected in the company’s net sales. However, this is generally more confusing, so net sales are typically the only value presented.

- It can give you a strong indicator of business performance and help identify any potential issues before they become serious problems.

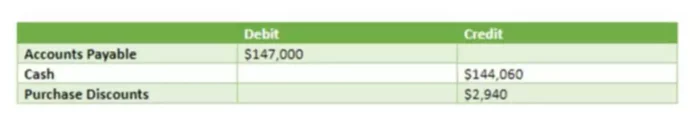

- A seller will debit a sales discounts contra-account to revenue and credit assets.

- This doesn’t include the cost-of-sales or deductions (like returns or allowance).

Although gross sales do not accurately represent a company’s profits, they do provide a baseline for measuring important sales metrics. Tracking your gross sales provides a way to measure the total amount of revenue made by sales teams. In the same view, net sales gives insight into the effectiveness of your team’s sales tactics as well as the quality of your products or services. Using both gross and net sales, you can understand how well your sales team is performing and how they can sell better. While interest payments are another item that you’ll deduct from your gross revenue to calculate your net revenue, dividend payments usually are not. Those payments are deducted later in your business’s accounting process, after you’ve calculated net revenue.

Sales Orders: What They Are Compared to POs & Invoices

Thus, if sales are to be reported separately from the income statement, the amount should be reported as net sales. Gross sales refer to the grand total of all sales transactions over a given time period. This doesn’t include the cost-of-sales or deductions (like returns or allowance). Your gross profit ratio measures the profitability of your specific product lines, answering the question of whether certain products are profitable to make and sell. The difference between your gross and net revenue is equal to your company’s expenses.

As such, each of these types of costs will need to be accounted for across a company’s financial reporting in order to ensure proper performance analysis. If a business has any returns, allowances, or discounts then adjustments are made to identify and report net sales. Net sales do not account for cost of goods sold, general expenses, and administrative expenses which are analyzed with different effects on income statement margins. A business might start by declaring its gross sales (commonly referred to as gross profit or total gross revenue), then listing the different sales deductions made as line items (which are the net sales). Other companies skip the part of identifying the gross sales and deductions and simply list the net income or net revenue.

benefits of knowing your gross sales and net sales

Net revenue measures how much money your company brought in after accounting for all expenses in the same period. A store with a small gap doesn’t have to have very many sales in order to draw customers and has a low return rate. Investors will see that as a net positive, as will others who examine your accounts. Knowing the amount of your gross sales is important in order to see the health of your business. Being able to see the difference between your gross sales, net sales, and profits allows you to determine where you need improvement. It also lets a company hold customers accountable for the state of products they return, the pace at which they do so, and whether they actually purchased the returned goods in the first place.

How to add gross and net sales on an income statement

Based on your gross and net sales, you can see where to allocate spending, how much to allocate and where spending might not be necessary. Let’s take a look at some of the benefits that come with understanding and analyzing your gross and net sales.

A company may elect to present its gross sales, deductions, and net sales information on separate lines within its income statement. Therefore, your net sales take into account returns, discounts, and allowances. Your net sales, then, are much closer to the actual amount of money you made. Gross sales and net sales are important metrics to understand — both in relation to and independently of one another.