Content

- Corporation Vs Sole Proprietorship Net Income

- Sole Proprietorship Taxes For Llcs

- How Bidens Tax Plans Could Negatively Impact Housing

- Business Mileage

- Does A Company Pay Taxes On Accounts Receivable?

Employees have this deducted from their paychecks, but as a sole proprietor, it is up to you to make these contributions while paying your income taxes. You will report your self-employment taxes on a Schedule SE which is submitted along with your Schedule C and 1040 income tax return. As we mentioned earlier, as a sole proprietor, you’re responsible for self-employment taxes—the social security and Medicare taxes that an employer normally takes out of an employee’s pay.

How do taxes work with a sole proprietorship?

Sole proprietorships are subject to pass-through taxation, meaning the business owner reports income or loss from their business on their personal tax return, but the business itself is not taxed separately. A sole proprietor will submit a Schedule C with their personal 1040 tax return on an annual basis.Because a corporation itself is a taxable entity and directly responsible for paying taxes, taxable income is computed at the corporate level. A corporation begins by aggregating all sources of business income to arrive at total income. Income sources include sales revenue, investment income, royalties, rents, and capital gains.

Corporation Vs Sole Proprietorship Net Income

Partnerships are established under the individual laws of each state, although their tax treatment at the federal level is determined by the IRC. According to the IRS, a sole proprietorship is the most common form of business organization. It is easy to form and is defined as any unincorporated business owned and controlled entirely by one individual. In general, for Maryland and federal purposes the owner is personally responsible for all financial obligations and debts of the business.

Sole Proprietorship Taxes For Llcs

The extent of your tax responsibilities, however, will largely depend on the specifics of your business—including, first and foremost, your business entity type. A sole proprietorship is attractive to the average entrepreneur – you get to reap all of the profits and to have full control of the business; however, it does come with some risk, namely unlimited liability for the owner. Thisnet income or loss of the business is entered on Line 31 of the owner’s Schedule C, to be included along with other income or losses of the owner for income tax purposes. The figure is entered on Line 3 of the Form 1040 if the business has a profit. A loss may be used to reduce the total adjusted gross income of the owner on the tax return if the business has a loss.If you’re going to take a deduction, you should be able to demonstrate to the IRS that it was a legitimate business expense. At least $600 by check, cash, electronic funds transfer, or wire transfer during the course of the year, you must file 1099s for them. If you paid your contractors by credit card or a service such as PayPal, the merchant processor is responsible for filing the 1099s. Are there any benefits to filing taxes for a small business with no income? One of the biggest issues a small business owner must face is whether to incorporate and if so, when. An Employer Identification Number is a unique number assigned to a business for easy IRS identification for tax reporting purposes.

- See Appendix for full data table with payroll by state and business form for 2011.

- You will often end up paying fewer taxes by incorporating your business than running it as a sole proprietorship.

- If the desired name is free, articles of organization must be filed with the state office where the business will be based.

- The actual expense method, where you track all of the costs of operating the vehicle for the year, including gas, oil, repairs, tires, insurance, registration fees, and lease payments.

Fringe benefits such as health insurance are also considered a guaranteed payment. The partnership deducts guaranteed payments as ordinary business expenses, and the partners include them as ordinary income. To the extent that the guaranteed payments are for personal services performed by a partner, the income is subject to self-employment tax. Like individuals, a corporation may be required to compute its income tax liability twice, once according to the regular corporate tax, and again according to the corporate alternative minimum tax . The AMT is designed to guarantee that corporations are subject to a minimum rate of taxation by limiting the degree to which tax deductions and credits may be used to calculate tax liability. To figure out how much to pay quarterly, you’ll need to have a good idea of your taxable income and deductions for the year.

How Bidens Tax Plans Could Negatively Impact Housing

Pass-through businesses face only one layer of tax on their profits compared to the double taxation faced by C corporations. This can be largely offset, however, because sole proprietors can deduct up to half of the total cost of these contributions. One of the most common mistakes that sole proprietors make is not reporting all earned income. Check with yourstate department of revenuefor more information on sales and excise taxes. Sole proprietorships are not typically liable for franchise taxes, because these are levied by states oncorporationsand other types of state-registered businesses. Here’s a brief overview of how to file and pay taxes as a sole proprietor — and an explanation of when incorporating your business can save you tax dollars.These professionals can answer any questions you have, ensure that you receive the maximum deductions, and even complete the returns on behalf of your business. Although there are different deadlines to adhere to, you’ll want to be sure to keep track of your tax responsibilities, pay your estimated taxes, and file on time.

Business Mileage

Also, it exists as a separate legal entity than if you were a sole proprietor. For legal and tax purposes, sole proprietorships are the only business type that isn’t separate from the owner. The owner is liable for all the debts of the business and can be sued in connection with its actions . Small businesses of all types pay an estimated average tax rate of 19.8 percent. This rate is the average of the tax for business or an individual taxpayer.

Does A Company Pay Taxes On Accounts Receivable?

Sole proprietors must estimate how much they’ll owe in taxes at the end of the year. If you’re not sure what you’ll owe, use your last year’s federal tax return as a guide. A major mistake that sole proprietors can make is failing to make estimated quarterly tax payments.The simplest business to set up is to become a sole proprietorship where you are the owner and the liabilities of the business are yours. Calculating profit and loss determines income and you can deduct expenses from income to determine your tax liability. One of the main goals of fundamental tax reform is to make U.S. businesses more competitive and to increase economic growth.

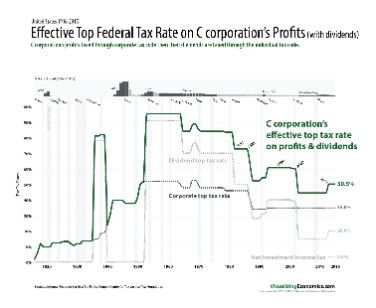

C Corporations

Like partners, shareholders who provide services to the corporation generally are employees of the corporation. The corporation may deduct as expenses wages, salaries, and some fringe benefits paid to these employees, but must also pay employment taxes and withhold income and payroll taxes. This report provides a general overview of the tax treatment of the major business types, including sole proprietorships, partnerships, C corporations, subchapter S corporations, and LLCs. Important nontax aspects of each business type are also presented and contrasted where appropriate.