Content

- Fighting Back Against Rising Property Taxes

- Property Tax Statement Guide

- How Your Property Taxes Are Calculated

- What Taxes Are On An Inherited House?

- Q&a: How Property Taxes Are Determined

- Property Assessment Faqs

- Home Values Soared In 2020 But So Did Property Taxes

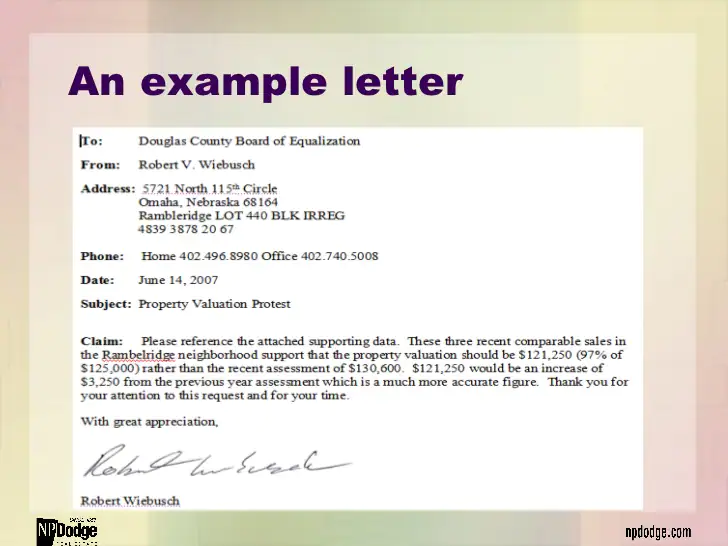

It’s for this reason that homeowners are advised not to max out their budgets when purchasing property. Although it’s possible to lock in the same monthly mortgage payment for up to 30 years so that there are no surprises, other costs of homeownership, like property taxes, have the potential to rise. Buyers must leave themselves wiggle room for those unplanned expenses so they’re not left scrambling to cover their bills. Homeowners whose property taxes go up have the option to appeal them. Once a year, property assessments are sent out, and from there, owners can argue that their homes are overvalued through whatever local process is in place. In other cases, it means having to stand before a judge and argue why a home is overassessed.There are, of course, some big changes to our tax code underway, which will impact many homeowners in this arena. The aggregate tax rate is determined by totaling the individual tax district rates of the districts that provide service for each area.

Fighting Back Against Rising Property Taxes

It can be hard to balance the desire for a beautiful home with the desire to pay as little tax as possible. However, there are some little things you can do to reduce your property tax burden without resorting to living in a dump.The Motley Fool is a USA TODAY content partner offering financial news, analysis and commentary designed to help people take control of their financial lives. We do receive compensation from some partners whose offers appear on this page. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Sign Up NowGet this delivered to your inbox, and more info about our products and services. Never underestimate the “condition” and it’s contribution to your tax bill. “They check building permits often,” said Edward Mermelstein, a real-estate attorney in New York. Property taxes are deductible, but only up to $10,000 according to the new tax law in effect since 2018.A home assessment doesn’t necessarily mean that your taxes will go up. For example, there may be a lot of new constructions in your community, which can help to offset any tax bill increase. Filing a tax appeal may cost you a small filing fee, which is paid to have someone review your appeal. Your attorney will likely charge you a fee—sometimes a portion of the savings on your tax bill if your appeal is approved. Your appeal should be filed in a timely manner; otherwise, you’re stuck with the bill you receive from your local tax office. Many people allow the tax assessor to wander about their homes unguided during the evaluation process.

Property Tax Statement Guide

Certain items are excluded from the $5 and $10 limits such as bond levies and some special assessments. These amounts can be found on the right-hand side of your bill in the third section of itemized amounts.

- Property taxes are real estate taxes calculated by local governments and paid by homeowners.

- Property assessments are based on property characteristics (e.g., size, age, style, quality, and condition of individual properties) and current activity in the real estate market.

- Homeowners whose property taxes go up have the option to appeal them.

- It lowers taxes for homeowners as long as they actually live in the property.

- The problem with rising home values is that they can cause assessments to increase, thereby driving up property tax bills.

Even improvements to your property outside of your home can trigger an assessment. While above ground pools don’t tend to increase property values, inground pools do. Adding fences, sheds, patios, and decks can also increase your home value, causing corresponding property taxes to increase. During this time, accessors, who are government officials, will go around and do their best to determine the true assessed value of the properties in their jurisdiction.

How Your Property Taxes Are Calculated

However, the assessment still contains a certain amount of subjectivity. This means more attractive homes often receive a higher assessed value than comparable houses that are less physically appealing. Anderson is CPA, doctor of accounting, and an accounting and finance professor who has been working in the accounting and finance industries for more than 20 years. Her expertise covers a wide range of accounting, corporate finance, taxes, lending, and personal finance areas. This video is designed to answer some of the frequently asked questions about Oregon’s property tax system. The first method is to compare the Fair Market Value of your property with recent sales of similar properties in your neighborhood.

What Taxes Are On An Inherited House?

This is why some people try to sneak by without requesting a permit but that’s a can of worms you don’t want to open — it will create huge headaches when you go to sell the house. Meanwhile, in New York City, seniors who make less than $50,000 can have the taxable value of their home reduced by as much as 50%. Realtor.com’s privacy policy applies to your use of the realtor.com site and apps. Converting a walk-up attic or basement into a livable space is also likely to trigger an automatic reassessment, saysRita Patriarca, a Realtor® with Re/Max Encore in Wilmington, MA.

Q&a: How Property Taxes Are Determined

Initiative 747 also provides limits on the increases in regular levy collections to 1% a year or the amount of inflation, whichever is less. This limit applies to a taxing district’s budget, not to the assessed value of an individual property. A district can “bank” the difference between the amount budgeted and their statutory limit and use the “savings” at a later time.Some assessors will only see the good points in the home such as the new fireplace or marble-topped counters in the kitchen. They’ll overlook the fact that several appliances are out of date, or that some small cracks are appearing in the ceiling. It is important to review comparable homes in the area and general statistics about the town’s evaluation results. For example, let’s say you have a four-bedroom home with a one-car garage, and your home is assessed at $250,000. Your neighbor also owns a four-bedroom home, but this house sports a two-car garage, a 150-square-foot shed, and a beautiful swimming pool.

Home Values Soared In 2020 But So Did Property Taxes

Combine that with SmartAsset’s property tax calculator and you’ll get a general idea of how much more you can expect to pay in taxes. As a result, homeowners are tapped to make up the difference with property taxes. “It’s going to bite deep into both homeowners’ and landlords’ pocketbooks, as reassessments kick in and send property tax bills soaring,” says Brian Davis of Spark Rental, a firm that makes software for landlords. Homeownership is one of life’s great highlights, but ask homeowners about paying property tax and they’ll tell you it’s one of their least favorite responsibilities.Some states have more favorable property tax levels, but there’s generally always some kind of tax to pay for municipal services. One of the ongoing costs of owning a home or business property is paying property taxes. These monies are essential for funding local governments and schools, but they can also add hundreds or thousands of dollars to a homeowner’s tax burden. Understanding what causes property taxes to rise can help you anticipate future payments and budget accordingly. So how can homeowners push back and lower their property tax rates? For starters, make sure your property records reflect your property accurately. Some assessments list more bedrooms or bathrooms than you have in your home.