Content

- What Is A Journal Entry?

- 5 Use Journal Entries To Record Transactions And Post To T

- Example Of A General Journal Accounting Entry

- You Make A Payment On Your Bank Loan

- What Are Journal Entries For?

- Examples Of General Journal Entries

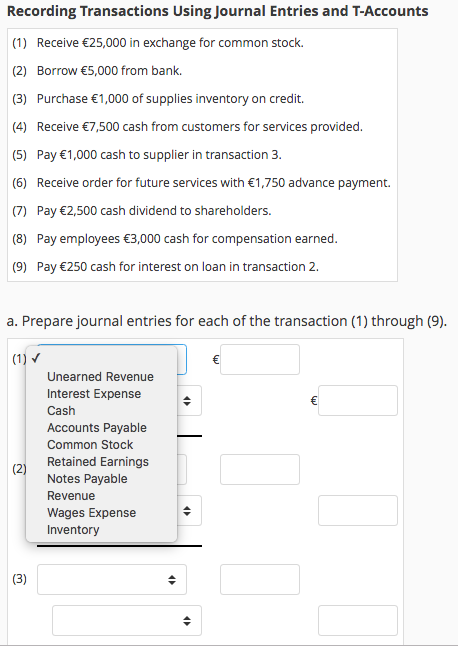

Finally, enter the debit or credit amount for each account in the appropriate columns on the right side of the journal. Generally, one blank line separates each transaction. A record of transactions in accounting is created when you journalize transactions.

What Is A Journal Entry?

If there was a debit of $5,000 and a credit of $3,000 in the Cash account, we would find the difference between the two, which is $2,000 (5,000 – 3,000). The debit is the larger of the two sides ($5,000 on the debit side as opposed to $3,000 on the credit side), so the Cash account has a debit balance of $2,000.

5 Use Journal Entries To Record Transactions And Post To T

You can’t just erase all that money, though—it has to go somewhere. So, when it’s time to close, you create a new account called income summary and move the money there.

Example Of A General Journal Accounting Entry

Accounts Receivable has a credit of $5,500 (from the Jan. 10 transaction). The record is placed on the credit side of the Accounts Receivable T-account across from the January 10 record. In the last column of the Cash ledger account is the running balance. This shows where the account stands after each transaction, as well as the final balance in the account. How do we know on which side, debit or credit, to input each of these balances? The following are selected journal entries from Printing Plus that affect the Cash account. We will use the Cash ledger account to calculate account balances.

- The debit is the larger of the two sides ($5,000 on the debit side as opposed to $3,000 on the credit side), so the Cash account has a debit balance of $2,000.

- If you’re not using accounting software, you’ll need to record this entry in the purchases journal.

- Accounts Receivable is an asset, and assets decrease on the credit side.

- This post is to be used for informational purposes only and does not constitute legal, business, or tax advice.

- Also, knowing when and how to determine that a gift card will not likely be redeemed will affect both the company’s balance sheet and the income statement .

- To find the account balance, you must find the difference between the sum of all figures on the side that increases and the sum of all figures on the side that decreases.

This liability increases Accounts Payable; thus, Accounts Payable increases on the credit side. Accounts Receivable was originally used to recognize the future customer payment; now that the customer has paid in full, Accounts Receivable will decrease. Accounts Receivable is an asset, and assets decrease on the credit side. Printing Plus has not yet provided the service, meaning it cannot recognize the revenue as earned. The company has a liability to the customer until it provides the service.

You Make A Payment On Your Bank Loan

When filling in a journal, there are some rules you need to follow to improve journal entry organization. You can see that a journal has columns labeled debit and credit. The debit is on the left side, and the credit is on the right. Journaling the entry is the second step in the accounting cycle. “Double entry means that amounts are shown in the journal and ledger.” Do you agree? On August 13, Alex sells a trumpet to a customer on account. On August 6, Alex sold all the drum heads to the local high school band for a total of $1,500 cash.The accounting transactions outlined below are examples of transactions you’d record in your journal, in chronological order, as part of the journalizing process. The purpose of using the double-entry accounting method is to make sure you’re balancing the fundamental accounting equation. If the sum of your debits is ever not equal to the sum of your credits, the equation is not balanced.

What Are Journal Entries For?

If you’re recording transactions manually, this should be recorded in your cash receipts journal. Any time you pay a vendor or supplier for goods and services that they’ve supplied to your business, you have two choices.

Examples Of General Journal Entries

This is placed on the debit side of the Salaries Expense T-account. Printing Plus did not pay immediately for the supplies and asked to be billed for the supplies, payable at a later date. This creates a liability for the company, Accounts Payable.

Want More Helpful Articles About Running A Business?

As a freelancer, the single-entry method might be all you need. Revenue accounts have normal balances on credit side. Equity accounts have normal balances on credit side. Liability accounts have normal balances on credit side. Expense accounts have normal balances on debit side. Debit refers to the left-hand side and credit refers to the right-hand side of the journal entry or account. B. Explain why you debited and credited the accounts you did.The module automatically creates a journal entry that debits the compensation and payroll tax expense accounts, and credits cash. This can be quite a complex entry, since it may also address garnishments and other deductions, and separately record several types of payroll taxes. The module automatically creates a journal entry that debits either cash or the accounts receivable account, and credits the sales account. There may also be a credit to the sales tax liability account. When a supplier invoice is received, the accountant logs it into the accounts payable module in the accounting software. The module automatically creates a journal entry that debits the relevant expense or asset account, and credits the accounts payable liability account. This approach is time-consuming and subject to error, and so is usually reserved for adjustments and special entries.

Accounting Journal Entries: Definition, How

Recall that the general ledger is a record of each account and its balance. Reviewing journal entries individually can be tedious and time consuming.A liability account increases on the credit side; therefore, Accounts Payable will increase on the credit side in the amount of $3,500. As you can see, not only did every transaction affect two accounts, it also affected them in the exact same amount. That’s another important concept of the double-entry accounting system to remember – the total debits must equal the total credits. Ensuring that they are equal keeps the balance in accounts. Every time your business makes a transaction, you must record it in your books.The software then prints checks or issues electronic payments, while also debiting the accounts payable account and crediting the cash account. In the journal entry, Cash has a debit of $2,800. This is posted to the Cash T-account on the debit side. You will notice that the transactions from January 3, January 9, January 12, and January 14 are listed already in this T-account. The next transaction figure of $2,800 is added directly below the January 9 record on the debit side. The new entry is recorded under the Jan 10 record, posted to the Service Revenue T-account on the credit side. When we introduced debits and credits, you learned about the usefulness of T-accounts as a graphic representation of any account in the general ledger.Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial. Description includes relevant notes—so you know where the money is coming from or going to. 3/21Invoice #123$600Date lets you know when the entry was recorded. When you’re visiting with your client, they pay the $600 invoice you sent them. You’re going to meet up with a client, pick up some office supplies, and stop by the bank to make a loan payment. Financial statements are the key to tracking your business performance and accurately filing your taxes.But most people today use accounting software to record transactions. When you use accounting software, the above steps still apply, but the accounting software handles the details behind the scenes. Journal entries are how you record financial transactions.