Content

- Local Governments

- You Are Heretaxes Business Taxes Sales And Use Tax

- Tpt And Use Tax:

- How To Get A Sales Tax License

- Department Of Taxation And Finance

- Types Of Certificates Of Authority

Instead, you will later collect sales tax on those goods from your customers. Out-of-state businesses under the remote seller tax law that went into effect on October 1 are reminded to use business code 605 . The tax applies to remote sellers and marketplace facilitators that have no physical presence in Arizona and meet certain economic thresholds. Marketplace facilitator requirements have made sales tax life a lot easier for smaller sellers who might only sell on marketplaces. But be warned, if you make other sales – such as in-person sales or you sell at trade shows or craft fairs, you are still required to collect sales tax on those sales.

How do you get a sales tax ID?

Contact your state’s tax authority or department of revenue. States usually allow you to apply for your sales tax number online. You’ll want to take this step as soon as possible, because your state may not allow you to conduct sales until your number has been issued, usually in the form of a paper certificate.The audit may determine that you owe tax, that you are entitled to a refund or that you have paid the correct amount. In general, you may be audited in four-year intervals; thus, you are required to keep records for a minimum of four years. The legal definition for “tangible personal property” is “personal property that can be seen, weighed, measured, felt, or touched or that is perceptible to the senses.” Nonprofit tax exemptions, like the other scenarios mentioned, are handled on a case-by-case basis as well. The IRS has guidelines for applying and reviews each case to determine eligibility.

Local Governments

Sales tax registration form and you’ll be contacted by a vetted sales tax expert. An ecommerce business has economic nexus when they exceed that state’s economic nexus threshold. As with everything sales tax related, this threshold varies by state. But a general rule of thumb is that if your eCommerce business makes more than 200 sales or more than $100,000 in a year into a state then your business likely has economic nexus. Some states only have a state sales tax rate and do not allow local areas to impose sales tax.You’ll generally need to apply for a separate permit for each additional business location, even if the additional locations are within the same state. Some states have temporary permits for those participating in events like a flea market, whereas some states don’t, so be sure to select the right permit. Most states require business owners to collect sales tax when selling taxable items or taxable services.In order to register for sales tax, please follow the application process. Resale exemptions are also a fairly common form of the exemption certificate. With a resale exemption, businesses that buy certain items to later resell them at a markup are not required to pay sales tax on the original purchase.. Note that sales tax must still be collected on all sales of taxable items to the final consumer. If you decide to apply for a resale certificate, you still need to have a sales tax permit. Apply for a seller’s license before applying for a resale certificate.Before you begin the online registration process, please ensure you have your Federal Employer Identification Number available. Corporations, Partnerships, Limited Liability Companies, and Associations must also have each Business Owner’s full name and Social Security Number available. Many types of business can benefit from having a compliance calendar to make sure they don’t miss any important filing dates and fulfill all regulatory obligations.

You Are Heretaxes Business Taxes Sales And Use Tax

In the first situation, a use tax will be due on your business purchases where you were not charged sales tax and were not entitled to an exemption. This means your online business would need to file a use tax return for purchases made by it. In addition, your business will have additional responsibilities and obligations beyond the collection of sales tax. Publication 20, New York State Tax Guide for New Businesses, provides information on New York State rules for corporation taxes, withholding taxes for employees, workers compensation benefits, and much more. If you will have multiple locations, and you plan to operate them as one business, you can register all the locations using New York Business Express. We will process your application and send you a Certificate of Authority for each location, all containing the same sales tax identification number. Whether you’re setting up shop at the farmers market or the grand opening of a retail store, collecting sales tax is an important part of running your business.

Tpt And Use Tax:

If you have a physical sales presence in a certain state, you will have to collect and pay sales taxes for that state. Any kind of physical location that you actually sell from — such as a small retail space or a vendor stand at a market — or any area where you keep inventory constitutes a physical presence. The Tax Department issues two types of Certificate of Authority for sales tax purposes, regular and temporary. The type of Certificate of Authority you need is based on the expected duration of your business activities.

- We are not a law firm, or a substitute for an attorney or law firm.

- Marketplace facilitator laws only require marketplaces to handle sales tax collected from buyers on their marketplaces.

- Adult use marijuana establishments must report such sales using a new Adult Use Marijuana business code on Form TPT-2.

- Forty-five states and the District of Columbia levy general sales taxes, which apply to nearly all tangible products and some services.

- The new business must have its own Certificate of Authority before it begins business.

Executing a taxable transaction without a certificate of authority can result in hefty penalties. Services – Businesses repair, improve, or alter tangible personal property owned by others. Businesses, who sell tangible personal property in addition to providing labor or a service, are required to obtain a sales tax license. Any property which goes with the customer in connection with the repair or service is considered a sale at retail and subject to sales tax. Wholesalers – Wholesalers sell to other wholesalers or retailers and not to the final consumer. The price at which the seller sells a product does not determine if the seller is a wholesaler.

How To Get A Sales Tax License

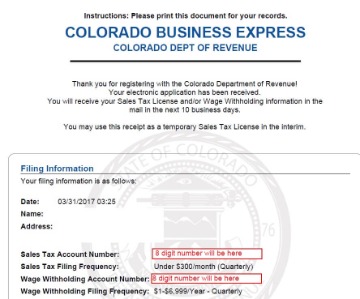

If you register online and there is a fee, you must make direct payment from your savings or checking account. If you register for Sales Tax, Room Occupancy or Over-the-counter Cigarette Dealer , a temporary permit will be available to print immediately. BE SURE TO PRINT A COPY FOR YOUR RECORDS. Once you have the temporary permit you may begin using it immediately.

Department Of Taxation And Finance

Be careful to check all of the appropriate boxes concerning the reactivation of your license and to also update any information about your business that may have changed from your original license. You are required to obtain a new Sales and Use Tax Permitif you will have more than a single place of business, you must obtain and display a Sales and Use Tax Permit for each location. Save money without sacrificing features you need for your business. Other responsibilities you may need to do before operating include registering your business, creating an unemployment insurance account, and setting up a new hire reporting account with the state. Taxpayers required to pay electronically will be subject to a penalty of 5 percent of the amount of payment made by check or cash. Failure to comply with the electronic filing and payment requirements may result in penalties. North American Industrial Classification System code required for all businesses.

Why do I need a sales tax license?

A sales tax license, also known as a sales tax permit or registration in some states, is an agreement with the state tax agency to collect and remit sales tax on items sold by your business. … In states that collect sales tax, this license is a must if you form a sales tax nexus, or bond, with that state.Taxpayers receiving pre-populated Form TPT-EZ through the mail can file and pay at AZTaxes.gov or print the form at azdor.gov. Would you rather hire a pro to register your business for sales tax? Many states have special sales tax rules for tobacco products, alcohol, and motor fuels. You have one business location where you will make retail and wholesale sales.

What Is A Sales Tax License?

A penalty of $250 applies for the first day the person engages in business without a seller’s permit, and a penalty of $100 for each following day that the person engages in business without a seller’s permit. The penalty may be waived if the person proves that the failure to obtain or renew the seller’s permit was due to reasonable cause and was not intentional or due to neglect. An out-of-state retailer or utility business making sales of tangible personal property to Arizona purchasers. Taxpayers required to file an electronic return will be subject to a penalty of 5 percent of the tax amount due for filing a paper return. Although commonly referred to as a sales tax, the Arizona transaction privilege tax is actually a tax on a vendor for the privilege of doing business in the state. Various business activities are subject to transaction privilege tax and must be licensed.

Types Of Certificates Of Authority

If you are buying an existing business, or taking over the ownership of a family business, you must apply for your own Certificate of Authority. You cannot use the Certificate of Authority that we issued to the previous owner. For additional information on the types of Certificates of Authority, see Publication 750, A Guide to Sales Tax in New York State. If you have any questions on whether or not you are required to register, see Tax Bulletin Do I Need to Register for Sales Tax?