Content

- How Often Do I Need To Balance My Checkbook?

- Checkbook Register

- Step 2: Open Your Checking Account Statement

- How Do I Fill Out The Form Of Du Cic? I Couldn’t Find The Link To Fill Out The Form

- Checkbook Balancing

You may also need to recheck your math to be sure additions and subtractions in your register were made correctly. Aggregators can be a great tool for anyone who wants to get a big-picture sense of their money. However, they can lull some people into believing that they are staying on top of their money chores because the aggregator does so much for you. If you simply let the aggregator do the work and never stop to check in, this kind of program will not replace manual balancing. You need to know what your money is doing and make sure you compare your (or the aggregator’s) records with the bank’s records.If you haven’t made one yet, you can, through Google or Facebook. Open the doc and select the page that needs to be signed. Press Done and your signature is ready. The eSigned file will be attached to the draft email generated by signNow’s eSignature tool.

How Often Do I Need To Balance My Checkbook?

Some people wait until the monthly statement comes from the bank to balance their checkbook. But if you’ll log in to your bank at least once a week, you’ll give yourself way less chance of letting any transactions slip past you (which helps you avoid those overdraft fees we mentioned earlier!). Let’s be honest, balancing your checking account—aka balancing your checkbook—probably isn’t on your list of fun activities. But keeping up with your spending and income is a must, and that’s exactly what balancing your checkbook does! So, let’s break down the what, why and how.

Is checkbook balance a cash?

Outstanding checks are checks recorded in a company’s checkbook but not subtracted from the company’s account in the bank’s customer deposits subsidiary ledger. … Those certificates of deposit with lives of less than 90 days are considered cash equivalents.Would you like to catch errors (including bank errors and mistakes you’ve made) before they cause major problems? Balancing your bank account helps you keep track of everything in your account, and it’s a relatively easy task. Justin Pritchard, CFP, is a fee-only advisor and an expert on personal finance. He covers banking, loans, investing, mortgages, and more for The Balance. He has an MBA from the University of Colorado, and has worked for credit unions and large financial firms, in addition to writing about personal finance for more than two decades. We have included a list of categories from our money management template that you can edit within the Settings worksheet.Compare Transactions Compare your bank statement with your check register to see whether all of the transactions you have made have cleared your account. Place a check mark in your checkbook register beside each transaction that appears on the bank statement as having cleared. There are a number of programs availablethat will automatically track your banking information for you, such as Mint.com and Personal Capital. These aggregators allow you to see an overview of all of your financial accounts in a single place, from your checking and savings accounts, to your loans, to your college savings account. Such an aggregator will do the tracking and recording for you, so all you’ll have to do is check it regularly and compare it to your banking information to make sure everything balances.

Checkbook Register

These are deposits you have made to your account but do not appear on any bank statement to date. Make use of the Sign Tool to add and create your electronic signature to signNow the Checkbook balance worksheet form. Read below to see how to fill in…

- Once you’ve finished signing your balancing a checkbook worksheet, decide what you wish to do after that – save it or share the doc with other parties involved.

- The total you calculate should match the current balance of your checkbook.

- This is the balance for all transactions marked with an “R” or “c” in the reconcile column.

- For example, $258 was recorded as $285.

- Start a FREE trial today.Some people write down transactions the second they happen.

- Sort checks into check number order.

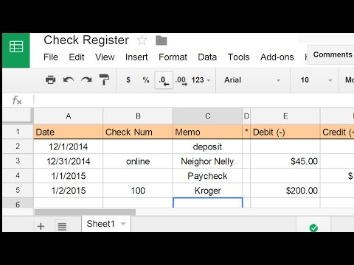

A user also requested we add a customizable Payee list, so we’ve done that as well. You can edit Payees that show up in the drop-down by editing the list in the Settings worksheet. The drop-down list for the Num field will show you the next check number and other options.

Step 2: Open Your Checking Account Statement

These amenities make it very easy to check your banking information each day. Balancing a checkbook means you’ve recorded all additions made to your account and subtractions . Look at your latest statement and verify that all deposits listed match the deposit amounts listed in your checkbook register. Locate any outstanding deposits and enter them above. These will be items that were not cleared in step 3.

How Do I Fill Out The Form Of Du Cic? I Couldn’t Find The Link To Fill Out The Form

You can track multiple accounts by making a copy of the Register worksheet. Account balance worksheet use the worksheet to balance your checkbook register with the checking account balance shown on your most recent bank statement. Be as accurate as possible when completing this form. This worksheet will help you know… What is the point of balancing your checkbook? Balancing a checking account shows how much money is available. A simple and easy-to-use check register template that automatically calculates your balance based on manually entered debit and credit transactions.The old-school method of checkbook balancing assumed that you would carry a paper check register with you everywhere you went, and that you would record your transactions by hand. It also assumed that your transactions consisted primarily of paper checks going into and out of your account. How do you balance a business checkbook? Compare the deposits listed on the bank statement with the deposits shown in your checkbook.For each debit, you’ll subtract the amount of the transaction from your balance. For each credit, you’ll add the amount. You’ll continue doing this until you have recorded all your transactions. Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms. One easy way to review transactions is to mark the transactions that are legitimate and that you’ve cross-referenced with your check register. Do you want to know exactly how much you have available to spend from your bank account?

Checkbook Balancing

But if you keep it there just in case of emergencies , it can make sense. Some options, like a transfer from savings or an overdraft line of credit, may be less expensive than traditional overdraft protection. The formula we uses displays ” – ” if you have not entered the Date, and it uses the OFFSET function to prevent the formula from breaking if you delete a row or sort the table. Transformation of legacy system odb modeling into aodb 1 shivani a trivedi, 2nalin. Jane, 3amal kumar ksv-skpimcs-mca, india, ksv-skpimcs-mca, india, 3 mba-bhavnagar university, india 2 1 abstract — this paper aims at modeling database…As you continue to make transactions, record them in your check register so you have a running tally of your debits, credits and total balance. The sigNow extension was developed to help busy people like you to reduce the stress of signing forms. Begin eSigning balancing a checkbook worksheet using our solution and become one of the millions of happy customers who’ve already experienced the key benefits of in-mail signing. After that, your balancing a checkbook worksheet is ready. All you have to do is download it or send it via email. SignNow makes eSigning easier and more convenient since it provides users with numerous additional features like Add Fields, Merge Documents, Invite to Sign, etc.

Beyond Balancing Your Checking Account

Look through every transaction on your bank statement and compare any checks paid to your check register. If you’re not sure what something is, figure it out. Reviewing your transactions lets you find any pesky, bank account-draining charges like these and take care of them for good. Balance checkbook worksheetes and tablets are in fact a ready business alternative to desktop and laptop computers. You can take them everywhere and even use them while on the go as long as you have a stable connection to the internet. Therefore, the signNow web application is a must-have for completing and signing checkbook balance sheet on the go.Checkbook register use this form to keep track of your purchases. Subtract each purchase amount from the balance and keep a running total as you work to make sure you don’t go over the budget. Be sure to record any other credit amounts listed, such as corrections by the institution. It’s important to record the transaction at the time you actually write the check, make a withdrawal, or make a deposit.

What Is Balancing A Checkbook?

Look for an entry in your account called “ending balance,” “previous ending balance,” or “beginning balance.” Enter this figure on your form or spreadsheet. Be sure that all of the outstanding items from your previous statements have been included in this statement. Otherwise, they are still outstanding. Simply look at and/or recheck your canceled checks or check images, deposit receipts, and/or ATM and receipts. Make sure every transaction on the statement is also in your register , even pending payments. Click on the link to the document you want to eSign and select Open in signNow.

People Also Ask Printable Checkbook Balancing Form

And if you aren’t tracking all your spending and income, you’re risking of dangerous overdraft fees. What you probably have at all times, however, is your cell phone.Use our detailed instructions to fill out and eSign your documents online. Keep a buffer of cash in your account so that you can absorb any surprises. Insufficient funds fees can cost $35 or so, and your bank can still apply those charges even if you opt out of overdraft protection. Set up alerts so that your bank automatically notifies you of any large withdrawals, or if your balance falls below a certain level. Most banks and credit unions can send text or email alerts based on rules that you specify.