Content

- Ending Inventory Under Fifo

- How To Find Ending Inventory Using Lifo

- Wac Method

- Closing Inventory: 3 Methods To Calculate It

- Counting Inventory

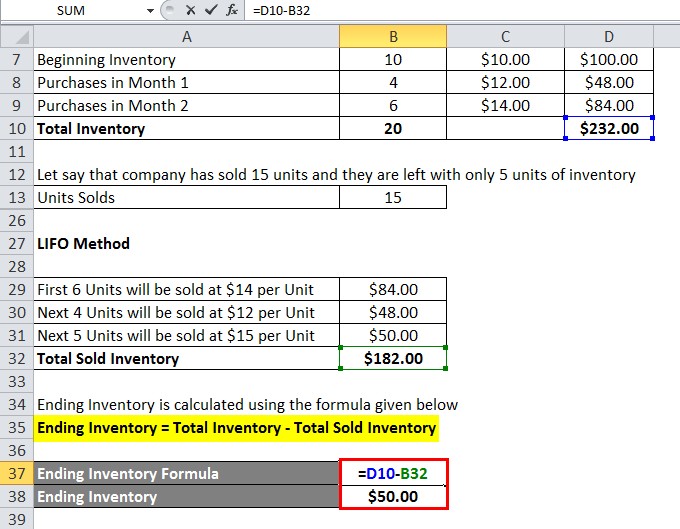

- Lifo Method

- What Is The Meaning Of Ending Inventory?

She got a job at a manufacturing company called ACME Lumber Yard, where they sell timber to various real estate development firms. Her first assignment is to calculate the ending inventory for all the lumber that is in stock. Ending inventory is the value of goods available for sale at the end of the accounting period. FIFO method is used during a period of rising prices or inflationary pressures as it generates a higher ending inventory valuation than LIFO . As such, certain businesses strategically select LIFO or FIFO methods based on different business environments. Last In First Out Inventory MethodLIFO is one accounting method for inventory valuation on the balance sheet.The business then chooses an inventory valuation method to account for changing costs. Ending inventory is an inventory accounting term that represents the total value of inventory you have ready to sell . Most businesses calculate ending inventory at the end of an accounting period, including it as an asset on their balance sheet for calculating taxes and accurately estimating the value of their business. At its most basic level, ending inventory can be calculated by adding new purchases to beginning inventory, then subtracting the cost of goods sold . A physical count of inventory can lead to more accurate ending inventory.

Ending Inventory Under Fifo

Advancements in inventory management software, RFID systems, and other technologies leveraging connected devices and platforms can ease the inventory count challenge. The formula for ending inventory is beginning inventory plus net purchases minus cost of goods sold. Net purchases are purchases after returns or discounts have been taken out.In these 2 cases, you’ll either have a number of units or dollars left to reflect. Then, when a purchase is made, the sand sold isn’t taken from the bottom of the sand mountain, but instead from the top – so the newest sand added to the pile is also the first sand sold. Subtract the cost of goods available for sold from the cost of goods sold to get the ending inventory.

How To Find Ending Inventory Using Lifo

This method of calculating ending inventory is formed from the belief that companies sell their oldest items first to keep the newest items in stock. It’s important to note that during inflationary periods, the FIFO method will result in a higher ending inventory amount.

Wac Method

Count the quantity of unsold products on the store’s shelves and stockroom. All of the methods outlined in this article are useful and can help you determine your ending inventory amounts. However, each has its own unique set of advantages and disadvantages as well. Markdowns, sales, product damages, depreciation, and theft can all have a profound impact with this method.

- You use the same formula for your calculations as you do for figuring the ending inventory of sales stock.

- Ending inventory formula is used to calculate the value of goods available for sale at the end of the accounting period.

- For the sake of simplicity, we’ll use the same company example as our previous formula.

- Therefore, it is important to be as accurate as possible, draw correct conclusions and make the right decisions both when you calculate beginning inventory and when you are calculating ending inventory.

- These transactions account for all of the pluses and minuses that occur within a specified accounting period.

- If there’s inaccuracies measured in the ending inventory, it will result in financial implication in the new reporting period also.

- This allows you to average out the costs over the period instead of relying on the oldest prices in the First In, First Out method or the latest prices in the Last In, First Out method.

Accounting PeriodAccounting Period refers to the period in which all financial transactions are recorded and financial statements are prepared. Every business that carries inventory should use the ending inventory formula. The inventory calculation helps you to conserve cash while you meet customer demand. Use the trends and analysis you perform using ending inventory and compare those balances to the inventory count results. But if you already know the beginning inventory and ending inventory figures, you can also use them to determine the cost of goods sold.

Closing Inventory: 3 Methods To Calculate It

Note that the methods described here can only be used to estimate ending inventory – nothing beats a physical count or cycle counting program to obtain a much more accurate ending inventory valuation. Increased accuracy can also be obtained with a proper reserve for obsolete inventory and consideration of the effects of any inventory cost layering methodologies, such as the LIFO or FIFO methods. Net Purchases are new inventory that was purchased during the current accounting period. A company will need to maintain accurate bookkeeping to maintain records of purchases obtained. This is the gross purchase amount minus any discounts, returns, and allowance.

What is the formula for inventory?

Average inventory formula: Take your beginning inventory for a given period of time (usually a month). Add that number to your end of period inventory (month, season, or year), and then divide by 2 (or 7, 13, etc).Also, there may be inventory losses in the period that are higher or lower than the long-term historical rate, which can also vary the result from whatever the actual ending inventory may turn out to be. Using the weighted average cost method, every unit is assigned the same cost, the weighted average cost per unit. To calculate the WAC per unit, we take the $21,400 total cost of all purchases and divide by the 1,000 total items . The WAC per unit is $21.40, so the COGS would be assigned a value of $14,980 (700 x $21.40) and ending inventory would be assigned $6,420 (300 x $21.40).

Counting Inventory

For these businesses, managing inventory cost can have a big impact on net income and cash flows. COGS – This amount is the cost related to the purchase or production of a product. This is known as direct cost and can include cost of raw materials, supplies for productions, packaging cost, etc.The next step is to assign one of the three valuation methods to the items in COGS and ending inventory. Let’s assume the 200 items in beginning inventory, as of 7/31, were all purchased previously for $20. Inventory market value may decrease if there is a large dip in consumer demand for the product. Similarly, obsolescence may occur if a newer version of the same product is released while there are still items of the current version in inventory. This type of situation would be most common in the ever-changing technology industry.The weighted average cost method assigns a cost to ending inventory and COGS based on the total cost of goods purchased or produced in a period divided by the total number of items purchased or produced. It “weights” the average because it takes into consideration the number of items purchased at each price point. Suppose it’s time to calculate the direct materials inventory for the previous quarter. You use the same formula for your calculations as you do for figuring the ending inventory of sales stock. Add the beginning materials inventory to the amounts purchased during the quarter.

How To Estimate Ending Inventory

Sarah recalls that calculating ending inventory is pretty straightforward but can be tricky if you are not careful. Ending inventory is an important component in the calculation of cost of goods sold. Chip Stapleton is a Series 7 and Series 66 license holder, CFA Level 1 exam holder, and currently holds a Life, Accident, and Health License in Indiana. He has 8 years experience in finance, from financial planning and wealth management to corporate finance and FP&A. You plan to manufacture 1,000 ornaments in the next quarter, which requires 200 pounds of glass. You started the current quarter with 300 pounds and expect to use 150 pounds.FIFO assumes that the cheaper units are sold first, and the more expensive units are sold later. This valuation method records more profit in the early periods, and less profit when the remainder of inventory is sold in later periods. The weighted average cost is the easiest method used for inventory costing. Another factor is the dollar value placed on each unit of ending inventory.It’s important to note that this method only works if you consistently mark up your products by the same percentage. You also need to have continued to use the same markup percentage in the current period. This method used the proportion of the retail price cost in prior periods for the formula’s foundation. The ending inventory refers to the final value of products held by a company at the end of a financial period such as the accounting year.Oil companies, supermarkets, and other businesses that experience frequent price fluctuations in their inventory costs tend to prefer the Last In, First Out method. The ending inventory formula is a valuable tool to help companies better understand the total value of products they still have for sale at the end of an accounting period. Understanding what your ending inventory is will help you not only sell more product, but also help you forecast marketing and sales for the upcoming month, quarter, or year.

Sales

There are a few methods for calculating ending inventory that will result in different values. The physical number of units on hand will not change, but their estimated value will change based on the method used. During an accounting period, Invest Media purchases 2,000 units at $10 in the first month and 1,000 units the next month at $20. The first set of units totaled $20,000 and the second set of units also totaled $20,000. This means the company has a total of 3,000 new units in this accounting period and has spent $40,000 on the acquisition of these items.This means that if the cost of purchasing or manufacturing your inventory increased since your oldest inventory was purchased, your COGS will be lower for the first items sold . The advantage weighted average cost provides over First In, First Out and Last In, Last Out is that it assigns the same value to each item you’ve purchased. This allows you to average out the costs over the period instead of relying on the oldest prices in the First In, First Out method or the latest prices in the Last In, First Out method. Beginning inventory is monetary values that a company assigns to their current inventory. This total will equal the ending inventory of the previous accounting period.This is especially important when determining the value of your business for obtaining financing or pitching to potential investors. There are a number of methods that can be used to calculate ending inventory, and each method will yield a different value, even if the amount of inventory stays the same.