Content

- How To Calculate Gross Income For A Salaried Employee

- Business Checking Accounts

- Wage Garnishments

- Gross Earnings For Hourly Workers

- What Is The Meaning Of A Salaried Employee?

- Details On Paying Overtime In Gross Pay

- How To Calculate Annual Earnings From Hourly Wages

If the employee worked overtime, make sure to include the overtime hours in the gross pay. Whether it’s an hourly rate or annual rate, the computation depends on the amount that is agreed upon by both the employer and employee. The amount, also called the pay rate, must be agreed upon in writing before the start of employment. Pay stubs are used to verify payment accuracy and may be necessary when settling wage/hour disputes. For this reason, employees may want to save their pay stubs, but aren’t required to do so. Employers, however, must keep payroll records for the specific lengths of time mandated by federal and state governments.

- If employees are interested in viewing their gross pay for the year, they can find their gross wage as well as any deductions on their pay stub.

- To find his gross pay, Victor multiplies his regular hours worked by his hourly salary ($15) to find his regular pay.

- Typical voluntary deductions include amounts taken to pay for small business health insurance, to fund a retirement account, and to pay union dues.

- Gross pay serves as the foundation for an employee’s payroll calculations.

- Salary can be supplemented, but it is essentially a minimum that the employee will make over the set time period.

Gusto takes the stress out of payroll with its bright, intuitive design. Designed with small businesses in mind, Gusto is an excellent payroll software for anyone getting started. QuickBooks Online Payroll is perfect for businesses already living in the Intuit QuickBooks ecosystem. This full-service payroll software has three plans to scale with you as your business grows. As you can see, the concepts of net pay and gross pay are foundational to understanding how to do payroll.

How To Calculate Gross Income For A Salaried Employee

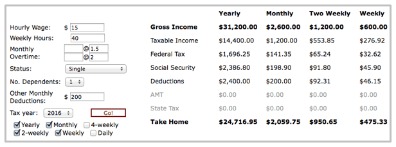

Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much you’ll take home. While the annual salary represents a “floor” for an employee’s wages, gross pay can exceed that level. But while every employee who is paid earns gross pay, not every employee earns a salary. To calculate gross income, multiply the employee’s gross pay by the number of pay periods .The majority of an employee’s gross wages typically consists of their base pay like their salary, hourly pay, or tips (for tip-based workers). When you start a new job or get a raise, you’ll agree to either an hourly wage or an annual salary.

Business Checking Accounts

This amount is split between the employer and employee to 7.65 percent each. For an employee, this percentage is then defined further into a Social Security tax (6.2 percent) and a Medicare tax (1.45 percent). Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks.

How do I calculate my gross salary?

To calculate an employee’s gross pay, start by identifying the amount owed each pay period. Hourly employees multiply the total hours worked by the hourly rate plus overtime and premiums dispersed. Salary employees divide the annual salary by the number of pay periods each year. This number is the gross pay.Any income after 142,800 is not subject to Social Security Tax. The course of action depends on the reason for the missed or late paycheck. Honest mistakes can usually be addressed by contacting the employer’s HR department. Today’s digital landscape means limitless possibilities, and also complex security risks and threats. At ADP, security is integral to our products, our business processes and our infrastructure. At ADP, we are committed to unlocking potential — not only in our clients and their businesses, but in our people, our communities and society as a whole.

Wage Garnishments

For instance, if someone is paid $900 per week and works every week in a year, the gross income would be $46,800 per year. Understanding what gross wages mean is important because taxes and deductions are based on a percentage of the employee’s gross wages. Gross pay is the amount of compensation a company or organization pays an employee before any required or voluntary deductions take effect, per payment period.

Gross Earnings For Hourly Workers

For hourly employees, you can calculate gross wages by multiplying the hourly wage by the number of hours worked in the period. The majority of an employee’s gross wages typically consists of their base pay such as their salary, hourly pay, or tips (for tip-based workers). In this scenario, the employee’s gross pay would be $445 for the week. For a salaried employee with an annual salary of $50,000 who gets paid biweekly, divide $50,000 by 24 to get $2,083.33—the gross pay for each pay period. Gross income includes gross pay, but potentially includes more money that an individual takes in.Check out these alternative options for popular software solutions. If you’re applying for a home or car loan, or if you’re trying to develop a budget, it’s important — and necessary — to know how much is coming in the door every month.

What Is The Meaning Of A Salaried Employee?

Imagine a young employee collecting the first paycheck of their career. They may have questions why they received less than what they are supposed to be paid. One way to think about net income is to see it as the “spendable” cash that actually flows through to your checking or savings account every month. Net income is also useful in developing a monthly budget since your regular after-tax expenses, both fixed and discretionary, will come from your net income. There are states, however, that have more unique overtime calculations. Make sure to understand how all the states where your hourly workers are employed calculate overtime.

How To Calculate Gross Income Per Month

Taxes are often a percentage of the employee’s gross wages minus pre-tax deductions, but in some cases, you will withhold a fixed amount. You need to know your employees’ gross wages so you can calculate taxes and other deductions. Once you determine the number of pay periods, divide the employee’s salary by the number of payroll periods to obtain the gross pay amount for each paycheck. If you’re paid an annual salary, the calculation is fairly easy. Again, gross income refers to the total amount you earn before taxes and other deductions, which is how an annual salary is typically expressed.This is important because it affects the taxable income for employees, as shown in employee gross pay on the W-2 forms for each year. Other pay and benefits an employee receives, like tips and car expense reimbursements, may be taxable to the employee. These are entered in different places on the employee’s annual W-2 form and they are not included in gross pay. Use SmartAsset’s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes.

Details On Paying Overtime In Gross Pay

Gross pay is the total amount of money an employee receives before any taxes or deductions—such as retirement account contributions—are taken out of their paycheck. All other calculations for employee pay, overtime, withholding, and deductions are based on gross pay.See how we help organizations like yours with a wider range of payroll and HR options than any other provider. Indeed is not a career or legal advisor and does not guarantee job interviews or offers.For example, if an employer pays a salary of $52,000 per year to an employee, that $52,000 amount is referred to as the employee’s gross pay. Hourly employees must receive overtime pay for any hours over 40 for the week. Businesses that offer health insurance, dental insurance, retirement savings plansand other benefits often share the cost with their employees and withhold it from their pay. Depending on the type of benefit and the regulations that apply to it, the deduction may be pretax or post-tax. Pretax is more advantageous to employees because it lowers the individual’s taxable income. A paycheck is how businesses compensate employees for their work.Unlike withholding certificates and other employment documents, paychecks are pretty easy to decipher. Reading them is simply a matter of making sure the payment information is correct.