Content

- The Overall Success Of Your Business

- Examples Of Profit Margin Formula With Excel Template

- Calculating Profit Margin As A Percentage

- Operating Profit Margin

- Gross Profit Margin Vs Net Profit Margin: Whats The Difference?

- Net Profit Margin

So if your profit margin is less than 10%, that means that you’re converting less than $0.10 for every dollar of revenue you’ve earned, leaving you vulnerable to market changes or an unplanned drop in sales. Gross margin shows the revenue a company has left over after paying all the direct expenses of manufacturing a product or providing a service. For example,retailstores want to have a 50% gross margin to cover costs of distribution plus return on investment. Each entity involved in the process of getting a product to the shelves doubles the price, leading retailers to the 50% gross margin to cover expenses. Profit margins can be tricky—both determining them and understanding what’s right for your business. Do your research for your industry and make sure to track those numbers down to every last expenditure and revenue source.AmortizationAmortization of Intangible Assets refers to the method by which the cost of the company’s various intangible assets is expensed over a specific time period. DepreciationDepreciation is a method of accounting for the costs of any physical or tangible asset over the course of its useful life. Below is what appears on Mrs. ABC’s profit and loss statement at the end of the financial year. Financial leverage refers to the amount of borrowed money used to purchase an asset with the expectation that the income from the new asset will exceed the cost of borrowing. It is recommended to compare only companies in the same sector with similar business models. Kussum rolls a small restaurant operating in Mumbai city is struggling to lure customers for its delicious dishes as there is stiff competition.

The Overall Success Of Your Business

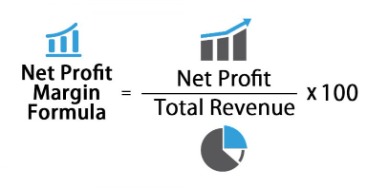

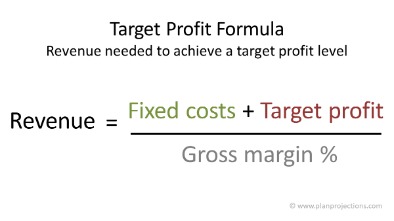

To calculate your profit margin, you first need to calculate your net income and net sales. Once you’ve identified your net income and net sales, you can use the profit margin formula. In this guide, we’ll define what profit margin is, as well as explain how to use the profit margin formula to calculate this number for your business. All Non-operating ExpensesNon operating expenses are those payments which have no relation with the principal business activities. These are the non-recurring items that appear in the company’s income statement, along with the regular business expenses. Net income is derived by deducting total expenses from the total revenues minus, and it is usually the last number that is reported in the income statement. Net Profit MarginNet profit margin is the percentage of net income a company derives from its net sales.A company in the food industry may show a lower profit margin ratio, but higher revenue. When analyzing a company a good analyst will look at a wide range of ratios, financial metrics, and other measures of performance. Below is a list of commonly used performance metrics that analysts often consider in order to compile a complete and thorough analysis of a business.Net profit factors in more deductions from revenue than either gross or operating profit. To sum up, it equals total revenue minus the cost of goods sold, operating expenses, interest, taxes, preferred stock, and debt repayments. This ratio compares the gross profit earned by the company to the total revenue, which reflects the percentage of revenue retained as the profit after the company pays for the cost of production.Profit margin comparisons between Microsoft and Alphabet, and between Walmart and Target is more appropriate. A closer look at the formula indicates that profit margin is derived from two numbers—sales and expenses. To maximize the profit margin, which is calculated as , one would look to minimize the result achieved from the division of (Expenses/Net Sales). Profit margins are used by creditors, investors, and businesses themselves as indicators of a company’s financial health, management’s skill, and growth potential. Gross profit margin indicates the profitability of a business and is a measure of a business’s financial health.

- Check out FreshBooks, The Blueprint’s pick for “Easiest to Use” accounting software.

- However, it’s just as important to understand what those results really mean.

- Beginner’s Guides Our comprehensive guides serve as an introduction to basic concepts that you can incorporate into your larger business strategy.

- Profit margin conveys the relative profitability of a firm or business activity by accounting for the costs involved in producing and selling goods.

- No profit margin alone can provide a complete picture of the financial health of your business.

- The gross profit margin formula is derived by deducting the cost of goods sold from the total revenue.

Good gross profit margins business investors can run different models with their margins to compare how profitable the company would be at different levels of sales. Overly high operating costs can impact your operating profit margin. Therefore, your operating profit is your total revenue minus your business expenses. Gross profit margin is an indicator of profits relative to production costs. Gross profit represents your total revenue minus the cost of goods sold. As a result, this figure covers the cost of producing merchandise and can range from materials to labor.

Examples Of Profit Margin Formula With Excel Template

A low profit margin ratio suggests that a business is spending a relatively large amount of money for a small return, whilst a high profit margin shows that a relatively low spend yields a strong profit. The measurement can be a strong indicator of company efficiency, allowing managers to set performance targets, see when budget cuts should be made, or reassure investors that the business is thriving. Creditors, investors, and other stakeholders use these ratios to measure how effectively a company is able to convert its sales into income. So all the stakeholders want to know that the company is working efficiently.

Calculating Profit Margin As A Percentage

All the additional income generated from operations, which are not the primary operations like a receipt from the sale of assets, is added. Mrs. ABC is currently achieving a 65 percent gross profit on her furniture business. This means that for every dollar of sales Mrs. ABC generates, she earns 65 cents in gross profits before other business expenses are paid. The gross profit formula is calculated by subtracting the total cost of goods sold from the total sales of the company. While this is common practice, the net profit margin ratio can greatly differ between companies in different industries. For example, companies in the automotive industry may report a high profit margin ratio but lower revenue as compared to a company in the food industry.Residual IncomeResidual income refers to the net earnings an organization possess after paying off the cost of capital. It is acquired by deducting the equity charges from the company’s net profit or income.

Operating Profit Margin

It also becomes important while taking out a loan against a business as collateral. The number has become an integral part of equity valuations in theprimary market forinitial public offerings . Businesses and individuals across the globe perform for-profit economic activities with an aim to generate profits. However, absolute numbers—like $X million worth of gross sales, $Y thousand business expenses, or $Z earnings—fail to provide a clear and realistic picture of a business’ profitability and performance. For the accounting year ending on December 31, 2019, Company X Ltd has a revenue of $ 2,000,000. The gross profit and the operating profit of the company are $ 1,200,000 and $ 400,000, respectively. Investors also use gross profit margins to measure the scalability of the business.

Gross Profit Margin Vs Net Profit Margin: Whats The Difference?

CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle. Construction Management This guide will help you find some of the best construction software platforms out there, and provide everything you need to know about which solutions are best suited for your business.A profit margin of 10% therefore demonstrates that a company receiving one dollar of sales has generated a profit of 10 cents, the remaining 90 cents of the dollar falling under costs rather than profit. As you can see, the ratio of profit to revenue can vary depending on the type of profit chosen for the profit margin calculation.

Interpretation Of Profit Margin

Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. Total expenses came to $900,000, allowing for web hosting, call centre staff, software engineers, and possibly even a few taxes. Our priority at The Blueprint is helping businesses find the best solutions to improve their bottom lines and make owners smarter, happier, and richer.Than another, then the firm with more debt financing may have a smaller net profit margin due to the higher interest expenses. This negatively affects net profit, lowering the net profit margin for the company. The EBITDA margin measures a company’s profit as a percentage of revenue. The greater the profit margin, the better, but a high gross margin along with a small net margin may indicate something that needs further investigation. Margins can be computed from gross profit, operating profit, or net profit. Gross margin is equal to $500k of gross profit divided by $700k of revenue, which equals 71.4%. As you can see in the above example, the difference between gross vs net is quite large.For instance, while earning $1 million in revenue is great, if your cost of goods sold is $1.1 million, you’re losing money. Likewise, if after expenses, you end up with a profit margin of 1%, any market changes, decrease in sales, or economic downturn can severely affect your business. Operation-intensive businesses like transportation which may have to deal with fluctuating fuel prices, drivers’ perks and retention, and vehicle maintenance usually have lower profit margins. Finally, profit margins are a significant consideration for investors. Investors looking at funding a particular startup may like to assess the profit margin of the potential product/service being developed.

Net Profit Margin

In other words, for every dollar of revenue the business brings in, it keeps $0.23 after accounting for all expenses. Cost of goods sold is defined as the direct costs attributable to the production of the goods sold in a company. It indicates that over the quarter, the business managed to generate profits worth 20 cents for every dollar worth of sales. Let’s consider this example as the base case for future comparisons that follow. A good profit margin very much depends on your industry and expansion goals and a host of other factors, like the economy. To calculate ABC Ecommerce’s gross profit, you’ll need to know revenue and COGS. Learn financial modeling and valuation in Excel the easy way, with step-by-step training.

Profit Margin Template

In other words, profit margin tells you how much you make on the sale of each product or service. Profit margin goes to the heart of whether your business is doing well.