Content

- Depreciation Methods

- Disadvantage Of Straight Line Depreciation

- Final Thoughts On Straight Line Depreciation

- Depreciation Expense: Straight

- Why Should Your Small Business Calculate Straight Line Depreciation?

- To Deduct Certain Expenses On Your Financial Statements

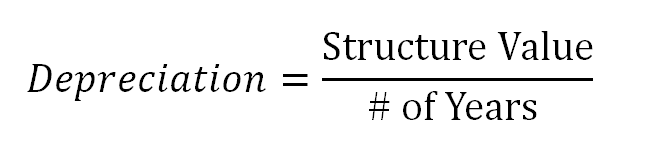

- How To Calculate Straight Line Depreciation Formula

When crunching numbers in the office, you can record your vessel depreciating $21,000 per year over a 10-year period using the straight-line method. To get a better understanding of how to calculate straight-line depreciation, let’s look at a few examples below. QuickBooks Online is the browser-based version of the popular desktop accounting application. It has extensive reporting functions, multi-user plans and an intuitive interface. Product Reviews Unbiased, expert reviews on the best software and banking products for your business.This deduction is fully phased out for businesses acquiring over $2,000,000 of such property during the year. In addition, additional first year depreciation of 50% of the cost of most other depreciable tangible personal property is allowed as a deduction. The carrying value would be $200 on the balance sheet at the end of three years. The depreciation expense would be completed under the straight line depreciation method, and management would retire the asset.Unlike more complex methodologies, such asdouble declining balance, straight line is simple and uses just three different variables to calculate the amount of depreciation each accounting period. To calculate straight line basis, take the purchase price of an asset and then subtract the salvage value, its estimated sell-on value when it is no longer expected to be needed. Then divide the resulting figure by the total number of years the asset is expected to be useful, referred to as the useful life in accounting jargon.

Depreciation Methods

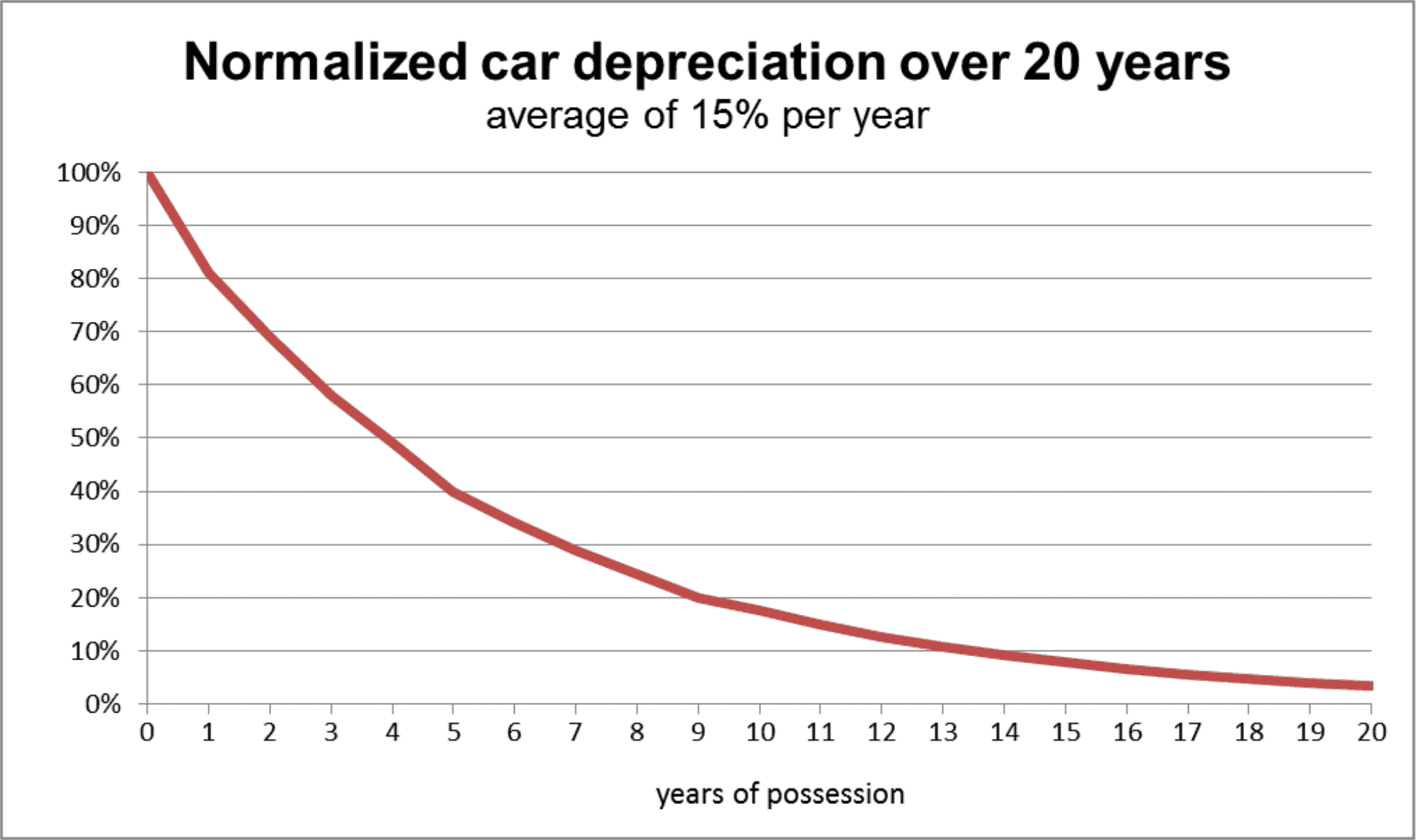

This method is useful for assets that depreciate quickly after purchase, like computers, which lose their value very quickly, even though they might operate well for a long time. For the first year, the double declining balance method takes the depreciation rate from the straight-line method and doubles it. For subsequent years, this method uses the same doubled rate on the remaining balance, instead of being based on the original purchase value.Whether you’re creating a balance sheet to see how your business stands or an income statement to see whether it’s turning a profit, you need to calculate depreciation. Costs of assets consumed in producing goods are treated as cost of goods sold. Other costs of assets consumed in providing services or conducting business are an expense reducing income in the period of consumption under the matching principle.Whereas the depreciable base is the purchase price minus the salvage value. Depreciation continues until the asset value declines to its salvage value. Regardless of the depreciation method used, the total depreciation expense recognized over the life of any asset will be equal. However, the rate at which the depreciation is recognized over the life of the asset is dictated by the depreciation method chosen.

Disadvantage Of Straight Line Depreciation

The best time to use the straight-line depreciation method is when you don’t expect an asset to have a specific pattern of use over time. Straight-line depreciation is often the easiest and most straightforward way of calculating depreciation, which means it’ll result in fewer errors.

- One half of a full period’s depreciation is allowed in the acquisition period .

- Take the purchase price or acquisition cost of an asset, then subtract the salvage value at the time it’s either retired, sold, or otherwise disposed of.

- The IRS allows businesses to use the straight-line method to write off certain business expenses under the Modified Accelerated Cost Recovery System .

- Recording depreciation affects both your income statement and your balance sheet.

We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. Check out our guide to Form 4562 for more information on calculating depreciation and amortization for tax purposes. The straight-line method of depreciation assumes a constant rate of depreciation. It calculates how much a specific asset depreciates in one year, and then depreciates the asset by that amount every year after that.

Final Thoughts On Straight Line Depreciation

Depreciation is technically a method of allocation, not valuation, even though it determines the value placed on the asset in the balance sheet. Take the purchase price or acquisition cost of an asset, then subtract the salvage value at the time it’s either retired, sold, or otherwise disposed of. Now divide this figure by the total product years the asset can reasonably be expected to benefit your company. The straight-line depreciation method is the easiest way of calculating depreciation and is used by accountants to compute the depreciation of long-term assets. However, this depreciation method isn’t always the most accurate, especially if an asset doesn’t have a set pattern of use over time. This means items like computers and tablets often depreciate much quicker in their early useful life while tapering off later on in their useful life.

Depreciation Expense: Straight

These are faster than what management decides to employ on the reported financial statements put together under the Generally Accepted Accounting Principles rules. Management is likely going to take advantage of this because it can increase intrinsic value. Sally recently furnished her new office, purchasing desks, lamps, and tables.

Why Should Your Small Business Calculate Straight Line Depreciation?

Some systems specify lives based on classes of property defined by the tax authority. Canada Revenue Agency specifies numerous classes based on the type of property and how it is used. Under the United States depreciation system, the Internal Revenue Service publishes a detailed guide which includes a table of asset lives and the applicable conventions. The table also incorporates specified lives for certain commonly used assets (e.g., office furniture, computers, automobiles) which override the business use lives.It means that the asset will be depreciated faster than with the straight line method. The double-declining balance method results in higher depreciation expenses in the beginning of an asset’s life and lower depreciation expenses later. This method is used with assets that quickly lose value early in their useful life. A company may also choose to go with this method if it offers them tax or cash flow advantages.

When should I use straight line depreciation?

Straight line depreciation is the default method used to recognize the carrying amount of a fixed asset evenly over its useful life. It is employed when there is no particular pattern to the manner in which an asset is to be utilized over time.When a long-term asset is purchased, it should be capitalized instead of being expensed in the accounting period it is purchased in. An allocation of costs may be required where multiple assets are acquired in a single transaction. Purchase price allocation may be required where assets are acquired as part of a business acquisition or combination. Common sense requires depreciation expense to be equal to total depreciation per year, without first dividing and then multiplying total depreciation per year by the same number. If the vehicle were to be sold and the sales price exceeded the depreciated value then the excess would be considered a gain and subject to depreciation recapture. In addition, this gain above the depreciated value would be recognized as ordinary income by the tax office.Most income tax systems allow a tax deduction for recovery of the cost of assets used in a business or for the production of income. Where the assets are consumed currently, the cost may be deducted currently as an expense or treated as part of cost of goods sold.Using the facts and circumstances presented, we can use LeaseQuery’s present value calculator to calculate the present value of the lease payments. This is the value we will record for the ROU asset and what will be depreciated. In order to do so, input annual payments of $100,000, a 10 year lease term, and a 4% discount rate. At commencement, the lessee records a lease asset and lease liability of $843,533.

How To Calculate Straight Line Depreciation Formula

Daniel is an expert in corporate finance and equity investing as well as podcast and video production. Note how the book value of the machine at the end of year 5 is the same as the salvage value. Over the useful life of an asset, the value of an asset should depreciate to its salvage value. Under most systems, a business or income-producing activity may be conducted by individuals or companies. Buildings and leasehold improvements are depreciated over 7 to 40 years. There are generally accepted depreciation estimates for most major asset types that provide some constraint. In the meantime, special adjustments must be made to the reported financial found in the annual report and10-K filing.

Calculating Straight Line Basis

For example, the balance sheet would show a $5,000 computer offset by a $1,600 accumulated depreciation contra account after the first year, so the net carrying value would be $3,400. Manufacturing businesses typically use the units of production method.