Content

- Start Your Business

- What Is Shareholders’ Equity In The Accounting Equation?

- Total Assets Formula

- Decoding Dupont Analysis

- Example: Dave’s Total Assets

- Current Assets

- How To Use Roa To Judge A Company’s Financial Performance

“Long-term liabilities” generally refers to long-term debt the company has issued , but can include other non-immediate expenses such as pension obligations. The current ratio is a liquidity ratio that measures a company’s ability to cover its short-term obligations with its current assets. If a business buys raw materials and pays in cash, it will result in an increase in the company’s inventory while reducing cash capital . Because there are two or more accounts affected by every transaction carried out by a company, the accounting system is referred to as double-entry accounting. The value of all of a company’s assets are added together to find total assets.

Start Your Business

Sometimes, leasing assets may be cheaper than buying them outright – calculating the total assets you’re carrying can help you to figure out your tolerance for buying versus leasing. The meaning of total assets is all the assets, or items of value, a small business owns.

- As an example, if a company spends $10,000 in cash on a new vehicle, their cash is reduced by $10,000 but they gain an asset worth the same amount.

- To determine total assets, you subtract the value of liabilities from the value of assets.

- As things of value, assets get recorded on the company’s balance sheet.

- To determine the value of a company’s assets, the average value of the assets for the year needs to first be calculated.

- This can give valuable clues about a company’s health and prospects.

- We also reference original research from other reputable publishers where appropriate.

Liquidity refers to how quickly you can turn an asset into cash. Cash always appears at the top of the list of current assets, closely followed by accounts receivables, inventory and short-term investments.

What Is Shareholders’ Equity In The Accounting Equation?

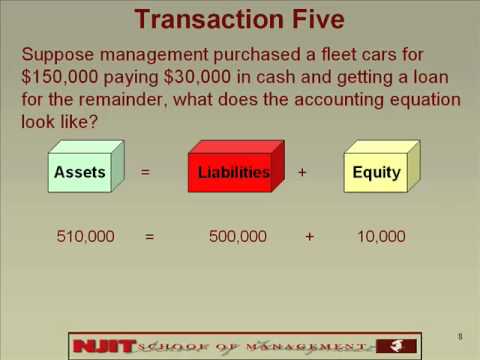

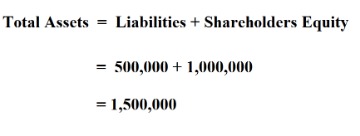

The expanded accounting equation is derived from the accounting equation and illustrates the different components of stockholder equity in a company. Shareholders’ equity is the total value of the company expressed in dollars. Put another way, it is the amount that would remain if the company liquidated all of its assets and paid off all of its debts. The remainder is the shareholders’ equity, which would be returned to them. These may include loans, accounts payable, mortgages, deferred revenues, bond issues, warranties, and accrued expenses. In other words, the total amount of all assets will always equal the sum of liabilities and shareholders’ equity. Examples would be short-term investments , inventory, and cash and cash equivalents.

Total Assets Formula

Liquidity is a term used to refer to how quickly an asset can be turned into cash. Cash is located at the very top of the balance sheet under the current assets classification.

What is net total and grand total?

July 27, 2021. Gross sales are the grand total of all sale transactions reported in a period, without any deductions included within the figure. Net sales are defined as gross sales minus the following three deductions: Sales allowances. A reduction in the price paid by a customer, due to minor product defects.Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.Investors use the asset turnover ratio to compare similar companies in the same sector or group. This metric helps investors understand how effectively companies are using their assets to generate sales. Double entry is an accounting term stating that every financial transaction has equal and opposite effects in at least two different accounts. The accounting equation is a concise expression of the complex, expanded, and multi-item display of a balance sheet. Total assets will equal the sum of liabilities and total equity. The accounting equation is also called the basic accounting equation or the balance sheet equation. Assets are recorded on a company’s balance sheet along with liabilities and equity.

Decoding Dupont Analysis

These things are what make up a company’s finances and a successful company should have assets that override the sum of liabilities. Looking at the total assets in isolation doesn’t tell you very much, and it’s much more useful to track the change in total assets over time. This can give valuable clues about a company’s health and prospects. To calculate the year-on-year change in total assets, simply subtract last year’s total assets from this year’s total assets.

Example: Dave’s Total Assets

For example, a small business has a debt to asset ratio of 45 percent. This means that 45 percent of every dollar of its assets is financed by borrowed money. A higher percentage means more of your assets are financed through debt, which could be problematic. The company is at higher risk of bankruptcy or insolvency , according to The Balance. Start by listing the value of any current assets like cash, money owed to you and inventory. Once you have all the values, you can use the common size percent for cash formula to obtain the amount of cash a company has relative to all its assets. Generally, cash appears as the first line in a balance sheet for a reason.

What is total net assets liabilities?

Net assets is defined as the total assets of an entity, minus its total liabilities. The amount of net assets exactly matches the stockholders’ equity of a business. In a nonprofit entity, net assets are subdivided into unrestricted and restricted net assets.Learn more about how you can improve payment processing at your business today. Company C would have the lowest risk and lowest expected return . In Law and Business Administration from the University of Birmingham and an LL.M. She practiced in various “Big Law” firms before launching a career as a business writer.

How Can A Company Improve Its Asset Turnover Ratio?

If you apply for new credit, owning cash accounts, inventory and substantial equipment show an ability to pay debt, even when your profit is modest. The accounting equation shows on a company’s balance that a company’s total assets are equal to the sum of the company’s liabilities and shareholders’ equity. Total assets from a company are typically presented on a balance sheet, where the total assets must be equal to the sum of total liabilities and stockholders’ equity combined. A liability represents an obligation, whether financial or a service, that an individual or organization owes to someone else. Taking liabilities into account makes for the most accurate calculation of total assets. To determine total assets, you subtract the value of liabilities from the value of assets. Total assets are the complete accounting of all that a person or business owns and its combined value.One variation on this metric considers only a company’s fixed assets instead of total assets. Total asset turnover ratio is a great way to measure your company’s ability to use assets to generate sales. Check out our asset turnover definition and learn how to calculate total asset turnover ratio, right here. Within these two categories, it’s conventional to list assets in order of liquidity.

Current Assets

Getting sound financial advice from the professionals is like an asset, too! Learn from a financial advisor in Baltimore, MD or if you live outside the area, do check out our financial advisor page.The liabilities and shareholders’ equity show how the assets of a company are financed. The most liquid asset is cash itself, while non-liquid assets include things such as real estate, machinery, or land, because they cannot be converted quickly to cash. Dave owns a small business that is valued at $1,000,000 including inventory, which he started with a business loan of $100,000. He runs the company from his apartment, which he rents for $2,000 per month. The rent includes all utilities except electricity, which costs $1,080 per year. Dave has a savings account that contains $16,000, and he also has $3,000 in stocks.To find average assets, find the average for the period of time you’re looking at, whether a year, quarter or month. You can do this manually by filling out the liabilities and equity in your balance sheet. Prepaid expenses reported as a current asset, represents the amount of prepaid expense which will be used up within one financial year.The two major types of assets are long-term and short-term assets. Before accounting for depreciation, the total value of their assets remains the same. When a company spends cash on an asset, the value of the “assets”section of the balance sheet remains the same.