Content

- The Standard Operating Procedure For The Collection Of Debt From Non

- Interest Calculation For Lines Of Credit

- Avoiding Interest On Balance Transfers

- Major Credit Cards

- Different Types Of Credit Card Interest

- How Your Credit Card Balance Affects Your Credit Scores

Intuit accepts no responsibility for the accuracy, legality, or content on these sites. Credit Card Insider receives compensation from advertisers whose products may be mentioned on this page. Advertising partners do not edit or endorse our editorial content.This way the management of both the vendor and client companies know the expectations, and there are no surprises later. Finally, there are more unconventional methods you can use to recoup the unpaid invoice. You’ll receive around 80-90% of the invoice value up front, and then the rest (minus the factoring company’s fee) after the remaining amount has been collected. To set up automatic late fees in QuickBooks Online, log in as Company Administrator or Master Administrator. Under Settings, select Account and Settings, then choose Sales. Want to make sure your business is protected from delinquent accounts? Here’s our step-by-step guide for creating a late payment policy for your business.

Can you charge interest on an overdue account?

Ideally, there should be an interest clause that provides for the charging of interest on overdue amounts. From the time that the amount becomes overdue (ie. … day 31 if the terms are payment within 30 days) then interest can be charged at the agreed rate. For the most part, this rate cannot exceed 2% per month.A typical late fee is either a flat rate or one that is calculated as a percentage of the total owing. Yes, there is nothing stopping a vendor from charging interest on overdue invoices. However, the real question is whether the clients are obligated to pay it. If you don’t hear back, place a call to the accounting team asking for an update.

The Standard Operating Procedure For The Collection Of Debt From Non

Having all of these concerns out of the way will help to avoid billing problems later on. However, late or returned payments usually end the 0% introductory period, making it critical to always pay on time. Some credit cards offer a 0% introductory APR for balance transfers. A balance transfer can reduce the cost of credit card debt when you manage the process well. Whether you add interest automatically with software or with a handwritten invoice, using the proper calculation is necessary on each of the invoices you send. You can charge the customer for daily interest accrued or on a monthly basis. Calculations are fairly simple for these types of interest charges.Here is how credit card interest works—and how you can pay less of it. An average outstanding balance is the unpaid, interest-bearing balance of a loan or loan portfolio averaged over a period of time, usually one month. Try waving a carrot instead of a stick by offering a discount for either full payment upfront or within 30 days. Sometimes incentives to pay early or on time can be more effective than threats of fees and interest charges. Allow a day or so and then one of two things will probably happen. The other possibility is that the client will notify you that somehow the invoice got lost. The client either didn’t receive it, didn’t open it, didn’t forward it for approval – or somehow when it was sent to accounting it was not processed.This means the borrower doesn’t promise the lender any collateral to back the LOC. One notable exception is a home equity line of credit , which is secured by the equity in the borrower’s home. From the lender’s perspective, secured lines of credit are attractive because they provide a way to recoup the advanced funds in the event of non-payment. Check for pre-approval offers before you apply for a credit card—with no risk to your credit score. This is a predetermined percentage of the total of an invoice, added every month that the invoice remains unpaid.

Interest Calculation For Lines Of Credit

Work with the customer directly to settle concerns about outstanding interest payments. When you issue invoices, the due date and interest rates must be clearly displayed. Payment terms such as net 10 or net 30 mean that you require payment within 10 or 30 days of the invoice date, respectively.

Avoiding Interest On Balance Transfers

Interest is also typically charged on transactions like cash advances and balance transfers. And a penalty APR might apply if you make late credit card payments or miss payments altogether.

- If it is accounted for in the original deal, then you should charge a late payment fee if your payment terms have not been met.

- It should also lay out the payment terms and the number of days the customer has to make the payment.

- This way the management of both the vendor and client companies know the expectations, and there are no surprises later.

- If you have the money to pay it off right away, though, you probably don’t need the cash advance in the first place.

- To avoid losing out on money you’re owed, track your invoices and follow up on late ones.

- We can also be reached via email at for non-urgent matters.

This means you won’t be able to avoid paying some amount of interest on a cash advance unless you pay it off the same day. If you have the money to pay it off right away, though, you probably don’t need the cash advance in the first place. A charge card is a type of electronic payment card that charges no interest but requires that the statement balance be paid in full. Some cards have multiple interest rates, such as one for purchases and another for cash advances. Most lines of credit, even home-equity lines of credit, use a simple interest method as opposed to compounding interest. Some lines of credit also demand loans that are structured to allow the lender to call the total amount due at any time for immediate repayment. The average daily balance used is often arrived at using 1/365th or 1/360th multiplied by the days in the billing period.

Major Credit Cards

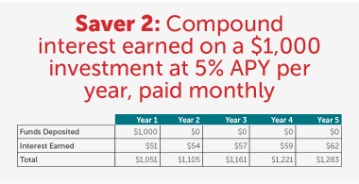

The most common payment terms are “payable upon receipt”, “net 30 days”, “net 60 days” and “net 90 days”. Calculate the interest amount by dividing the number of days past due by 365, and then multiply the result by the interest rate and the amount of the invoice. For example, if the payment on a $1,500 invoice is 20 days late with a 6-percent interest rate, first divide 20 by 365.

Different Types Of Credit Card Interest

You can send an email invoice directly after the transaction occurs and a follow-up email if the bill goes unpaid after a certain period. A payment reminder should nudge the customer politely to call attention to the upcoming invoice obligation. Make sure your invoice reminder includes accurate contact information for your company’s billing department.

What does FICO stand for?

A FICO score is a credit score created by the Fair Isaac Corporation (FICO). 1Lenders use borrowers’ FICO scores along with other details on borrowers’ credit reports to assess credit risk and determine whether to extend credit.The Best Business Loan and Financing Options of 2021 Many small businesses need funding to get started…. The Best Tax Debt Relief Services of 2021 Looking for the best tax debt relief service? Every week, five times a week, she delivers pastries to Ian’s Investors, an investment firm about five minutes from her store.Now the question is, when should Pat start chasing her money? She’s very busy, but her enterprise is not huge, and the $800.00 owed matters to her. The $2.13 daily charge, even if collected, won’t make a difference to her business. We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals.

What Is A Reasonable Late Payment Fee?

Each month you carry a balance over from the previous month, you’ll have a finance charge added to your balance. A credit card may offer an introductory or promotional APR on purchases and balance transfers. After the introductory or promotional period ends, the rate will return to the standard APR disclosed in the card’s terms. The interest rate, or APR, can either be variable or non-variable. A variable APR is often based on the prime rate—an index that most lenders use to set their own interest rates. And a variable APR could change when the prime rate changes. A non-variable APR typically stays the same, but it can change under certain circumstances.