Content

- Basic Features & Functionality

- Choose How To Pay Your Employees

- Best For Quickbooks Online Users

- By Verge Systems

- Users Complain The Customer Support Is Unresponsive

- What Is A Payroll System And How Does It Work?

- Paycor

In the years ahead, expect to see payroll systems become more adaptable to the growing diversity of work roles and payment structures. Nine-to-five salaried employees are increasingly going to be joined by a variety of wage earners and gig workers, many of whom will work remotely. Look for providers that either offer direct support everywhere you need or have partnerships to support those regions.Advanced features include job costing, highly customizable reports, and global payroll. Zenefits, too, would be a good choice for even an inexperienced payroll or HR manager who must stay current with the myriad compliance issues that exist in today’s workplace. Both Rippling and Zenefits have won Editors’ Choice awards in other categories. These are excellent services, but if you just want to get the payroll out, they may be more than you need. Designed to meet the needs of small and medium-sized businesses, APS Payroll is a cloud-based solution for managing human resources. Additionally, each organization has access to a dedicated support team and account lead that can assist with tech support and field general assistance inquiries.

- Gusto will appeal to both new and experienced payroll administrators because of its usability and top-notch payroll setup, processing, and reporting tools.

- Integrating with the well-known POS solution from the same company offers features that assist with processing pay, filing taxes, employee self-service and more.

- In our research, we found over 200 different payroll software vendors, ranging from fresh new startups on the scene to familiar old faces like Kronos and Quickbooks.

- But they can still create problems if companies don’t keep up with the latest rules.

- It automatically calculates the correct amount your employees should be paid each pay period based on the number of hours they’ve worked.

- Contractors can be entered into the system as employees and vice versa.

- As an employer, it’s your job to ensure your workers are compensated correctly and on time.

It helps organizations adapt to new types of work and stay up to date with changes in technology. Read case studies from real clients to see the difference of tailored HR software matching. We’re here to match you up with the best possible HR software for your unique business. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page.

Basic Features & Functionality

Make sure the software can be configured easily, without the need for coding or IT involvement. The software you choose should integrate natively with your time and labor, compensation, financial management, absence management, and other business systems. The best payroll systems provide a simple, consistent experience across platforms. When an employee looks at the dashboard on their phone, for example, it looks the same as it does on their desktop, with intuitive interactions that reduce the need for help desk calls.We believe everyone should be able to make financial decisions with confidence. Capterra is free for users because vendors pay us when they receive web traffic and sales opportunities. Capterra directories list all vendors—not just those that pay us—so that you can make the best-informed purchase decision possible.AI and business intelligence will be used to enhance automation and streamline workflows. The best time to switch is usually at the end of a quarter or the beginning of the year, but this is not a requirement set in stone. Before switching, talk to your new payroll provider – or prospective service – and ask for advice. If you already work with an online payroll provider and want to switch to a new service, it’s possible to do so with minimal headaches. Much like setting up your software, learning how to use the system depends on the company you’re partnering with.

Choose How To Pay Your Employees

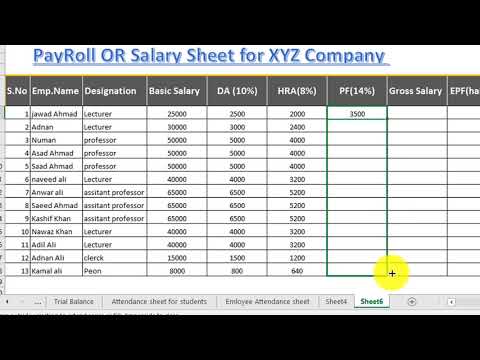

Lastly, it provides transparency and accountability, increasing trust between all parties involved. Mitigate errors in the payroll process and reduce the hours spent calculating hours, wages and tax withholdings via a cloud service. Running payroll refers to the process of compensating employees for their work. Every pay period, an employer must calculate and distribute employees’ wages.

Best For Quickbooks Online Users

While some claim it has a user-friendly and intuitive interface, others complain that the user experience is clunky and it takes a while before processes are properly streamlined. On top of that, even the most dedicated and loyal employees want a steady paycheck so you really can’t afford mistakes. Plus, the amount of time you need to dedicate to payroll is insane and that’s putting it lightly. We can integrate your processes and eliminate the need for repetitive, manual data entry. Make benefits administration easier for your HR team and workforce by connecting your employees with their benefits online. Businesses that opt for full-service payroll may also receive professional assistance with regulatory compliance and have taxes filed on their behalf. ADP’s certified, experienced professionals are available to assist with all your payroll software needs.

By Verge Systems

It also provides payroll integration that enables employers to integrate with several payroll offerings and employee benefits data in payroll. A network of healthcare advisors and brokers nationwide are available for integration. It helps organizations of all sizes across the U.S. improve employee engagement and gain real-time insights to enhance workforce processes and workplace operations.You face specific challenges that require solutions based on experience. Quickly connect ADP solutions to popular software, ERPs and other HR systems. Kathy Yakal has been writing about PC applications since 1983, when she joined the editorial staff of COMPUTE! She began specializing in financial solutions in 1989, writing a newsletter for CPAs who were exploring the use of personal computers in their firms. Since then, she has contributed to numerous print and web-based publications, including Barron’s and Kiplinger’s Personal Finance Magazine. Full BioMaddy Simpson is an experienced data journalist and fact-checker with a background in financial analytics. Employees can also take advantage of user-friendly interfaces to view their payment history and easily adjust their personal information and payment preferences.

Users Complain The Customer Support Is Unresponsive

Contractors can be entered into the system as employees and vice versa. Employees can be hired and entered into the system but not show up for the first day.A professional service should provide standard templates for the most common compliance documents and predefined reports for the same purpose. It should also track tax rules obsessively at the local, state and federal level, updating automatically when things change to cut down on time spent hunting for answers by accounting. While not generally needed for smaller companies,employee self-service optionscan make life easier for human resources managers in larger companies. Self-service gives employees access to personal information regarding pay history, deductions, hours worked, benefits, and time-off requests. They can automatically request changes and review information instead of having to contact the human resources department.Make sure you choose one that’s made for small- to medium-sized businesses. Payroll software automates the process of managing employee salaries, wages, bonuses, and deductions. Payroll software is available as a standalone application or as part of a larger software suite such as HR or accounting software. As a business owner, you likely want to spend as little time on payroll as possible. Stay on top of employee compensation by choosing the best payroll software for your company. As far as what a payroll system looks like, companies have a few different options.

What Is A Payroll System And How Does It Work?

Ensure users can track specific variables and send them between departments like HR and accounting. Payment Options Employees prefer convenient options when it comes to payments. Direct deposits are usually the best option, but companies should provide other options – like checks, invoices and more – to the employees that want them.

Quickbooks Payroll

To help you choose the right payroll software for your business, we considered 15 different payroll solutions. We looked at cost, ease of use, important integrations, convenience, reporting features, and support. Automation is another far-reaching benefit of cloud-based payroll systems, which often have artificial intelligence built in to anticipate needs and reduce errors. Payroll systems help ensure that the right people have access only to the appropriate information for their role. Especially with mergers and acquisitions, new hires, and shifting regulations, payments to employee can be complicated and time consuming. With payroll software, organizations can be sure that employees are paid the right amount and on time, every time, helping to build employee trust and confidence. Many payroll companies may integrate with your existing time and attendance software and your HR management tools.It works as a standalone application, but makes more sense as an add-on to QuickBooks Online. The average cost of payroll software is about $30 per month for the base fee, and then around $4 to $8 per employee per month. Some of the most expensive plans start at $150 per month, plus $12 per person per month. Running payroll manually leaves a lot of room for error, which can lead to hefty fines from the IRS. This is why so many businesses prefer to outsource payroll, but that can get expensive.Users have easy access to W2s and pay stubs, even after termination. It also handles new hires, multiple forms of payment, direct deposit, extra income, tax forms and more. BambooHR is an HRMS designed for small and medium-sized businesses, and provides solutions for organizations in all industries. It facilitates hiring, onboarding, compensation administration, performance management, provides employee self-service capabilities and everything in-between.Some payroll services included here even served as the lender for these loans or partnered with third-party lenders so that users could apply directly through them. Since most of these sites submit your payroll taxes and support direct deposit for compensation, you may need to supply bank account information. Consider ADP’s main competitors and you’ll see why it’s typically used by larger businesses.