Content

- Invoice Corrections

- Create Workflow Rules Using A Spreadsheet

- How To Request Partial Payment Upfront

- Higher Probability Payment

- Partial Payment Invoice Template

- How To Use Partial Payment To Collect Overdue Invoices

If the check fails for any invoice distribution, the funds status of the corresponding invoice line, as well as the invoice, is failed. Compares the invoice distributions against available funds, with consideration to tolerances and overrides, and provides the results of the comparison. After a few exchanges, your manager approves the early payment and you can pay the supplier immediately. The conversation details provide the reasons behind deciding on the early payment of this invoice.An automatically-generated invoice for interest on overdue invoices. The Approvals infolet displays invoices pending, others, and rejected approvals. You may have invoices you can approve, you can track the pending approvals from other, and those that have been rejected. Clicking on the category displays the invoices in the subsequent table.

Can invoice be paid partially?

Partial payment refers to the payment of an invoice that is less than the full amount due. Create professional credit notes for free with SumUp Invoices. Partial payment is normally half of the total amount or a percentage of it.You need to discuss the activities as well as the specifics. This will help you determine the total hours of work needed and calculate an appropriate cost for the partial payment invoice. When your client pays a part of the total invoice, it is called a partial payment. In such an invoice, the buyer pays less than the due amount. It could be a specific amount or percentage of the total invoice. Also called upfront payments, such invoices are useful for managing unanticipated business expenses while working.

Invoice Corrections

If you’re matching to a purchase order line, you can specify a value for either the PO_LINE_ID or the PO_LINE_NUMBER column. If you’re matching to a purchase order, the AMOUNT is equal to the QUANTITY_INVOICED multiplied by the UNIT PRICE. Enter the lookup code for the type of invoice line to create from this record. If you don’t specify a value, this column is populated by the AP_INVOICE_LINES_INTERFACE_S sequence. Address belonging to the supplier or party that receives payment.

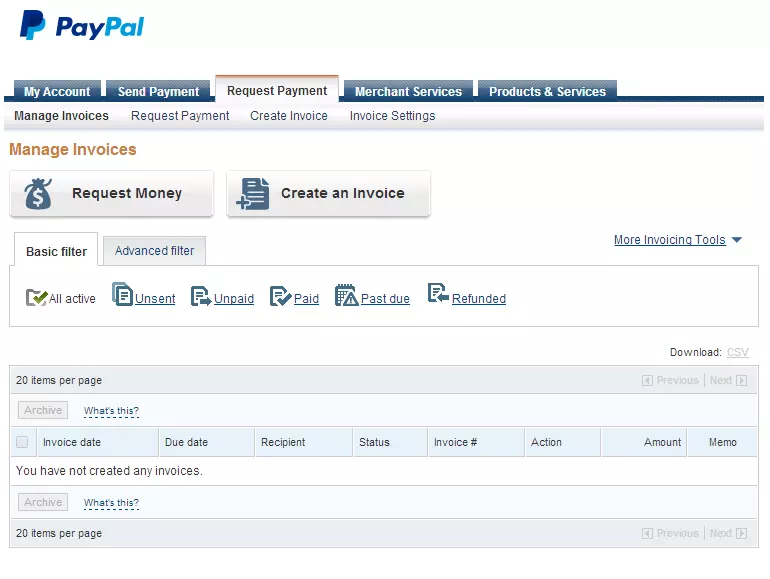

- Payment Requests are a feature which allows BTCPay store owners to create long-lived invoices.

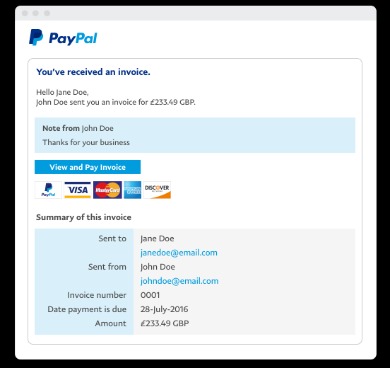

- Once your customer receives the invoice, they’ll be able to pay the deposit first, and then the remaining balance.

- Lines for prepayment application or unapplication, which are automatically created.

- Canceling the invoice reduces the billed quantity on the purchase order less than zero.

- This is applicable despite the last multiperiod accounting date is in an open or closed period.

- Also, every successful rule upload using a spreadsheet template overrides the existing rules for the workflow.

The notification templates can be easily configured to meet other specific requirements. If required, you can change the delivered template layouts and content, to add images, change colors and styling, add or remove attributes or modify text. All invoices with an invoice amount greater than or equal to USD 5000 require approval by the Finance approval group. The Finance approval group that must approve the invoice varies based on the invoice distribution cost center and the business unit on the invoice. Any invoice with an invoice amount less than USD 5000 is automatically approved. A data set enables you to define a mapping between your data and the variation in approvers based on such data.

Create Workflow Rules Using A Spreadsheet

If you want to disconnect a progress invoice from the original estimate, select the trash icon for the estimate line item. QuickBooks will ask if you want to unlink the entire invoice. Decide how much you want to invoice for, then select Create invoice. You can charge for a percentage or a specific amount.

How To Request Partial Payment Upfront

If approvals are enabled for Standard Invoices, it also applies to payment requests from external sources. No further step is required to enable approvals for One Time Payments. Approval aren’t enabled for payment requests from internal applications such as Oracle Fusion Receivables and Oracle Fusion Expenses. The business unit for the payment is different from the business unit for the invoice and you don’t have access to that payment business unit. You can view general payment information on the Payments tab, but you can’t drill down to view the payment details. For example, a supplier needs urgent payment on a large invoice and offered a discount of two percent if the invoice is paid within the next ten days.After you confirm this action, the configuration file stored in UCM is used to restore the workflow rules to the state before migration. Ensure that you select a template for the workflow for which you want to migrate the rules.If your business process is to receive invoice images from your suppliers, communicate to them your imaging requirements. The suppliers can then e-mail the invoice images directly to the designated e-mail account. You can choose any of the available values provided to replace the default value of 1000. This specifies the total number of invoice lines that will be retrieved in your search. The parameter External should be selected when importing the invoices. Option to allow changes to the default document category on a payment. Scanned invoices are arranged in aging buckets, when you click on any of the numbers those invoices are displayed in a table.The ability to configure workflow notifications to meet your specific business needs and requirements is now available. The capability to configure the notifications supports changing the format, content, and display of the notifications.undefinedIn the send email screen, you can customize your email message to the customer and click your payment option if you are using QuickBooks Payments. To convert the estimate we created previously, click on the Sales tab and then select All Sales. Once your customer receives the invoice, they’ll be able to pay the deposit first, and then the remaining balance. On the “create invoice” screen, enter all the necessary data. It’s best practice not to mark the invoice as “paid” until you receive the full amount. Otherwise, it could throw off your books and reporting. In the “receive from” field, input the name of the customer.

Higher Probability Payment

Invoices having amounts greater than or equal to 1000 require approval by the immediate supervisor of the requester on the invoice. Funds check or reservation has failed for some lines or distributions. Validate the invoice to consume the budget and reduce available funds from expense accounts used in the invoice. When funds are insufficient or a budget period is closed, you may be able to override a budgetary control failure. You must first enter a justification for the override.

Partial Payment Invoice Template

Partial payments are most applicable for fixed-price projects where the total costs are quoted already. Payment Requests are a feature which allows BTCPay store owners to create long-lived invoices. Funds paid to a payment request use the exchange rate at the time of payment. This allows users to make payments at their convenience without having to negotiate or verify exchange rates with the store owner at the time of payment. It’s important to keep careful track of these events, as your ledger can get out of hand fast. Luckily, QuickBooks makes it easy to both send and receive partial payments and notate them accordingly.

How To Use Partial Payment To Collect Overdue Invoices

If you’re the last user, then you’re expected to provide the missing distribution amount to complete the task. The rate specified for a tax status in effect for a period of time. An optional value entered by a user to ensure that the calculated tax is the same as the tax on the physical document. This value is used to match Oracle B2B XML invoices to receipts. If you’re matching to a purchase order receipt, enter the receipt number. To override the balancing segment in the account, enter a value.To match to a purchase order schedule when either the PO_SHIPMENT_NUM or PO_LINE_LOCATION_ID columns are blank, you can enter a value for this column. One schedule on the purchase order must have the SHIP_TO_LOCATION_CODE value that you specify. For example, you enter a SHIP_TO_LOCATION_CODE of Taipei for a purchase order with exactly one schedule with the value Taipei. If you’re matching to a distribution, you must enter a value for either the PO_DISTRIBUTION_NUM or PO_DISTRIBUTION_ID column. Internal identifier for purchase order distribution number. If you’re matching to a purchase order distribution, you can enter a value for either the PO_DISTRIBUTION_ID or the PO_DISTRIBUTION_NUM column.