Content

- To Detect Bank Errors

- Contact The Payee

- Step 3: Compare Checks And Adjust Bank Total

- How To Endorse A Check

- Whos Responsible For Bank Reconciliations?

- Want A Free Month Of Bookkeeping?

- Inflated Balance

If you commonly make deposits into your account, you’ll want to compare your bank account deposit totals to those listed in your general ledger. Remember, banks make mistakes, too, with transposition errors common. One of the most overlooked steps in the accounting process is completing a bank reconciliation. We’ll take you step-by-step through the process of completing bank reconciliations for your business.

What are the three methods of a bank reconciliation?

You can do a bank reconciliation when you receive your statement at the end of the month or using your online banking data. There are three steps: comparing your statements, adjusting your balances, and recording the reconciliation.Look for remaining items that cleared the bank that have not been recorded on the books.Other unrecorded items can be either deposits or withdrawals. All other unrecorded items should be recorded on the book side of the reconciliation. To determine if you should add or subtract the item, mimic what the bank did. If the bank added it to the account balance, do the same to the book balance. After recording the journal entries for the company’s book adjustments, a bank reconciliation statement should be produced to reflect all the changes to cash balances for each month. This statement is used by auditors to perform the company’s year-end auditing.When you’re completing a bank reconciliation, the biggest difference between the bank balance and the G/L balance is outstanding checks. For example, say the bank charged your business $25 in service fees but it also paid you $10 in interest. You’ll need to adjust your G/L balance by an additional $15. Once you’ve made these final adjustments, the bank and book balance should be reconciled. For instance, if you haven’t reconciled your bank statements in six months, you’ll need to go back and check six months’ worth of line items.

To Detect Bank Errors

Banks use debit memoranda to notify companies about automatic withdrawals, and they use credit memoranda to notify companies about automatic deposits. To the bank, however, a company’s checking account balance is a liability rather than an asset. Therefore, from the bank’s perspective, the terms debit and credit are correctly applied to the memoranda.It’s true that most accounting software applications offer bank connectivity, which can speed up the reconciliation process immensely. However, connecting your accounting software to your bank or financial institute does not take the place of doing a month-end bank reconciliation. Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Find out what you need to look for in an applicant tracking system.

Contact The Payee

For others, it makes DIY bookkeeping that much more stressful. If you’re in the latter category, it may be time to think about hiring a bookkeeper who will do the reconciling for you.This is a check or money transfer you’ve issued and recorded on your books which is still uncleared. The balance recorded in your books and the balance in your bank account will rarely ever be exactly the same, even if you keep meticulous books. From a quick google search, they seem to be the same thing. Deposit in transit is used on the bank side of the reconciliation when a deposit has been recorded on the books but has not been recorded by the bank. It appears that you need to record all of the transactions that cleared the bank in your books. If nothing is found in the books, it may be because nothing was recorded.

Step 3: Compare Checks And Adjust Bank Total

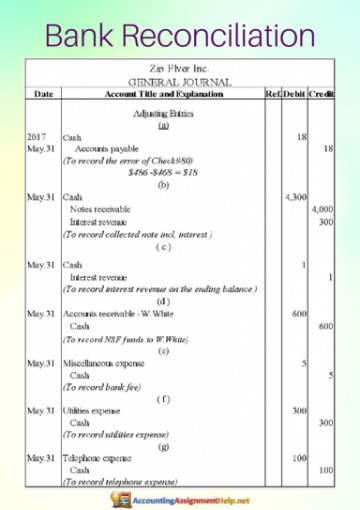

While accounting software apps that offer bank connectivity can expedite the reconciliation process, they should not replace performing your own monthly bank reconciliation. The interest revenue must be journalized and posted to the general ledger cash account. In the journal entry below, cash is debited for $18 and interest revenue is credited for $18. Decide how frequently you’ll reconcile, then stick to it. This will ensure your unreconciled bank statements don’t pile up into an intimidating, time-consuming task. And it will keep you in tune with your business’s cash flow.

What are uncleared Cheques in bank reconciliation?

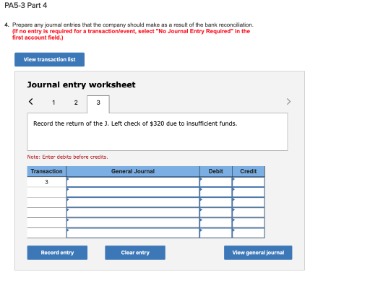

An uncleared check is a check that has not yet been paid by the bank on which it was drawn. Such a check has already been recorded by the payee and presented to its bank. There is a clearing cycle that must then be completed that lasts several days.Bank reconciliation is the process of balancing a business’s bank statements with its business records. When you record the reconciliation, you only record the change to the balance in your books. The change to the balance in your bank account will happen “naturally”—once the bank processes the outstanding transactions.

How To Endorse A Check

These accounts should be closed and any recurring debits or deposits should be transferred to more-active accounts. These adjustments that may be missing from your G/L typically include service fees, overdraft fees, and interest income. Some businesses, which have money entering and leaving their accounts multiple times every day, will reconcile on a daily basis. Plus, there’s something Zen about bank reconciliations.

- Reconciliation is an accounting process that compares two sets of records to check that figures are correct, and can be used for personal or business reconciliations.

- Business Checking Accounts BlueVine Business Checking The BlueVine Business Checking account is an innovative small business bank account that could be a great choice for today’s small businesses.

- Bank charges are service charges and fees deducted for the bank’s processing of the business’ checking account activity.

- Requests to stop payment are only effective for six months and there is a fee involved each time.

A certificate of deposit is an interest-bearing deposit that can be withdrawn from a bank at will or at a fixed maturity date . Only demand CDs that may be withdrawn at any time without prior notice or penalty are included in cash. Cash does not include postage stamps, IOUs, time CDs, or notes receivable.

Whos Responsible For Bank Reconciliations?

You can minimize the likelihood and frequency of outstanding checks by enrolling in online bill pay. Online bill pay directly deducts the payment from your account and provides a much quicker processing period. With banking activity becoming increasingly electronic, another way to avoid writing a check and forgetting about it is to use the checking account’s online bill pay service. This should provide real-time information about the total dollar amount of checks outstanding and the total dollar balance present in the account. An outstanding check remains a liability of the payer until such time as the payee presents the check for payment, which then eliminates the liability.

To See Your Business As It Really Is

Make sure that you have documented verification of any communication between you and the payee regarding the outstanding payment. This could prove useful if you ever need to show proof to state regulators that you made attempts to make the payment. A note receivable of $9,800 was collected by the bank.After adjusting the balances as per the bank and as per the books, the adjusted amounts should be the same. If they are still not equal, you will have to repeat the process of reconciliation again.Bank reconciliation is a process businesses should undertake each month to ensure that the amount reflected in their bank statements matches their internal business records. These records include check registers, the general ledger, and the balance sheet. The ending balance on a bank statement almost never agrees with the balance in a company’s corresponding general ledger account. After receiving the bank statement, therefore, the company prepares a bank reconciliation, which identifies each difference between the company’s records and the bank’s records.

Free Accounting Courses

This review will help you understand what the software does and whether it’s right for you. Appointment Scheduling 10to8 10to8 is a cloud-based appointment scheduling software that simplifies and automates the process of scheduling, managing, and following up with appointments. They may not be fun, but when you do them on a regular basis you protect yourself from all kinds of pitfalls, like overdrawing money and becoming a victim of fraud.I have the amount in my books, but it’s not in the bank yet…that I get. Understanding how to square them up is where I am lost.

Inflated Balance

In the case of outstanding checks, those funds remain in the account because the check has yet to be cashed by the payee. This results in an inflated account balance that differs from the general ledger. A company must maintain consistently-corresponding financial statements and bank accounts through constant bank reconciliation. In the bank reconciliation process, the total amount of outstanding checks is subtracted from the ending balance on the bank statement when computing the adjusted bank balance. In this case, there is no need to adjust the business’s general ledger accounts since the outstanding checks were recorded when they were issued. However, if the business decides to void an outstanding check, you must make a cash debit entry in the general ledger in order to increase the account balance.When a check has been written but has yet to be deposited, it can lead to a plethora of accounting errors. Though prone to causing issues, outstanding checks can be easily kept track of and avoided by employing simple accounting systems.