Content

- How To File A Business Tax Extension Online

- Tax Pro Or File Your Own?

- How To File A Tax Extension For Your Small Business

- How To File Business Taxes

- Get A Tax Pro Who Dave Trusts

- More In Forms And Instructions

- How To File For A Business Tax Extension Federal

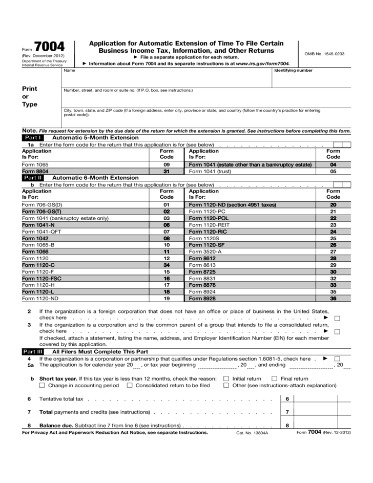

Filing for an extension can be completed simply filing a form online. The type of form you use depends on the type of business you run. While business extensions are considered automatic, if you make mistake on your Form 7004 your tax extension will be denied. For businesses concerned about paying their tax bill , there’s the IRS Fresh Start program. They offer flexible options for businesses struggling with paying their taxes. If you’re having trouble calculating the amount of estimated tax you need to pay the IRS, we recommend reading our summary article How to Calculate and Pay Estimated Quarterly Taxes.

Can I get an extension on my business taxes?

If you need more time to complete your 2021 business tax return, you can request an extension of time to file your return. However, even with an extension, you must estimate how much you owe (if you owe) and send in that amount by the due date. Otherwise, the IRS can invalidate your extension.H&R Block prices are ultimately determined at the time of print or e-file. Small Business Small business tax prep File yourself or with a small business certified tax professional. The IRS doesn’t reject many extension applications. The most common reason an application is rejected is because of an error. Check to make sure you have filed the extension application correctly. The extension is automatic for both types of extensions . Just be sure to file the extension by the tax due date.

How To File A Business Tax Extension Online

Available at participating offices and if your employer participate in the W-2 Early AccessSM program. Supporting Identification Documents must be original or copies certified by the issuing agency. Original supporting documentation for dependents must be included in the application.

Tax Pro Or File Your Own?

However, your tax payment is still due by April 15. Because tax returns that have been granted an extension won’t be complete, he added, those who file for an extension must estimate what their tax payment will be and pay that amount instead. Business tax on the personal return.

- Starting price for state returns will vary by state filed and complexity.

- Having an ITIN does not change your immigration status.

- They offer flexible options for businesses struggling with paying their taxes.

- The IRS doesn’t charge for e-filing, but some firms that prepare returns for submitting electronically do.

- The deadline for extensions is also July 15.

Business owners who pay business taxes as part of their personal tax returns are called pass-through businesses. These businesses use Form 4868 to apply for an extension. For personal tax returns, useForm 4868 to file an extension application. These include sole proprietors, partners, LLC owners, and S corporation owners. Use Form 7004 to request an automatic 6-month extension of time to file certain business income tax, information, and other returns. All the major tax software applications allow you to file an extension using either Form 4868 or Form 7004.

How To File A Tax Extension For Your Small Business

The due date for your partnership return will be extended until September 15, 2021. If you think you may need more time to prepare the S corporation’s return, you should file for an extension using Form 7004.6 months for sole proprietorships, who are filing Schedule C along with their Form 1040, and for single-member limited liability companies filing as sole proprietors. For sole proprietors, all of whom have a December 31 year-end, the extended tax return is due October 15. You can use your personal computer or have your tax preparer do this for you. You can also use IRS Free File which allows you to file an extension and request payment options online. When you request a partnership extension, you LLC will get an automatic five-month extension to file Form 1065. For a partnership, Form 1065 is submitted instead of Form 1120S. For single-member LLCs, use Form 4868 filed by individuals who need to request an extension. Get automatic extension up to 6 months by choosing ExpressExtension as your e-file IRS service provider.

How do I file an extension for my small business taxes?

How to File An Extension. If you’re an individual or sole proprietorship, simply file Form 4868 to get an automatic six-month extension to file a completed tax return. You can e-file from your own computer or have a tax professional do it for you. You can also print the form and send it through the mail.There are several reputable software programs you can use to prepare and file your taxes. Three of the better-known programs are TurboTax, TaxACT, and H&R Block. Each has different versions of its software available, from free to “deluxe,” depending on your needs and how complicated your finances are. There are different products available from each of the major companies for sole proprietors, independent contractors, corporations, partnerships, and LLCs. The IRS posts the proper forms for filing an extension on its site, along with instructions and specifics about the regulations.

How To File Business Taxes

If your organization is a corporation, and is the common parent of a group that will be filing a consolidated return. If your organization is a foreign corporation that doesn’t have an office or place of business in the U.S. Once complete, the extension is applied automatically.

Get A Tax Pro Who Dave Trusts

See Online and Mobile Banking Agreement for details. The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. One state program can be downloaded at no additional cost from within the program. Get the facts from H&R Block about the IRS monthly payment plan called a conditional installment agreement, which considers your full financial picture. Wave self-serve accounting Financial software designed for small businesses. There is only one extension allowed per tax year.

How To File For A Business Tax Extension Federal

Even better, you can get extra time to file your taxes in 30 minutes or less if you have a wifi connection. If your business is organized as an S corporation, the income tax return or extension is due by the 15th day of the 3rd month after the end of your tax year. If the business is a C corporation then the extension is due by the15th day of the 4th monthafter the end of your tax year. There is no process for filing an additional extension beyond the one you’re granted through October 15. A return can still be completed after this date, just expect to pay additional penalties. However, it’s a case where it’s definitely better late than never as to avoid additional penalties by further delaying the filing of a return.Any Retail Reload Fee is an independent fee assessed by the individual retailer only and is not assessed by H&R Block or MetaBank®. Price for Federal 1040EZ may vary at certain locations. Learn about withdrawal rules and early withdrawal penalties for Roth and Traditional IRAs with detailed information from the experts at H&R Block. Receiving notices for an IRS balance due? Learn how to handle and IRS tax bill with help from the tax experts at H&R Block. Do you think there’s an error on your Schedule K-1?You can’t get multiple extensions. We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. No pressure, no credit card required. Corporations and S corporations also use Form 7004. The deadline for corporations and S corps to file is March 15. ExpressExtension.com is an IRS authorized e-file provider.Use this free quiz to help you decide which tax filing method is right for you. There’s a special day that comes once a year that most people absolutely dread. No, it’s not Thanksgiving with weird Uncle Junior. Although, yeah, that day can be brutal. And while both days might make you look for a heavy bag to punch (you’ve got to work out that stress somehow), only one of them can be postponed, giving you a little extra time to prepare. Businesses operating as C-Corporation, S-Corporation, Partnership, LLC, Estate and Trusts can request an extension using Form 7004. Tax obligations can be confusing, and they change all the time….