Content

- The Filing Deadline For W

- Am I Required To File A Form 1099 Or Other Information Return?

- I Am Sending Electronic Magnetic Media; Do I Need To Complete And Send Form 447?

- Not Required To File Information Returns

- My Business Is Not Liable For Business Taxes In The State Of Michigan How Do I File 1099 Forms?

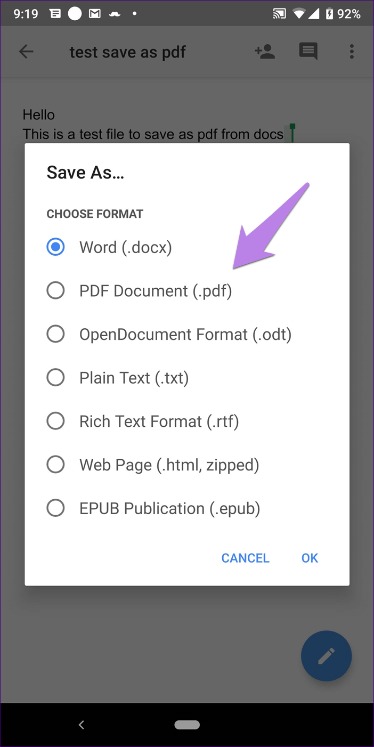

If you are registered with Iowa as an Iowa withholding agent and withheld Iowa tax, you need to file the VSP. If you have identified any errors on your previously filed Form 1099, you have to correct them and submit a correction Form to the IRS and must send the same to the recipient. Form 1099-S is used to report the proceeds from the real estate transactions, and to report the sales or exchange of real estate. Instead of inputting your recipients’ details individually, upload all your recipients’ information instantly, for a more efficient e-file experience. To report interest income issued by all payers of interest income to investors at year-end. Payer errors cannot be fixed electronically at this time.

- Do not include Social Security numbers or any personal or confidential information.

- The due date to submit Forms 1099-MISC, 1099-R and W-2G electronically to DRS is January 31.

- E-file fees do not apply to NY state returns.

- If you are a recipient or payee of an incorrect Form 1099-MISC contact the payor.

- A non-employee might be an independent contractor or any person hired on a contract basis to complete work, such as a graphic designer, writer, or web developer.

Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. We’re here to review questions about the form, why you may receive it and what it would report for each situation. The 1099 form is a common one that covers several types of situations. Depending on what’s happened in your financial life during the year, you could get one or more 1099 tax form “types” or even more than one of the same types of 1099.If you sent paper, you will have to fill in and send a paper REV-1667. Starting with tax year 2020, Track1099 will offer a state e-file service for +$1.49 per form. Track1099 offers a 1099 state e-filing service to certain states.In addition, use Form 1099-MISC to report that you made direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment.The program is great, but what impressed me the most was the service you provided. Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. When you use an ATM, in addition to the fee charged by the bank, you may be charged an additional fee by the ATM operator. See your Cardholder Agreement for details on all ATM fees.

The Filing Deadline For W

Jump past the investment section, if you’re more interested in the non-investment income type 1099. An independent contractor is a person or entity engaged in a work performance agreement with another entity as a non-employee.

Am I Required To File A Form 1099 Or Other Information Return?

A penalty may be imposed for filing forms that cannot be scanned. Mail Form 1096 and all your Form 1099s to the IRS.

I Am Sending Electronic Magnetic Media; Do I Need To Complete And Send Form 447?

Businesses that issued W-2s or 1099s that contain Iowa withholding must electronically file those documents with the Iowa Department of Revenue. Form 1099 is a series of Forms that IRS refers to as “Information Return” which is used to report various types of income that a taxpayer receives throughout the year. The income may be the compensation paid to the independent contractors, interest amount paid by bank or any financial institution, and dividends paid in exchange for stocks or any mutual funds. The IRS determines if a person or business paying compensation to another person or business has an employee or contractor relationship.If you’ve provided Form 1099-MISC to contractors in prior years, you’re still in the right place. The new Form 1099-NEC has replaced 1099-MISC to report nonemployee compensation. As a self-employed individual, you must pay Social Security and Medicare taxes. However, since your 1099-NEC income is not subject to employment-tax withholding, you’re required to pay these taxes yourself. The process of filing your taxes with Form 1099-NEC is a little different than if you only had income reported on a W-2. Here’s some tips to help you file.

Not Required To File Information Returns

If you receive an incorrect 1099 form and the payer already sent it to the IRS, ask the originator to send a corrected form. The deadline to mail 1099s to taxpayers is usually Jan. 31.

My Business Is Not Liable For Business Taxes In The State Of Michigan How Do I File 1099 Forms?

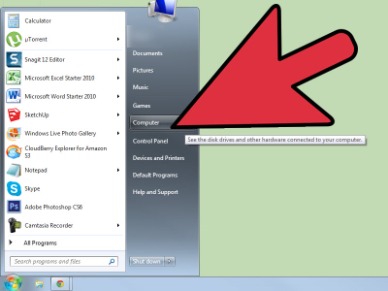

If you have 250 or more income statements, you must use MTO to electronically send a magnetic media formatted file. Taxpayers with fewer than 250 income statements, may send physical magnetic media or utilize any other filing option listed in Treasury’s Income Statement Remittance Guide. Taxpayers with fewer than 250 income statements, may utilize any filing option listed in Treasury’s Income Statement Remittance Guide.A company must provide a 1099-NEC to each contractor who is paid $600 or more in a calendar year. Independent contractors must include all payments on a tax return, including payments that total less than $600.

When Are State Copies Of Income Statements Due?

You will have to send paper to that state. Review Form 447, Transmittal for Magnetic Media Reporting of W-2s, W-2Gs and 1099s for information about sending magnetic media to Treasury. Forms W-2, W-2C, W-2G, 1099-R, 1099-MISC, and 1099-NEC may be filed by magnetic media. W-2G when required to report certain gambling winnings of, and withholding for, nonresidents of Michigan. Do not include Social Security numbers or any personal or confidential information. If you are filing paper returns with us, attach the returns to IRS Form 1096 and mail to the following address. You do not need to request an extension to file with us if you file electronically under the IRS Combined Federal/State Filing Program.Wave self-serve accounting Financial software designed for small businesses. Small Business Small business tax prep File yourself or with a small business certified tax professional. Complete your 1099s via a supported accounting or payroll software. If you miss the deadline, you could be penalized anywhere from $ per form up to a maximum of $500,000 a year. However, if you intentionally ignore filing requirements or deadlines, the IRS may decide to penalize you $550 per incorrect form with no cap. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear.