Content

- Contact Your Employers Payroll Provider

- Can My Tax Service Get My W

- Learn Which Credits And Deductions You Can Take

- Contact The Irs

- About H&r Block

- Form W

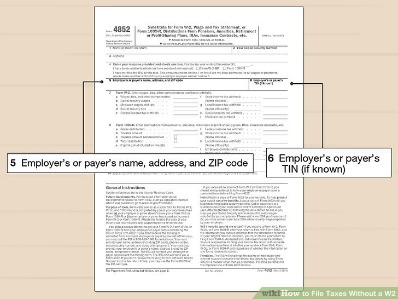

However, this doesn’t always happen. W-2s can get lost in the mail and sometimes they are misplaced by the taxpayer after receiving them. H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file.If any of the information is off, file Form 1040X to correct that information. Keep the completed form with your tax records. You are not expected to submit Form 4852 to the IRS along with your tax return. However, you are expected to keep it with your tax records in the event of an audit. Unlike other tax records, you should also retain a copy of the form at least until you start receiving Social Security, to protect your Social Security benefits.

Contact Your Employers Payroll Provider

Let’s take a look at the steps you can take to obtain your income statement. We’ll even let you know how to file without one altogether. We will notify you if there is a change in your tax situation that requires a price adjustment. If you request cash back when making a purchase in a store, you may be charged a fee by the merchant processing the transaction. Always ask the merchant if a surcharge applies when requesting cash back at the point of sale. Vanilla Reload is provided by ITC Financial Licenses, Inc.While most won’t actually email your W-2 because of security concerns, they will send you an email notice that you can go to the company’s employee portal and download your earnings statement. If that message hasn’t appeared in your inbox, check your spam folder. If you’re not sure where your forms are and are wondering, “How can I get a copy of my W-2 online?” or “What if I lost my W-2? Often, a W-2 isn’t missing because the taxpayer lost it. For privacy reasons, most payroll services won’t speak to employees directly or give you information about your W2s.If that happens, or if you realize you included incorrect information on your return, you can file an amended return as soon as you receive or locate the missing form. The IRS online tool to request wage and income transcripts also lets you get the information that was reported on your W-2, 1099 and other forms for previous years. You can request a lost W-2 for any one of the last 10 tax years. If you don’t file your return by the due date because you don’t have a W-2, the consequences could potentially be serious. The IRS levies a penalty of 5 percent of the unpaid taxes for each month or part of a month a return is late. That can go up to 25 percent of the unpaid taxes.

Can My Tax Service Get My W

US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions.

- Additional fees and restrictions may apply.

- Copy the information from your pay stubs onto the form.

- You may need to correct your tax return if you get your missing W-2 after you file.

- CPAs Instantly access HR & payroll data with real-time analytics to guide decision-making.

- NerdWallet strives to keep its information accurate and up to date.

- Timing is based on an e-filed return with direct deposit to your Card Account.

As an American living overseas, filing your U.S. taxes can seem like a complicated, overwhelming task—and reporting foreign income without a W-2 only adds to the complexity. When you use an ATM, in addition to the fee charged by the bank, you may be charged an additional fee by the ATM operator. See your Cardholder Agreement for details on all ATM fees.

Learn Which Credits And Deductions You Can Take

Wait until mid-February to see if your W2 arrives in the mail. Employers are required to send W2s to all employees by January 31.Many employers now issue Form W-2 electronically to employees. But that doesn’t mean they’ll always email the form to you, as it isn’t particularly secure. Instead, they’ll email you a link to an online portal where you can download the form yourself. If you’re expecting a refund, you probably want it as soon as possible.If you worked 12 hours in the previous calendar year, you would multiply $10 by 12 to get $120. You would then add $120 to the year-to-date total for taxes withheld. Add on additional days that weren’t included in your final pay stub. If the year happened to end in the middle of a pay period, you’ll probably need your first pay stub of the following year as well. Then, you’ll need to add the pay and taxes that related to the previous calendar year to your year-end totals.Wave self-serve accounting Financial software designed for small businesses. Finances Emerald Advance Access to a line of credit, with no W-2 required to apply.

Contact The Irs

If you haven’t received your W-2 by mid-February, contact your employer to see what happened. This will most likely resolve the issue. Once you receive the transcript, you can use it to compare the information you provided on Form 4852 to the wage and withholding information that the IRS has on record. You can request a Wage and Income Transcript online using the Get Transcript Online tool, or by mail using Form 4506-T. What happens if your employer truly never issued your W-2? Perhaps they went out of business or aren’t responding to your request for a W-2?

About H&r Block

If you’re a U.S. citizen working overseas and you don’t have a W-2 come tax time, don’t worry. The first thing you should do is find out if your country has a version of the American W-2. Many countries that charge income tax do.You may need to correct your tax return if you get your missing W-2 after you file. If the tax information on the W-2 is different from what you originally reported, you may need to file an amended tax return. Use Form 1040X, Amended U.S. Individual Income Tax Return to make the change.As long as your employer issued one, TurboTax can import it. However, if you work as an independent contractor, the company will likely send you Form 1099-MISC rather than a W-2. Work more than one job where you’re considered an employee. Before we walk through what to do if you haven’t received a W-2, we’ll start with the basics—what it is and who receives one.