Content

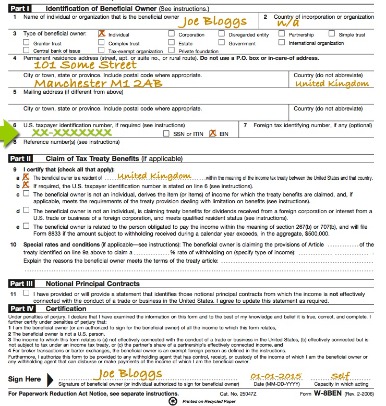

- Line 2: Country Of Incorporation

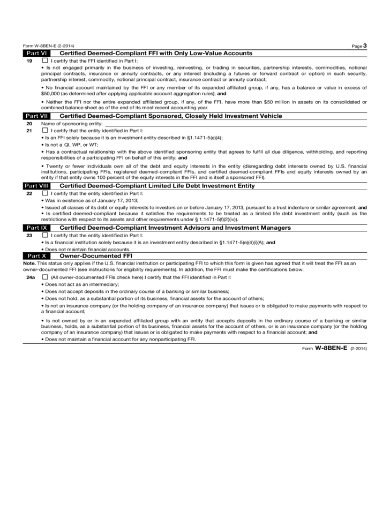

- Line 4: Select The Chapter 3 Status That Applies To Your Entity

- Who Needs To Fill Out Form W

- Country Of Incorporation Of Your Organization

- How To File For A Tax Extension

- Line 8: U S Tax Identification Information Tin Or Employer Identification Number Ein

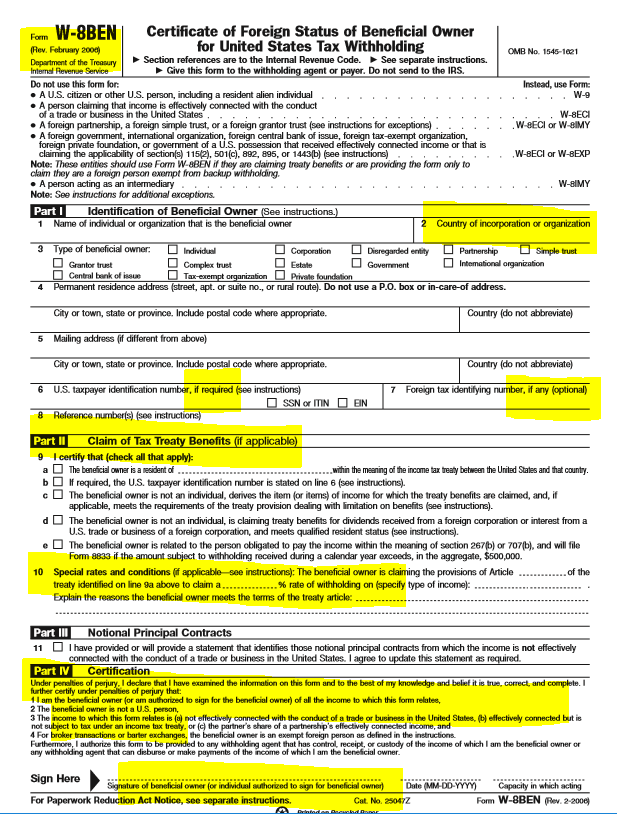

- About Form W

Similarly to foreign persons receiving certain types of income, the generated income by foreign entities is typically subject to a tax withholding of 30% by the payer or withholding agent in the United States. However, the form W-8BEN-E allows the foreign business to claim a reduction in US taxes if its foreign government has a tax treaty with the United States. Failure to provide an accurate form W-8BEN-E to a withholding agent may result in a 30% tax rate on gross income being applied even if the foreign entity has a claim of tax treaty benefits.

Line 2: Country Of Incorporation

It also helps categorize foreign vendors doing business with U.S. companies. Sole proprietors and individuals must not fill out the W-8BEN-E form. Instead, they are required to submit the W-8BEN form to receive payment from U.S. companies. Using digital forms is the best way to go to ensure that the information is secure and legible. Further, digital forms can be stored and referenced without having to dig through hardcopy files.At Deel, we often help US-based businesses who want to hire contractors and employees located all over the world and need this form. We’ll guide you through the different W-8BEN versions and how to complete one. Must provide a completed W-8BEN form to their U.S. client in order to avoid paying tax to the IRS. The first step in addressing a myriad of potential errors is to consider automating W8 workflows. A secure, cloud-based AP solution can save companies valuable time and money that can be invested in the growth of the business. Manual collection can contribute to inaccuracies and heighten the risk of legal trouble.

Why do I need to complete a W-8BEN E form?

The W-8BEN-E is an IRS form used by foreign companies doing business in the United States. … The W-8BEN-E form is used to confirm that a vendor is a foreign company and must be filled out before the vendor can be paid, according to the University of Washington.Permanent residence address (street, apt. or suite no., or rural route) – Enter detailed business residence address. The W-8BEN is valid for three calendar years, ending on the last day of the third year. For example, if you hire someone in September 2021, the W-8BEN form will be valid until December 31, 2024. If a US taxpayer identification number is provided, the form is valid indefinitely. Form W-8BEN-E is filed and submitted by a foreign entity, not an individual. From collecting tax forms to storing them all in one place, we automate everything, so you can stay focused on growing your business.

Line 4: Select The Chapter 3 Status That Applies To Your Entity

Therefore, an investor in a PTP that has a US PE would not be able to satisfy the treaty requirements outlined previously. Due to the timing of the final versions, withholding agents may continue to receive the prior version of Forms W-8 from clients during early 2022 and can continue relying on unexpired prior-version forms. The Section 1446 updates to Forms W-8IMY and W-8ECI are needed for purposes of the PTP withholding requirements on payments made after 31 December 2022. Therefore, withholding agents making payments subject to Section 1446 withholding may need to consider a Section 1446-specific solicitation in 2022 to obtain updated Forms W-8 from clients who have not provided the latest version of their form. Businesses must provide the Form W-8BEN-E for the same sources of income as an individual would with a Form W-8BEN. If foreign entities do not provide an accurate Form W-8BEN-E when required, they risk paying the full 30% tax rate. Any non-US, or foreign, company or entity that conducts business with a US-based company or entity must file a W-8BEN-E with a payer’s withholding agent before the first payment is ever received or collected. This form is not sent to the IRS, rather it is used by the withholding agent for purposes of payment and withholding regulations.

Who Needs To Fill Out Form W

When payment is not made directly to the foreign entity and goes through foreign or U.S. sources, like an accounting institution, then this section should not be skipped. The Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting a.k.a. Form W-8BEN-E is used by a foreign person to establish beneficial ownership and foreign status. Globalization is bringing international commerce to our doorsteps.

Country Of Incorporation Of Your Organization

If one of these parts are required, it is indicated in the description of the box selected in Line 5. If the Line 5 description does not indicate one of these parts, they can be ignored.We’ve paired this article with Laurie Hatten-Boyd’s AP Tax Compliance webinar. Get your Executive Summary to find out how FATCA requirements impact organizations with a global supplier base.

- All foreign (non-U.S.) businesses that are receiving payment from an American company must fill out the W-8BEN-E form.

- But doing business with a foreign person and/or entity requires a well-planned process that honors the tax laws of every country involved.

- He has authored books on technical analysis and foreign exchange trading published by John Wiley and Sons and served as a guest expert on CNBC, BloombergTV, Forbes, and Reuters among other financial media.

- For more information about our organization, please visit ey.com.

- Here, in writing, there needs to be a first name, last name, and date .

In her spare time, she’s a self-proclaimed chef, lives in the middle of the woods, and has a frequent flyer card for birdseed and dog bones. Cut down on wasted time and resources that can be redistributed to more productive activities.

How To File For A Tax Extension

Any foreign (non-U.S.) company that receives payment from an American business must fill out the W-8BEN-E form and send it to the Internal Revenue Service . Form W-8IMY, is used by intermediaries that receive withholding payments on behalf of a foreigner or as a flow-through entity.

Who should fill out form W-8BEN E?

Who Must Provide Form W-8BEN-E. You must give Form W-8BEN-E to the withholding agent or payer if you are a foreign entity receiving a withholdable payment from a withholding agent, receiving a payment subject to chapter 3 withholding, or if you are an entity maintaining an account with an FFI requesting this form.Only certain fields will be prefilled – you must review and complete the rest of the fields before submitting. It is important to consult your tax advisor as to what status applies to you. For example, a W-8BEN-E form signed in 2012 would be valid for the rest of 2012 as well as 2013, 2014 and 2015.At the time the form is provided, however, nothing will have been, or must be, remitted. It may be possible to base the claim on what is projected to be remitted, but this is not addressed in the instructions. Form W-8BEN-E is used by international companies to capture tax information and claim tax treaty benefits. Individuals should not use Form W-8BEN-E. Individuals will generally use Form W-8BEN. The beneficial owner derives the item of income for which the treaty benefits are claimed, and, if applicable, meets the requirements of the treaty provision dealing with limitation on benefits. If you are resident of a country with a tax treaty with the US, fill this section to claim your exemption from withholding tax.The version of the form used is determined by both whether or not the filer is an individual or a business and the nature of the income the filer received. The forms are effective for the year in which they are signed and three calendar years afterward. Therefore, a W-8BEN signed on Sept. 1, 2021, would be valid through Dec. 31, 2024. These forms are requested by the payers or withholding agents and kept on file with them—not filed with the IRS.

About Form W

The Form 1042-S LOB codes might be updated to incorporate this new checkbox. If you don’t submit a W-8BEN-E form to your US client, 30 percent of your income is subject to withholding, regardless of whether your country has a tax treaty with the U.S. Can only be claimed if there’s a tax treaty between the U.S. and the country where the business is a tax resident. The United States has tax treaties with countries such as Canada, the United Kingdom, Ireland, Mexico and Australia. The W-8BEN-E is a form from the United State’s tax collection agency, the Internal Revenue Service . All foreign (non-U.S.) businesses that are receiving payment from an American company must fill out the W-8BEN-E form. Line 6b , FTIN not legally required, has been added for account holders otherwise required to provide a foreign taxpayer identification number on line 6 to indicate that they are not legally required to obtain an FTIN from their jurisdiction of residence.

Form W

Interim Certification The certification substantially in the form of Exhibit Two to the Custodial Agreement. Federal Certifications means the “Certification Regarding Lobbying – Compliant with Appendix A to 24 C.F.R. Part 87” and Standard Form LLL, “Disclosure of Lobbying Activities,” also in Attachment B, attached hereto and incorporated herein for all purposes. FIRPTA Affidavit means the form of FIRPTA Affidavit to be executed and delivered by Seller to Purchaser at Closing in the form attached hereto as SCHEDULE 8. Several additional changes are reflected in all of the Forms W-8 and accompanying instructions.The W-8BEN is a form required by the Internal Revenue Service , the United States tax agency. Also expires if any information on the form changes, such as the address of the foreign vendor. Then a new W-8BEN-E has to be filled out and submitted, according to the University of Washington. The W-8BEN-E form is used for reporting to the IRS information about a non-U.S. Download the W-8BEN-E form on the IRS website as well as the accompanying instructions.Not only does financial technology lead to a higher rate of speed and accuracy, it ensures tax-related documents will not be rejected during an audit. Take your time here to ensure all data is accurate and in the right spot. Estimated tax is a quarterly payment that is required of self-employed people and business owners who do not have taxes automatically withheld. Form W-9 is an Internal Revenue Service form which is used to confirm a person’s taxpayer identification number . Medicare Certification means certification by CMS or a state agency or entity under contract with CMS that a health care operation is in compliance with all the conditions of participation set forth in the Medicare Regulations. The undersigned has furnished the Administrative Agent and the Borrower with a certificate of its non-U.S.