Content

- Apply By Fax

- Step 2: Understand The Online Application

- Forms & Instructions

- Option 1: Check Your Ein Confirmation Letter

- How To Get An Employer Identification Number Ein

Unless the applicant is a government entity, the responsible party must be an individual (i.e., a natural person), not an entity. An Employer Identification Number is also known as a Federal Tax Identification Number, and is used to identify a business entity. You may apply for an EIN in various ways, and now you may apply online. This is a free service offered by the Internal Revenue Service and you can get your EIN immediately.Then you need to choose the option that best describes why you are applying for a new EIN. This can be to start a new business, for banking purposed or for a range of other reasons. The online questionnaire then requests your Social Security number before you can finish your application. Are you a business that employs workers, withholds taxes or operates as a corporation or partnership?

Apply By Fax

Getting a business license and taxpayer identification number or employer identification number are two important basic requirements when starting a new business. However, they have very little to do with one another.

- It’s still recommended to open a bank account, to hire employees later, and in order to maintain your corporate veil.

- The FEIN will help easily identify your business on payroll and other taxation forms.

- Selecting the correct real estate legal forms when starting your business is crucial.

- The IRS will ask for your business formation date and legal business name.

- If you perform services as a sole proprietor or SMLLC for which you’re paid over $600 during the year, you must provide an EIN or Social Security number to your clients or customers.

- Before you can open a bank account, apply for a business license, or file a tax return, you will be required to obtain a federal employer identification number for your business.

If so, the Internal Revenue Service agency requires you to get an Employee Identification Number , also referred to as your business tax ID number. Just like your social security number, each EIN is unique. This number allows the IRS to identify your business and requires you to provide all your tax documents and forms on it. This includes your business name and business address, as well as what type of legal structure your business uses, like a sole proprietorship, partnership, or corporation. Although many entities use their FEINs to report their taxes and other financial information to the IRS and other government entities, it is public information.

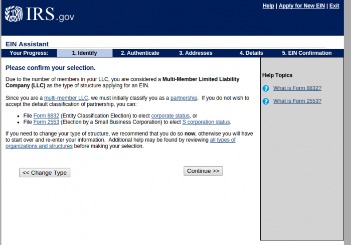

Step 2: Understand The Online Application

This gives you some degree of privacy protection by separating your business from your personal finances. However, you may not obtain an EIN simply as a replacement for your Social Security number. Once you finalize your application and are assigned an EIN, the number can never be canceled. NerdWallet’s ratings are determined by our editorial team. The scoring formula takes into account the type of card being reviewed and the card’s rates, fees, rewards and other features. Close your business account with the IRS by writing a letter. If you close your account and launch another business in the future, you’ll need a new EIN at that point.

Is an EIN public record?

Your employer identification number (EIN), or FEIN, allows you to do business and report financial information to the Internal Revenue Service. However, an EIN number is a public record, making your company vulnerable to people who care less about your business.This article is for entrepreneurs and small business owners who need information about acquiring a federal tax identification number. If you have a corporation or LLC, it should have its own EIN for tax purposes. If you’re a sole proprietor, using an EIN means you won’t have to provide your social security number on W-9 forms. While it may seem complicated, this task can be accomplished for free in about 5 minutes. Because it’s so easy, it’s not worthwhile for you to pay a service to obtain your EIN. Secure the 9-digit employer ID number , also called a Tax ID Number, from the IRS so you can open a bank account, hire employees, and protect your personal assets. However, the rules differ if you’re a sole proprietor.

Forms & Instructions

An Employer Identification Number , also called a Tax ID Number, is a 9-digit code assigned by the IRS to identify your business. You can think of it as the social security number for your company. An EIN is required for a partnership, corporation, or LLC to open a business bank account, gain financing, hire employees, and more. You need to obtain an EIN from the IRS whenever you form a business that is legally separate from yourself. This includes forming a corporation, partnership, or a limited liability company with more than one owner. This is so whether or not your business hires any employees.

Option 1: Check Your Ein Confirmation Letter

The date of the end of your fiscal or accounting year. This is typically the month of December if you pay your taxes through the calendar year. The processing timeframe for an EIN application received by mail is four weeks. Mail a completed Form SS-4 to the address you’ll find on the IRS website’s “Where to File Your Taxes” (for Form SS-4) page. This Uber driver tax checklist will prep any rideshare driver for tax time.Make sure you keep this number safe so you’ll have it whenever necessary. You can also call the IRS to look up your federal tax ID number. If you have a legitimate need to find the EIN for another business, then you can use one of these options to look up the number. Only share the number with a limited subset of people—lenders, prospective suppliers, bankers, etc. You should guard your business’s EIN just like you would guard your social security number. Try purchasing a business credit report from any of the major credit agency. We recommend using a web calling service to save money on the call.

Is my EIN linked to my SSN?

An EIN is to a business as a SSN is to a person. The IRS tracks your personal tax filings with your SSN, just as it uses your EIN to keep tabs on your business filings. … Unless your business is a disregarded entity, you must use an EIN when filing a business tax return.In other words, you don’t need to obtain a separate tax ID number. You can apply for your EIN by fax, phone or mail; however, the IRS prefers that you submit your application online. When you do, you can receive your EIN immediately after completing the short application. Go to the IRS website to access the EIN Assistant page and click on “Begin Application” at the bottom to get started. The easiest way to find your EIN is to dig up your EIN confirmation letter. This is the original document the IRS issued when you first applied for your EIN.

How To Get An Employer Identification Number Ein

The name of a “responsible party.” This is a person who controls, manages, or directs the business operations. You are required to have an EIN by a state or local government agency. Your business tax ID number is important for many business milestones.You don’t need an EIN if you’re self-employed; you can simply use your Social Security number. It is very easy to look up your EIN number, and there are several ways you can do so.

Ein Lookup: How To Find Your Business Tax Id Number

If the entity is a corporation, the state or foreign country of incorporation. The company’s mailing address and street address if different from the mailing address. Once you complete all sections of the application, the system will generate a new EIN that you can begin using immediately.This article has been reviewed by tax expert Erica Gellerman, CPA. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. Here is a list of our partners and here’s how we make money. The IRS will ask for your business formation date and legal business name.For this reason, it’s wise to keep your personal Social Security number as private as possible. If you perform services as a sole proprietor or SMLLC for which you’re paid over $600 during the year, you must provide an EIN or Social Security number to your clients or customers. If you fail to do so, your clients must withhold 24 percent of your payments and send the money to the IRS. Getting an EIN allows you to avoid having to provide your Social Security number to clients and other members of the public. It’s particularly important to obtain an EIN if you expect to hire employees. Without a business tax ID number you won’t be able to withhold taxes from your employees’ pay or send the money to the IRS. Not having the tax ID number can result in severe IRS penalties.