Content

- Ready To Send Out Professional Invoices?

- Independent Consulting Jobs At Top Companies

- Free Invoice Templates

- When Is The Right Time To Send An Invoice To Your Contract Clients?

- Difference Between An Invoice And Bill

- What Should Be Included On An Invoice For Contractors

- Software

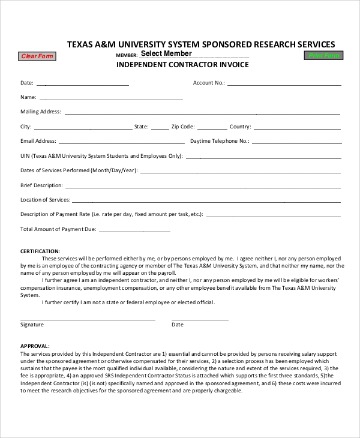

State that payment of the principal has been received, including the date of receipt. The Contractor shall include EFT banking information on the invoice only if required elsewhere in this contract. Description, quantity, unit of measure, unit price, and extended price of supplies delivered or services performed. If the contract does not require submission of an invoice for payment (e.g., periodic lease payments), the due date will be as specified in the contract.Contract work typically means you don’t have extra benefits, such as dental care, included in your work agreement, so you need to ensure your payments keep coming in. Whatever payment time period you choose, make sure it’s clearly noted on each invoice, and clarify what portion of the final ‘cost’ has been paid to date. You fit in easily, and get up to speed fast when you take on a contract position at a company or organization. Make sure you send out an invoice that is equally as effective at getting you paid by following these important invoicing steps. Since most carpet and tile jobs require a initial deposit, you might need to create two invoices.

Ready To Send Out Professional Invoices?

The information provided in the MBO Blog does not constitute legal, tax or financial advice. It does not take into account your particular circumstances, objectives, legal and financial situation or needs. Before acting on any information in the MBO Blog you should consider the appropriateness of the information for your situation in consultation with a professional advisor of your choosing. If you’re wondering if you are billing the right amount for your services, check out this article to learn more about how to calculate your bill rate. MBO helps companies in many industries engage successfully and compliantly with independent talent.Ever since that time, John has worked with hundreds of startups and thousands of entrepreneurs from all different backgrounds in helping them achieve their goals. Having been an entrepreneur his entire life, John understands what it takes to create and maintain a successful business. He enjoys sitting down and working with his clients in figuring out each of their unique challenges. Contractor invoice provides contractor with official way request some payments for their services, which were granted or obligated to be granted. However, even with an established policy in place, some client contracts may differ. In addition to having your own set of rules, it is also critical to understand your clients’ billing policies.Browse our blog posts, white papers, tools and guides on topics related to growing a small business and being successful. Work with fellow independents who have related skills to deliver enterprise-scale projects as a team. MBO Communities offers the power of working for an established company without giving up your independence. Please be aware that our agents are not licensed attorneys and cannot address legal questions.

Independent Consulting Jobs At Top Companies

Select the payment in question to see the card type and last four digits. Ask to see a copy of the card and the customer’s identification when you meet him or her in person. This article and related content is the property of The Sage Group plc or its contractors or its licensors (“Sage”). Please do not copy, reproduce, modify, distribute or disburse without express consent from Sage. This article and related content is provided as a general guidance for informational purposes only.

Free Invoice Templates

However, this gives you less visibility into how your customer is paying, so we recommend following these best practices. At some point, you’ll want to consider automating your invoicing process. Be sure to check outSage Business Cloud Accounting online invoicingto really streamline your whole operation. Sage Intacct Advanced financial management platform for professionals with a growing business. Invoicing and Payment.Fees will be invoiced annually in advance and otherwise in accordance with the relevant Order Form.

Can you sue someone over a verbal agreement?

Yes, you can sue for breach of verbal contract even if a handshake agreement didn’t occur. If one party accepted another party’s services, then the parties most likely reached an enforceable agreement. … Even though verbal contracts are as valid as written ones are, oral contracts are more difficult to prove.Unless otherwise specified on this order, no invoice shall be issued prior to shipment of the goods and no payment shall be made prior to receipt of both the goods and a correct invoice. Applicable discount periods shall be computed from the date of receipt of the goods and a correct invoice to the date Buyer’s check is mailed. Unless freight and other charges are itemized, discount shall be taken on the full amount of invoice. Managing accounting tasks such as time entry, invoicing, and collections requires accuracy, tracking, and follow-up. To eliminate this unnecessary stress and instead dedicate your valuable time to billable work, may want to consider a more comprehensive service option. MBO Partners can help you efficiently and compliantly complete these accounting tasks. Find resources, blog posts, tools and guides related to contracts and finance.

When Is The Right Time To Send An Invoice To Your Contract Clients?

Number your invoices– this simple tactic does much for establishing yourself as the real deal. If you’re sending your first invoice, you may want to assign it a higher number to come off as more experienced. Be professional, be polite– these two qualities can coexist on your invoice. Professional courtesies include the time-honored “please and thank you’s” as well as clear, honest reporting of your services. As you develop experience and foster relationships with repeat clients, your invoicing process may evolve into a more relaxed but streamlined process. Invoice and Payment.Unless otherwise provided in the applicable Order, invoicing and payment shall be in accordance with SBP Section 7.0. An invoice number is a unique number that’s assigned to each new invoice created.See the most commonly asked questions and answers about using Marketplace to find independent consulting jobs with top companies. Should things change as the job proceeds, the invoice can be updated to reflect final costs.

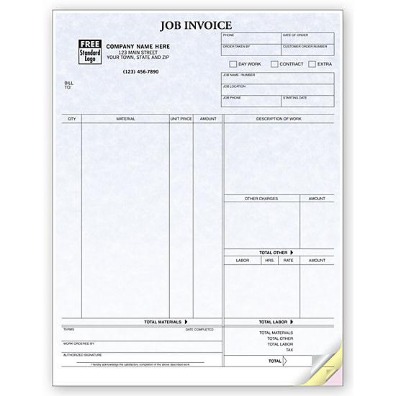

Difference Between An Invoice And Bill

Headings may include work order number, part number, unit cost, job description, labor cost and total price. If you performed multiple different services, list each one according to what the job required. You want to create an invoice you can be proud of and that your customers can easily read and understand.Use our crowdsourcing platform to source ideas from a community of over 500,000+ creative problem solvers. Since freelancers often negotiate directly with clients, they may also be able to capture more of the revenue too, rather than having to split it with an employer or other middleman. You’re probably already taking a few photos for your own reference, your company Facebook/Yelp page. Contract terms should be established before committing to a project, so that you both start off on the right foot. If you only accept credit or debit cards, make sure to clearly outline this in your payment options.

- The burden of proof that a classification of a specific product is, in fact, prevailing industry practice is upon the Contractor making the representation.

- Lessor will pay to suppliers, employees, contractors and government entities all expenses related to the operations of the Aircraft hereunder in the ordinary course.

- Often in the case of larger companies, there will be a dedicated billing department and your point of contact for invoicing will be different than your daily business contact.

- You can track your hours manually, by writing down the start and end time each time you work on a specific project, along with a brief description of the work completed.

- Lastly, remember that every client touchpoint reflects your brand—including invoices.

Any other information or documentation required by the contract (e.g., evidence of shipment). Name and address of Contractor official to whom payment is to be sent .

What Should Be Included On An Invoice For Contractors

John received his Bachelors Degree at John Jay College of Criminal Justice where he majored in Criminal Justice. Afterwards, he attended New York Law School where he focused his studies on Corporate and Securities Law.My experience includes serving as General Counsel to small businesses. I negotiate, draft and review a wide array of commercial contracts; provide business strategy and employment advice and assist in the sale of businesses entities. In reviewing agreements, I conduct risk analysis of contract and interpret the terms and conditions so that clients understand exactly what their obligations are under the agreement and are protected as much as the law requires. I am detailed and thorough in my review and drafting of agreements. Additionally, I advise clients on how to limit their liability and lower their contractual risk. Creating billing policies and procedures for your business is a key organizational task.

Software

Look to this group when you need highly-skilled outside talent to drive critical initiatives and organizational transformation for your business. Our independent business management platform enables successful solo independents and boutique consulting practices to position, scale and grow their book of business. If you charge by the hour, input your hourly rate and the number of hours it took you to do the job. In the description column, describe the work you did with specific details. If a work order was created, the job description on the invoice should match the information on the work order. Make the word “invoice” stand out on the page so anyone who receives it immediately knows exactly what it is, recommends FreshBooks. Below that, write the invoice number, invoice date, due date and terms of sale such as “net 10 days” or “net 30 days.” Each invoice you create should have a sequentially generated number that is unique to the job you are invoicing.