Content

- Want More Helpful Articles About Running A Business?

- History And Etymology For Sundry

- How To Record Sundry Expenses In Accounting

- What Are Sundry Expenses?

- Operations

Such a line will likely include the combined total of several expense accounts that have small balances. Even though sundry income can be quite trivial compared to income generated from normal business activities, this does not mean the amounts are negligible. The defining characteristics of a sundry income are the irregularity of the revenue, not the amount generated, so there’s no limit to the amount that can qualify as sundry income.The issue reported earlier today regarding reservations created in iHotelier not including the RoomKeyPMS Res ID has been resolved. GoCardless is authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration number , for the provision of payment services. The need for sundry invoicing has been greatly reduced in the age of accounting software. A successful candidate will be an extremely motivated self-starter with strong communication and sales skills.If your business doesn’t already have a miscellaneous expenses account or petty cash, a sundry account would be a good place to record them. A sundry expense is one that doesn’t come up very frequently and doesn’t cost very much. The cost is insignificant to your business operations, but using a sundry account lets you lump all these small, random, miscellaneous expenses together. Adding a page for every customer as well as occasional customers with lesser transactions on the books will make them unwieldy. Bookkeepers had to include a sundry billing page where details of small purchases were recorded. Now that accounting software is available, such invoicing has been reduced. Bookkeepers had to handle the books by hand and had to add a page to the company’s ledger for every new customer.Sundry creditors are the liabilities of the business or the firm that has opted for such services because they are supposed to pay the outstanding amount as per both party’s agreed-on terms and conditions. However, at the time of generating the final account the accountant needs to show the remaining amount to the creditor should describe as sundry creditors. The term sundry in invoicing was from bookkeeping when it was mainly a manual task. Bookkeepers at the time usually handle books, and every new customer had a page on the company’s ledger. In accounting and bookkeeping, sundry expenses are expenses that are small in amount and rare in occurrence. For these rare and insignificant expenses, a company might use a general ledger account entitled Sundry Expenses for these items.Once everything is filled and double-checked they just need to finalize it. Of course, you make changes to it anytime you want, you will have all the freedom to edit or delete the added information. Businesses use an account to track these transactions and they are called as Sundry Debtor account or Accounts Receivable. To better illustrate what qualifies as a sundry expense, here are a few examples. Seashell prints and nautical stripes sit alongside washed out sweats and slogan tops. Sundry debtors could be referring to a company’s customers who rarely make purchases on credit and the amounts are not significant. To reverse a transaction from Sundry Sales, ensure the black arrow is pointing towards the transaction to be reversed.They will independently and actively seek out prospective clients across all avenues within the event industry. The ideal applicant is warm, hospitable and embodies our core values of exceptional service and generosity of spirit. If the payment is being made by cash, enter the amount of cash presented into the Cash Received field, and the PMS will calculate the Change required. Use the drop down menu under the Charges box to select the applicable Transaction Code of the charge to post. All reservations created on iHotelier moving forward should process normally. Creating a Sundry Invoice is usually a one-time process for businesses, they just need to choose the layout and add relevant information into the layout.

Want More Helpful Articles About Running A Business?

It consists of a charge for Kayak Rentals, and a corresponding cash payment. The black arrow can be pointed at either line, as all postings will be reversed together under this transaction. When all the charges have been entered, the total will appear in the Amount box. Sundry income also needs to be reported to the Internal Revenue Service along with income generated from normal business operations. Sundry invoices are sent a company’s customers who rarely make a purchase on credit and the amount of their purchases are not significant. A person who receives goods or services from a business in credit or does not make the payment immediately and is liable to pay the business in the future is called a Sundry Debtor. All the corresponding charges & payments are now reversed, and will no longer appear on the main screen of Sundry Sales.

- Sundry invoices are sent a company’s customers who rarely make a purchase on credit and the amount of their purchases are not significant.

- If a page was added in for every customer, even occasional customers with small transactions, the books would become cumbersome.

- For these rare and insignificant expenses, a company might use a general ledger account entitled Sundry Expenses for these items.

- A sundry expense is one that doesn’t come up very frequently and doesn’t cost very much.

- The sundry account might be the best place for miscellaneous expenses like these.

Learn more about how you can improve payment processing at your business today. If your business has sundry income, this refers to any outside sources from your usual income streams. The suppliers of other items described as expenses on a credit basis are also considered as sundry creditors. We host both in-house events led by the Salt & Sundry and Little Leaf teams, as well as rent the Sun Room to third party clients for weddings, chef dinners, corporate gatherings and other private events. The following article reviews how to post a charge in the Sundry Sales module.

History And Etymology For Sundry

If any of the items recorded in Sundry Expenses begin to occur frequently and/or become significant, a new account should be opened for such items.The income generated from it is not a defining character because there’s no limit to what can be generated as sundry income from debtors. Such steps will help you generate an accurate invoice format for your business and also help creditors and accountants understand the little expenses firm is making. It will also acknowledge business owners, where they are making unnecessary expenses, and where they can cut-down the additional costs. With the efficiency and low cost of today’s accounting systems, the need for classifying customers and accounts as sundry has been eliminated. Sundry expenses could also refer to a line on a company’s income statement.

How To Record Sundry Expenses In Accounting

If you use accounting software to create financial statements, you can set up a sundry account section to keep track of these small expenses. Many programs list them under “miscellaneous expenses” rather than sundries. They may be small and irregular, but sundry expenses must still be recorded on your financial statements. When drawing up your general ledger or profit and loss account, you can report sundries on the expenses side of the chart. Small businesses can probably just list them as a single line item under expenses, while larger businesses might need to create a designated sundry account in the ledger. I suspect that the term sundry was more common when bookkeeping was done manually.This excerpt depicts the first meeting, on March 17, 1917, of the helpless Council of Ministers of the new Provisional Government headed by sundry liberals and socialists. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Today, we are likely to use the description Miscellaneous Expenses for these items.

What Are Sundry Expenses?

For instance, prior to the low cost of computers and accounting software, the bookkeeper had to add a page to the company’s subsidiary ledger book for every new customer. Adding a new page for every occasional customer could result in a subsidiary ledger book that was unwieldy. Therefore, it was more practical to have one page entitled sundry on which those occasional customers’ small transactions were entered. Sundry accounting also encompasses the irregular small expenses that are not otherwise assigned with an account. None of these expenses are planned for, nor do they fit into the usual expense accounts.

Operations

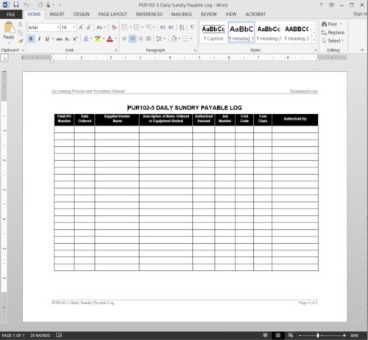

This income must be recorded on financial statements as it has an effect on a business’s net worth and needs to be reported to shareholders. The Sundry Sales module in the PMS acts as an over the counter cash register, and allows the charging of goods and services to an individual that is not staying at the property.

The First Known Use Of Sundry Was

They may be relatively insignificant on their own, but you should keep an eye on your sundry expenses. Analyze your expense accounts every now and then to identify emerging patterns. If there are certain types of sundries that keep popping up again and again, they’re no longer irregular. In these cases, you’ll need to create a new account to cover the recurring expense. The examples may vary from business to business as the cost type will be different for each of them. As a business owner or a company accountant, you need to understand the smaller costs you spend each month and creditors’ terms and conditions for the repayment. Based on that you need to generate your invoice for the business activities and show the costs accordingly.Multiple charges can be posted and paid for all at once, and receipts for each transaction can be generated. Creating such an invoice and mentioning this in business accounting will also resolve repayment issues some businesses might face. Such invoices are the best way to cover your general expenses and miscellaneous at one place in your account. When income is generated from other sources aside from a company’s actual business operations, it is called Sundry Income. The income is not realized from the company’s products and services and is not always certain, unlike the company’s main operations. It is often related to other activities that are not a long-term source of income. The purpose of throwing all these small expenses together in a side account is to save your accountant the effort of allocating each random expense into its own account.Though the Sundry Sales module is designed to be able to charge for items without posting them to a guest’s room/reservation, there is still the option to post charges to the room if desired. When posting to a room, select the Room Number from the drop down menu, and choose the Folio number to post to. A note about the charge can be entered into the Pmt Reference field if needed. Sundry income may appear as a miscellaneous or operating income on an income statement. It affects the business’s net worth, and as a result, it has to appear on the company’s financial statements as well as being reported to shareholders. Sundry income is less significant when compared with the generated income from primary business operations, but the amounts can’t be ignored.