Content

- Earnings Before Income Tax

- Free Accounting Courses

- Interest Expense

- Calculate Your Income

- Income From Continuing Operations

- Financial Statements, Taxes, And Cash Flow

- What Goes On An Income Statement?

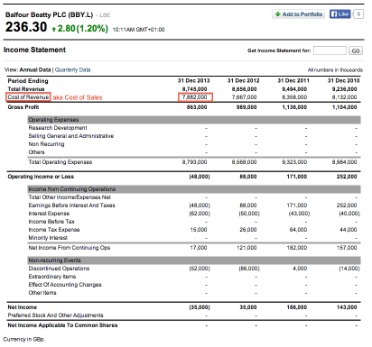

“Bottom line” is the net income that is calculated after subtracting the expenses from revenue. Since this forms the last line of the income statement, it is informally called “bottom line.” It is important to investors as it represents the profit for the year attributable to the shareholders. Cumulative effect of changes in accounting policies is the difference between the book value of the affected assets under the old policy and what the book value would have been if the new principle had been applied in the prior periods. For example, valuation of inventories using LIFO instead of weighted average method. The changes should be applied retrospectively and shown as adjustments to the beginning balance of affected components in Equity.

Earnings Before Income Tax

After revision to IAS 1 in 2003, the Standard is now using profit or loss for the year rather than net profit or loss or net income as the descriptive term for the bottom line of the income statement. Income tax expense – sum of the amount of tax payable to tax authorities in the current reporting period (current tax liabilities/ tax payable) and the amount of deferred tax liabilities . Other expenses or losses – expenses or losses not related to primary business operations, (e.g., foreign exchange loss). GAAP’s assumptions, principles, and constraints can affect income statements through temporary and permanent differences. The goal with earnings management is to influence views about the finances of the firm.

Free Accounting Courses

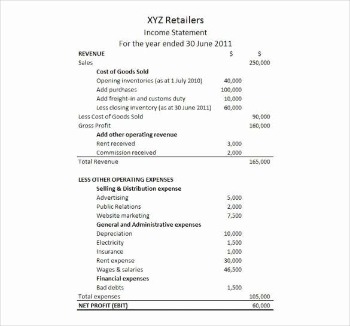

An income statement is a financial statement that shows you the company’s income and expenditures. It also shows whether a company is making profit or loss for a given period. The income statement, along with balance sheet and cash flow statement, helps you understand the financial health of your business. Recurring rental income gained by hosting billboards at the company factory situated along a highway indicates that the management is capitalizing upon the available resources and assets for additional profitability.Differences between IFRS and US GAAP would affect the interpretation of the following sample income statements. Broadly speaking, depreciation is a way of accounting for the decreasing value of long-term assets over time. A machine bought in 2012, for example, will not be worth the same amount in 2022 because of things like wear-and-tear and obsolescence. Income statements include judgments and estimates, which mean that items that might be relevant but cannot be reliably measured are not reported and that some reported figures have a subjective component.

Interest Expense

Microsoft had a 68% higher net income of $16.571 billion compared to Walmart’s $9.862 billion. James Chen, CMT is an expert trader, investment adviser, and global market strategist. He has authored books on technical analysis and foreign exchange trading published by John Wiley and Sons and served as a guest expert on CNBC, BloombergTV, Forbes, and Reuters among other financial media. However, changes in estimates (e.g., estimated useful life of a fixed asset) only requires prospective changes. Some numbers depend on accounting methods used (e.g., using FIFO or LIFO accounting to measure inventory level).

- This is because the report is comparing the second quarter of 2020 to the second quarter of 2021 as well as the first half of 2020 and the first half of 2021.

- Though calculations involve simple additions and subtractions, the order in which the various entries appear in the statement and their relations often gets repetitive and complicated.

- It does not differentiate between cash and non-cash receipts or the cash versus non-cash payments/disbursements .

- We also reference original research from other reputable publishers where appropriate.

- The following income statement is a very brief example prepared in accordance with IFRS.

- James Chen, CMT is an expert trader, investment adviser, and global market strategist.

This net income calculation can be transferred to Paul’sstatement of owner’s equityfor preparation. Indirect expenses like utilities, bank fees and rent are not included in COGS—we put those in a separate category. Such data is to color any hard-coded input in blue while coloring calculated data or linking data in black. After discounting for any non-recurring events, the value of net income applicable to common shares is arrived at.

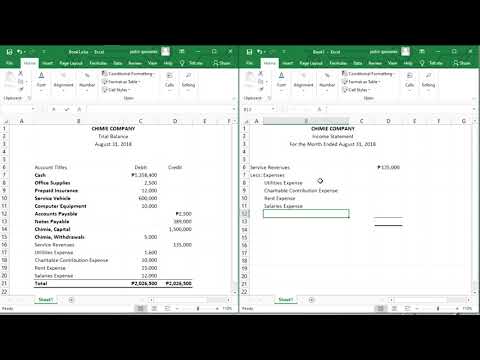

Calculate Your Income

When a business records an expense, its assets will decrease or its liabilities will increase. The income statement and the balance sheet report on different accounting metrics related to a business’s financial position. By getting to know the purpose of each of the reports you can better understand how they differ from one another. It shows the company’s revenues and expenses during a particular period, which can be selected according to the company’s needs. An income statement indicates how the revenues are transformed into the net income or net profit. To finalize your income statement, add a header to the report identifying it as an income statement. Add your business details and the reporting period covered by the income statement.Add up all the revenue line items from your trial balance report and enter the total amount in the revenue line item of your income statement. One of the limitations of the income statement is that income is reported based on accounting rules and often does not reflect cash changing hands. This could be due to the matching principle, which is the accounting principle that requires expenses to be matched to revenues and reported at the same time. Expenses incurred to produce a product are not reported in the income statement until that product is sold. Another common difference across income statements is the method used to calculate inventory, either FIFO or LIFO.

Income From Continuing Operations

Whereas the income statement records your income and expenses, the balance sheet covers your business’s liabilities, assets, and equity. It’s also important to remember that income statements cover a specific period. In contrast, the balance sheet provides a snapshot of what your business owns and owes at a single point of time. A multi-step income statement is a more complex income statement which reports different types of revenue and expense, allowing detailed analysis of the business.

What happens to your net worth if you sell your car for more than you owe?

The balance that you owe on the car loan is $7,000. You lose your job and can not afford to make payments on your loan so you sell the car for $9,000 and pay off the loan. … Before selling the car, your net worth is $12,000 – $7,000 = $5,000. After selling the car and paying off the loan, it is $2,000.Gross profit is calculated by subtracting Cost of Goods Sold from Sales Revenue. Financial modeling is performed in Excel to forecast a company’s financial performance.

Financial Statements, Taxes, And Cash Flow

Names and usage of different accounts in the income statement depend on the type of organization, industry practices and the requirements of different jurisdictions. This essentially demonstrates the added value of each unit of sales, as it focuses exclusively on the impact of the cost of goods sold . COGS represents the costs incurred from materials, labor, and production of each individual unit. This can be a great indicator of how scalable an operation is, and the relative return an organization will see as they achieve growth. Another useful metric is the gross margin, which underlines the variable costs attached to adding new units of sales. Depreciation refers to the decrease in value of assets and the allocation of the cost of assets to periods in which the assets are used–for tangible assets, such as machinery.

What Is A Common Size Income Statement?

Operating revenues and expenses are segregated from nonoperating income and costs, for example. This document will also generate a gross profit figure for your business. Next, you’ll need to calculate your business’s total sales revenue for the reporting period. Your revenue includes all the money earned for your services during the reporting period, even if you haven’t yet received all the payments.Comprehensive income is the change in a company’s net assets from non-owner sources. Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics.A balance sheet format can be broken down into two main sections – assets on one side, and liability and equities on the other. These sections will need to be recorded in a balanced format, meaning when an entry is inserted in one column, a corresponding entry will be made in the other column. Internal users like company management and the board of directors use this statement to analyze the business as a whole and make decisions on how it is run. For example, they use performance numbers to gauge whether they should open new branch, close a department, or increase production of a product. COGS only involves direct expenses like raw materials, labour and shipping costs. If you roast and sell coffee like Coffee Roaster Enterprises, for example, this might include the cost of raw coffee beans, wages, and packaging. A cash flow Statement contains information on how much cash a company generated and used during a given period.

Elements Of The Income Statement

Like the name mentions, the figures on the balance sheet must match as any increases or decreases must be offset. Unlike the income statement it does not provide information on how much money the company has made or lost, it only provides the amount of debt, cash and other assets that the company owns at that point in time. Every time a sale or expense is recorded, affecting the income statement, the assets or liabilities are affected on the balance sheet. When a business records a sale, its assets will increase or its liabilities will decrease.The total tax expense can consist of both current taxes and future taxes. Most businesses have some expenses related to selling goods and/or services. Marketing, advertising, and promotion expenses are often grouped together as they are similar expenses, all related to selling. The cost for a business to continue operation and turn a profit is known as an expense. Some of these expenses may be written off on a tax return if they meet the IRS guidelines. David Kindness is a Certified Public Accountant and an expert in the fields of financial accounting, corporate and individual tax planning and preparation, and investing and retirement planning. David has helped thousands of clients improve their accounting and financial systems, create budgets, and minimize their taxes.