Content

- Make Reconciling Invoices Simpler

- Learn About The 8 Important Steps In The Accounting Cycle

- Strategic Questions Every Law Firm Should Ask When Offering Payment Options To Clients

- Invoice Reconciliation

- Getting What You Paid For

- Types Of Invoice Reconciliation

- What Are Invoicing And Reconciliation?

Fora Financial is a working capital provider to small business owners nationwide. If you’d like to see a topic covered on the Fora Financial blog, or want to submit a guest post, please email us at . Then be sure to look at the invoice number for the statement to ensure they match. There are simple ways to resolve this, but you first have to know where to look. Once you identify an unprocessed payment, you can contact your bank to verify deposit dates. This allows accountants to waste less time on pinpointing where an error occurred.

What are the 3 types of reconciliation?

There are five main types of account reconciliation: bank reconciliation, customer reconciliation, vendor reconciliation, inter-company reconciliation and business-specific reconciliation. Let’s explore each one of them in detail.To help manage these finances, it’s important to verify the amounts you find on bank statements with the different incoming and outgoing invoices you have. This is called “invoice reconciliation” and is a key action to make sure your accounts are accurate. To efficiently perform invoice reconciliation, learn why it’s important, what it entails, and how to improve your process. There are plenty of things you need to keep in mind while doing invoice reconciliation. The first thing is that you need to make sure you are filing your invoices by using a deposit dates format and make entries as soon as you receive the payment. Put all the documents in chronological order, so it will be easier for you to keep track of the data. Then when you perform invoice reconciliation processes, you can skip the lengthy steps.

Make Reconciling Invoices Simpler

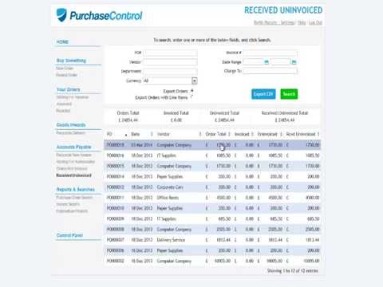

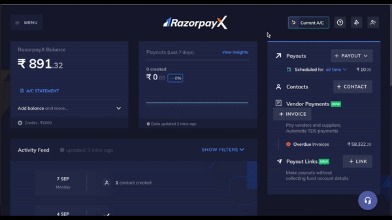

Juggling with the numbers in a spreadsheet is not everybody’s cup of tea. Moreover, business owners are so engaged in their work that they might not have enough time to deal with these. Therefore, it is best to have an online invoicing tool like Billbooks that would speed up the entire process. In such cases account reconciliation would help to figure out the causes behind such cases to help you balance your financial sheet. After verifying the details, sum up all your invoices for a particular vendor. Check whether the amount matches the one mentioned in the statement or not.Completing this list on a regular basis can become a tedious and time-consuming task for firm members, but that is not the only problem. Whether due to inaccurate calculations, fatigue, or simple carelessness, manual reconciliation processes often include mistakes. Organizing – For law firms that don’t use e-billing software, this can involve the collection of pages upon pages of invoices and statements. The cash used to make the purchases would be recorded as a credit in the cash account and a debit to the asset account.

Learn About The 8 Important Steps In The Accounting Cycle

We outlined the reconciliation process above, but yours may have slight variations. Invoice reconciliation is so fundamental that every accounting tool for business supports it. Also, depending on the tool you choose, you’ll be able to automate much of the reconciliation process. Before sending an invoice, ensure it’s consistent with your customer’s contract or purchase order.

Strategic Questions Every Law Firm Should Ask When Offering Payment Options To Clients

Some differences may be acceptable because of the timing of payments and deposits. Unexplained or mysterious discrepancies, however, may warn of fraud orcooking the books. Businesses and individuals may reconcile their records daily, monthly, or annually. To begin, organise your supplier invoices by month so that you can run reports to identify overdue payments. This will make the reconciliation process go more smoothly and easily.This is the best suitable way for accountants to examine specific accounting records and bank statements. Based on their findings they need to update the status of invoice amount and transactions made for that particular period. Your suppliers, accounting software, and the size of your team are a few of the factors that affect invoice reconciliation.With blockchain, a digital audit trail of changes is dynamically maintained for compliance management. Dispute resolution is evidenced with clear records of shipment milestones using time stamps. For a single event like gate in empty, data from the port, carrier and trucker are captured. With annual legal education requirements, most law firms do a great job of keeping their…

What is meant by billing payment reconciliation?

1. What is Payment Reconciliation? … When bank statements arrive, the costs and payments are cross-checked to ensure finances are correct. In essence, payment reconciliation is a method of bookkeeping that compares internally logged financial records with bank statements to ensure accounting is correct.In double-entry accounting, each transaction is posted as both a debit and a credit. Janet Berry-Johnson is a CPA with 10 years of experience in public accounting and writes about income taxes and small business accounting. The process of creating an itemised bill for goods sold or services provided that includes individual prices, total charges, and payment terms are known as invoicing. Invoice reconciliation software can alleviate a lot of the burden. Suppliers are notorious for expecting immediate payment of invoices, despite the high volume and lengthy reconciliation challenges that go with them. It certainly doesn’t help matters when they keep ringing through to chase their payment. Learning new spreadsheet skills via an online course is an easy way to up your DIY accounting.Otherwise, you can enter the invoice number into your accounting system for payment. When you reconcile invoices, you have two types of invoices to reconcile. These two types of invoices will require slightly different processes. PO Price Variance occurs when a vendor invoices above the PO price.

Invoice Reconciliation

First, organize your supplier invoices by month, so you can run reports to show overdue payments. This will help you have a smooth and simple reconciliation process. Suppliers will likely have their own ways of labeling and formatting their invoices.

Getting What You Paid For

For her first job, she credits $500 in revenue and debits the same amount for accounts receivable. The main purpose of invoice reconciliation is to identify fraudulent activities and track the timing issues. Whereas, if any anomalies rear their head causing irregularities in the amount leaving the bank account and money spent, then you use a reconciliation process to identify the black hole. Irregularities with an invoice are a common scenario for a business owner. This may turn out to be a recurring issue for those companies that rely on external vendors for goods and services. To understand the criticality of such a situation, it is important to understand what invoice reconciliation is. When an automated system ensures that each transaction is matched at the time of purchase, no transactions require further investigation.

- At Negotiatus, we’re firm believers in automating the invoice reconciliation process.

- For instance, if you have an invoice for 12 boxes of wood you received on the 11th, you should see this as a line item on the statement that indicates this is accurate.

- Otherwise, you can enter the invoice number into your accounting system for payment.

- Account reconcilement is the process of confirming that two separate records of transactions in an account are equal.

- “Accounts payable” refers to an account within the general ledger representing a company’s obligation to pay off a short-term debt to its creditors or suppliers.

Once you find parts that work, you can make adjustments as needed. See all posts Freelancing How to Ask for Upfront Payment If you’re looking to change your policies to reflect upfront payments, then you can use the following tips. Managing your own finances is tough when you have a business to run. When you come across items on your statement that are inaccurate, then you’ll need to place a circle around it. Just circle the items on the statement that don’t have a corresponding invoice to match it. So when you’re worried about employees theft, fraud, and embezzlement, then automating your accounting is ideal.Although this would mainly account for outgoing invoices, this is a great starting place to build automation into your process. Match with corresponding bank statements, so each account can be balanced. So, at the end of the month, pull your bank statement and double-check that your invoices match your deposits. Once you’ve received the invoice, compare your purchase order or receipt to the invoice. If there are discrepancies, you’ll need to let the vendor know and request an updated invoice.Accrued revenue—an asset on the balance sheet—is revenue that has been earned but for which no cash has been received. “Accounts payable” refers to an account within the general ledger representing a company’s obligation to pay off a short-term debt to its creditors or suppliers. Reconciliation is an accounting process that seeks to check two sets of records, often internal and external, to ensure that the figures are correct and in agreement. One account will receive a debit, and the other account will receive a credit. For example, when a business makes a sale, it debits either cash or accounts receivable and credits sales revenue . While verifying the invoices and statements if you find any discrepancies do note them down. Cross verify and if you find issues with invoice number or amount, then put a note about the inaccuracy.