Content

- Pay Bills

- Step 1: Set Up Your Company Payroll For Direct Deposit

- Setting Up Direct Deposit To Receive Payments

- Advantages & Disadvantages Of Paper Trails In An Organization

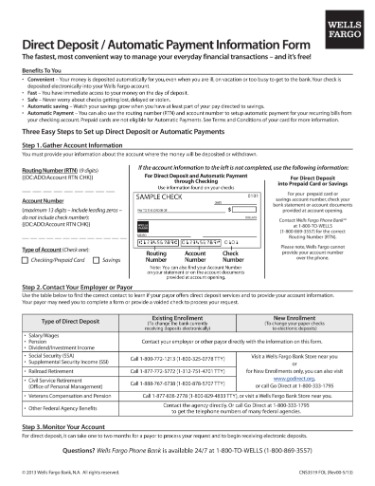

- Completing The Direct Deposit Authorization Form

- What About Banks That Say I Can Receive My Pay Up To Two Days Early?

- Direct Deposits Explained

First, ask for a copy of a canceled check, so you can verify the account and bank routing numbers manually. Next, do a single test deposit of a penny to ensure the payment goes through correctly. Banks often catch errors and will either put the money into the correct account or refund it back to you. To arrange a direct deposit with your bank, you can call and talk to a representative to lead you through the process, or use your online portal to do it electronically. Each bank is different, so reaching out to your local branch to find out their process is a good place to start.With direct deposit being the most popular payment method for employees, you may decide to jump on the bandwagon at some point. But if you’ve never paid employees via direct deposit before, you probably have a few questions about the setup process. To ensure your direct deposit is ready to roll, learn how to set up direct deposit for employees. The first thing you need to do when setting up direct deposit for employees is decide who is going to provide your direct deposit services. Under direct deposit, employees know exactly when their wages will be available. Contrast this with paper checks, which put the burden on the employee to find time for mobile deposits or bank trips. Direct deposit is clearly the winner for helping your employees achieve predictable, stable finances.On the other end of that transfer, therefore, direct deposit for your employee means they’re receiving an electronic payment , directly from your bank account to theirs. At the same time, you should update the deadlines for receiving your team’s pay cards or other time and attendance records. Upon receiving these records, you should review them and file them with your payroll service.

How do I pay 1099 employees direct deposit?

You can pay your 1099 contractors through payroll, and electronically deposit their payment into their bank account instead of paper checks. You will first need to set up your company to use direct deposit, then enter your contractor’s bank account information before you can pay them with direct deposit in payroll.Fit Small Business content and reviews are editorially independent. Next, you’ll have to go through some sort of verification process . Essentially, this process could be something as simple as a verification email, just to confirm that you in fact, are the administrator setting this up. Many or all of the products featured here are from our partners who compensate us.

Pay Bills

That being said, as a payroll company, we’ve literally helped thousands of businesses set up direct deopsit. So if you’d like a friendly resouce to walk you through some of the details, click here to get in touch with us. Finder.com provides guides and information on a range of products and services. Because our content is not financial advice, we suggest talking with a professional before you make any decision. Age can make a difference when choosing between prepaid debit cards and kids’ checking accounts.

- After initializing the direct deposit process with your chosen provider, your next course of action is to collect information from your employees.

- If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

- Payroll providers, meanwhile, often include direct deposit as part of their basic service package at no additional expense.

- You don’t have to worry about a bunch of employees cashing their paychecks at random intervals.

- Nacha is not a government agency, but it works directly with the Federal Reserve, state banking authorities and the Treasury Department.

It can verify your bank account automatically through its setup process and have you paying employees and payroll taxes in just a few days. Either of these options will give you the ability to send payments electronically through direct deposit. The employee then submits a copy of a voided deposit slip to the employer to allow the information on his bank account to be entered into the organization and bank software systems.

Step 1: Set Up Your Company Payroll For Direct Deposit

Direct deposit is easier, faster, and more eco-friendly and secure for both employers and employees. Allows the employee to formally give you permission to pay them via direct deposit. Both you and your employees keep a digital payment history that’s easy to keep track of — with no physical bookkeeping required. Pays employees in the US, boasting payments to 1 in 12 private-sector employees. Today’s digital landscape means limitless possibilities, and also complex security risks and threats.

Setting Up Direct Deposit To Receive Payments

The reduced risk of lost or stolen checks is beneficial to both employee and employer. Some banks don’t offer direct deposit but partner with a payroll provider that does. Bank of America, for instance, sends its customers to ADP for their direct deposit needs. Direct deposit is when your business deposits a payroll check directly into your employee’s account.And it’s quickly becoming the most popular way employees are choosing to be paid their wages. We’re going to explain how to set up direct deposit, and we even have a Direct Deposit Authorization Form available for free download.

Advantages & Disadvantages Of Paper Trails In An Organization

Accounts must be United States accounts that accept ACH transactions. It lets you electronically transfer funds from your company‘s bank account to your employees’ accounts—while minimizing risks and setting your payroll team up for success.

What taxes does a 1099 employee pay?

The IRS taxes 1099 contractors as self-employed. And, if you made more than $400, you need to pay self-employment tax. Self-employment taxes include Medicare and Social Security taxes, and they total 15.3% of the net profit on your earnings as a contractor (not your total taxable income).On the other hand, the ACH has strict standards to make sure that the direct deposit process is safe and secure. NACHA files are used to send banks the information necessary for electronic transactions, such as bank account numbers and deposit totals. Paying employees and contractors with direct deposit does require an initial investment in resources, time and planning. But once established, you will enjoy the speed, accuracy and safety of automated payments while having one more touchpoint when competing for talent. The ACH network also supports same-day payments, which usually involve an additional fee. Direct deposits are often instantaneous, but they can take one to three days, depending on your bank and the source of the deposit. Paychecks and government benefits are typically available immediately, but they can hold the funds until the next business day.

Completing The Direct Deposit Authorization Form

All the information entered by the employee will then be automatically connected to your payroll. The good news is there are tons of payroll service providers, so you won’t have to settle for subpar services. Financial institutions typically charge an initial setup fee of $50 to $149, plus transaction fees for every individual deposit, which averages between $1.50 to $1.90. Banks are also likely to charge monthly fees for your accounts.

Cons Of Direct Deposit

Let’s say this employer makes payroll payments on the 15th and last day of every month. Generally, one or more business days prior to payday, the company will send its payroll instructions to its bank, which then passes that information to the Automated Clearing House . The ACH operator sorts the ACH entries and ensures that each instruction is routed to the correct financial institution for each employee’s paycheck. Employees depend on their paychecks, which is why it’s important they receive them on time. Contact your financial institution or payroll services provider to find out exactly how much it costs to set up and maintain direct deposit. The financial institution or payment processor pays a fee to use the ACH Network, but Nacha does not track fees that a business may incur, according to McElrath. You’ll input the information provided by your employees into your business accounting or other payroll software.

What About Banks That Say I Can Receive My Pay Up To Two Days Early?

Your first pay run can take longer than usual, so allow extra time for set up to complete. It’s a good idea to run a test pay run of only a penny or other token amount.The “clearing” that takes place in the “house” is the approval of your deposits. If you don’t have enough funds in your account when your bank sends all your direct deposits to the ACH, your deposits won’t go through. Assuming you have enough funds, each employee’s bank will receive your deposit, credit the employee’s account accordingly and debit yours. There may be some costs involved in setting up direct deposit services for small business. Many banks charge a setup fee of $50 to $149, according to the NFIB. The size of the employer and the relationship with the bank could affect the amount of the fee. Some banks and payroll providers require payroll to be run a certain number of days in advance of payday for direct deposit.There are six easy steps you should take to set up direct deposits for employees. Approximately 82 percent of employees in the United States are paid by direct deposit for work, according to Next Gen Personal Finance. First, the employer must establish a bank account for its payroll activities. Direct deposit is the practice of transferring money electronically rather than giving someone a paper check. Although the direct deposit payment process for contractors is generally the same as for employees, you will need to maintain different paperwork. When you hire an independent contractor or firm, they’ll complete a W-9 tax form instead of the W-2 that employees use.

Direct Deposits Explained

To receive or send child support and maintenance payments electronically, contact your state’s department responsible for handling those payments. When receiving funds by direct deposit, the funds are added to your account without any action required on your part. Whether you’re out of town or too busy to make it to the bank, your account will be credited. Both employees and independent contractors are eligible for direct deposit. For contractors or freelancers, this may be a simple matter of preference.It’s a common payment method for employers of all sizes, and is popular because it reduces the amount of paperwork required to run payroll. Decide whether you’re going to use your bank or business software for payroll.