Content

- Send Out Payment Reminders

- Cut Contract Prep Time In Half For Free

- Typical Late Fee For Invoices: What You Should Know

- How To Inform Customers That You Will Be Charging Late Fees

- Late Fees Sample Clauses

- Charge A Late Fee For A Delinquent Payment

If Mark finally realizes that he’s to pay an extra charge because of late payment, and there’s another invoice in line for another month of pastry supplies. He can challenge the amount of an extra fee because he feels Annie will want to keep doing business with him. Yes, it is legal for a vendor to charge interest on unpaid invoices and there is no problem in changing for overdue invoices and the due date is passed.This adds urgency to the invoice and puts the onus of timely payment on to the customer. Adding a late fee caveat can influence faster payment by educating the customer about the repercussions of paying late and facilitating the prioritisation of these invoices over other pending bills. Likewise, it is important to ascertain with the customer as to what all details are mandatory and should be mentioned on the invoice to avoid invoice rejection and payment delay. Many vendors have specific requirements like provision of Purchase Order number, invoice to be made attention to a particular person or department, bill to / ship to addresses etc. on the invoice copy. Non-adherence to these specifications can adversely impact timely payments. The challenge here is when Annie should start sending payment reminders to Mark’s investors for her invoice payment. She’s a busy person surrounded by a hectic task with a small enterprise, and the $800 may likely affect her cash flow.

Send Out Payment Reminders

It’s also a good idea to use automated invoicing systems and accounting software like QuickBooks. Business owners can use QuickBooks to manage all invoices and track down missing payments more easily. Regularly tracking invoices can help you create a healthy cash flow and ultimately help boost your net profits. An easy way to track and manage your invoices is by using accounting software like QuickBooks. With QuickBooks, you can set up invoice reports and notifications to alert you to both paid and unpaid invoices. You can also choose a set time each month or quarter to check in on delinquencies.

- There are steps you can take to recover payment from customers who fail to respond to your payment reminders, including mediation and legal action , although this should be a last resort.

- Saying words and phrases such as “Please,” “Thank you,” and “If you have any questions, don’t hesitate to reach out” may seem small, but their effects are immeasurable.

- Annie’s Pastries in San Diego, California, delivers pastries five days a week to Mark’s investors, a company about 10 minutes walk from her store.

- Please let us know when we can expect to receive payment for this invoice.

- A shorter pay term will ensure faster cash flow and adequate working capital to meet your business requirements.

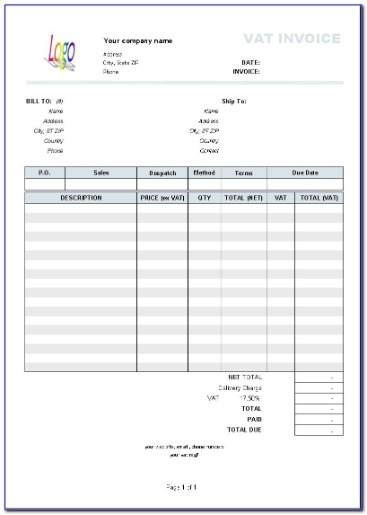

Late fees can be charged every at a flat rate or a monthly percentage of the total amount for the past due invoices. I bill once a month, usually on the 1st and give customers at least 15 days to pay. Now if someone doesn’t pay by the 1st of the following month I want to add in the late fee of $10. Should I tell them if payment isn’t received by due date they get the $10 late fee or should there be a little grace period. I’m looking for some ideas on wording that I can put at the bottom of my estimates. To work out the total fees; multiply the daily late payment fee by the number of days the invoice is overdue and add the compensation fee.

Cut Contract Prep Time In Half For Free

Let us know when we can expect to receive payment for the outstanding invoice. Make sure your invoice clearly states when their payment is due. You can also request clients to pay you a certain amount before you start working on projects.If you can encourage your clients to pay their invoices on receipt, regardless of the due date, both you and your client can relax knowing that everything is in order. And in most cases, choosing the right invoice wording is the best type of encouragement. Even if you don’t rely on clients paying their invoices to pay your monthly bills, waiting for a client to submit payment isn’t fun. If you grant the customer time to pay the bill, you can use the word “Net” followed by the number of days the customer has to pay, such as Net 7 days or Net 30 days. You may use the term “Net E.O.M” if you give customers until the end of the month to pay.

Typical Late Fee For Invoices: What You Should Know

It’s important to let customers know in advance that you will be charging late fees on overdue invoices so as not to damage your client relationships. A late payment fee is an extra charge fined against a client for not paying a bill by its agreed-upon due date. To charge a late payment fee, you must include payment expectations within your original contract or sales agreement. In addition, when charging a client a late fee penalty, the invoice provided must list the due date and the late fee percentage or amount. If you’re a Satago customer, you can add late fees to your invoice payment reminders automatically. The platform will calculate the fees for you in line with statutory limits and add them to your automated payment reminders as soon as an invoice becomes overdue. Remember keeping your clients happy should be your number one priority.

What is the standard late payment fee on an invoice?

Generally, however, the typical late fee for invoices among freelancers is roughly 1.5% monthly interest. While the 1.5% rate may hardly burn clients’ pockets, it often works effectively. For the most part, it’s motivating enough to encourage customers to settle their debts, without making them feel swindled.Include your invoice details and the total amount due on the subject line. In such a case, make sure you link to the invoice where clients can pay with their credit card in your email. You can charge interest on unpaid invoices if you stay within the bounds of the law.

How To Inform Customers That You Will Be Charging Late Fees

She lives in the Adirondacks Mountain in upstate New York where, when she’s not shoveling snow, she writes young adult fiction, enjoys boating on Lake George and hiking in the woods. Well, email reminders are quick and easy to send compared to mailed reminders, which require postage and delivery time. Maintaining well-managed invoices is the first step to ensuring you get paid on time.

Late Fees Sample Clauses

Learn how to add ‘Pay Now’ button on invoices by integrating a payment gateway. With all the clarity and respect both vendors and buyers can do business without any complications. Everything goes with the flow as both the parties agree to the invoices’ terms and conditions. If Mark signs and sends back the form to Annie, that means he is convenient and comfortable with her policy. She has a strong case and can take legal actions against Mark if he fails to add interest.You’ll be surprised how quickly your clients pay their invoices when all it takes is a simple click. However, this method does not always ensure immediate payment, because it can take the purchaser’s accounts payable department some time to issue the payment. The best thing for Annie is to make a call for a reminder almost every day for getting paid after her payment is overdue to her debtor, Mark. She calls Mark to find out that he’s been sick or something else is there for about a week, just around the time she sent the invoice. He was then flown overseas for business meetings for up to 2 weeks; for this reason, her invoice has been delayed.