Content

- Common Types Of Invoices

- Why Current Deep Learning Tools Don’t Suffice?

- What To Include On An Invoice

- When Does An Invoice Get Paid?

- Charge Summary

- Create, Send, And Track Invoices

- Crucial Parameters Of An Invoice

Digitizing information has several advantages a business can gain on several grounds. Businesses can track their processes better, can provide better customer service, improve the productivity of their employees and reduce costs. Docsumo significantly reduces the manpower required to be employed for processing invoices, thus improving the cost-effectiveness of the whole operation. With minimal manual intervention required only to validate the anomalies detected while capturing data, Docsumo truly automates the entire invoice reading process.

Common Types Of Invoices

While the prices on a pro forma invoice can change at any time, a commercial invoice is legally binding. If you issue one of these, you can’t change the price until the invoice has expired.

Why Current Deep Learning Tools Don’t Suffice?

The process of reviewing invoices has evolved a lot over time. The growth in technology has seen the process of invoice processing move through three major phases. The Charge Summary section breaks down your invoice total into individual charges. Some charges covered by this invoice are retroactive, meaning you are paying for usage in the previous month, while others are proactive, meaning you are paying for services for the upcoming month. This information is broken down in the Service Period column. A pro forma invoice shows items and costs, but they’re not a legal record of a sale. Mortgage lenders receive multiple identity and income verification documents along with different forms from loan applicants in a variety of formats and styles.Payment terms also inform the customer of what preferred payment method the supplier of service accepts. Some payment terms can be confusing, especially when the customer has his own payment time, and does not agree with that of the supplier.

- When the supplier of goods gets paid for the invoices, he can reference the invoice number to keep a record of the invoices that have been paid, after which the transaction becomes closed.

- And you can increase the likelihood of getting paid on time, every time.

- The process of reviewing invoices has evolved a lot over time.

- Building a vendor repayment system, for example, requires us to include several steps.

- The purchase order, once signed, is considered to be a legally binding agreement.

This store can save a lot of time by automating the process of invoice processing. With an automated data extraction solution, loan documents can automatically be processed end-to-end without any human errors and delays. Automation in loan document processing prevents downtimes, eliminates data redundancy, and allows companies to respond faster to client queries. A past due invoice is an unpaid invoice that is past its due date. When an invoice is past due, it means your customer or client hasn’t paid you according to the agreed payment terms. Past due invoices can impact cash flow, and collecting overdue invoices can cost business owners time and energy.

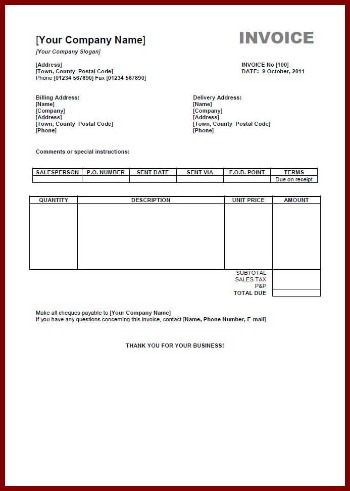

What To Include On An Invoice

A bill refers to a document of sale wherein customers pay immediately. Customers may also use the term “bill” to describe a request for payment due to their vendor.You may choose to collect half of the payment upfront or partial payments over time or require immediate payment upon completion. To increase the likelihood of receiving payment on time, provide clear details about payment expectations. Your payment terms should specify the amount of time the buyer has to pay for the agreed-upon purchase. Within an invoice, you must provide your business contact information, including name, address, phone number, and email address, along with your client or buyer’s information. Businesses can use invoices to track what customers owe in total as a way to monitor cash flow. For example, Jack is the owner of a landscaping company in Florida.

When Does An Invoice Get Paid?

If you own a service-based business, include the title of your project, as well as a description of the activities you perform. If you’re selling a range of products, include your SKU or product ID in the itemized list on your invoice.This reference number establishes a paper trail of information for you and your customers’ accounting records. Assign invoice numbers sequentially so that the number on each new invoice is higher than the last. Invoices aren’t necessarily due immediately when customers receive them.

Charge Summary

The information included in commercial invoices is used to calculate tariffs. It’s important to remember that 30 days is not equivalent to one month. If your invoice is dated March 9, clients are responsible for submitting payment on or before April 8. Businesses may also set invoice terms to Net 60 or even Net 90, depending on their preferences and needs. Choose invoicing terms that encourage early payment to maximize your cash position and the likelihood of getting paid.Invoices are a critical element of accounting internal controls. Charges on an invoice must be approved by the responsible management personnel.

How much tax do I pay on an invoice?

What tax rate do I use? The current standard California statewide sales and use tax rate is 7.25 percent.An invoice carries more information than just the five parameters mentioned above; however, this extra information does not adversely impact full-cycle accounts payable. These documents are a legal tender that binds the supplier to fulfill the delivery of the goods ordered by the buyer as per the terms and conditions mentioned in the purchase order. These numbers act as identifiers when a payment from the buyer is initiated – it helps the vendor pinpoint the sale for which the payment is being received against an invoice. It helps in keeping the ledgers duly updated and categorized.

Create, Send, And Track Invoices

With QuickBooks Payments invoicing features, you can accept payments, send custom invoices, and take advantage of automatic matching to streamline your bookkeeping. Financial statements update in real time, immediately reflecting shifts in your accounts receivable and bank account balances. A debit invoice is issued when a business needs to increase the amount a client owes for a service or product. It is advisable for vendors working with a company for the first time to ensure that payment terms are agreeable to both parties. In this case, John could have asked for an immediate deposit of 30% of the fee paid up front, before he began his work.Specify who to make the check out to, how to process an online payment or where to call for a credit card payment. The supplier’s contact information includes the correct supplier’s name, company name, and address, email address, phone number, details of the accounting department. If any of this information is missing, then you might get a late payment. It is issued by the vendor (or “seller”) of a product or service, once the products have been delivered or the services have been completed. Let’s say halfway through a transaction, the client decided that he needed 12 items of a product, instead of 10.While similar information is included in sales receipts and invoices, they are not the same. An invoice is issued to collect payments from customers, and a sales receipt documents proof of payment that a customer has made to a seller. Receipts are used as documentation to confirm that a customer has received the goods or services they paid for, and as a record that the business has been paid.

Crucial Parameters Of An Invoice

There are many different sections in writing an invoice and missing one may leave you looking unprofessional. The interval of payment release from a buyer to the seller is usually indicated in the terms of payment of an invoice. An invoice must state it is an invoice on the face of the bill. It typically has a unique identifier called the invoice number that is useful for internal and external reference. An invoice typically contains contact information for the seller or service provider in case there is an error relating to the billing. An invoice is a document that maintains a record of a transaction between a buyer and seller, such as a paper receipt from a store or online record from an e-tailer.If your attempts to collect payment aren’t successful, you have a few options, such as invoice factoring or taking legal action. Letting customers know you offer discounts for early payments or charge late fees on overdue invoices may encourage them to make timely payments. The invoice date indicates the time and date the vendor officially records the transaction and bills the client. The invoice date is a crucial piece of information, as it dictates the payment due date and credit duration.