Content

- Why Is Merchandise Inventory A Current Asset?

- Accounting Standards Relating To Depreciation & Inventory

- Cash And Cash Equivalents

- Division Of Assets

- How To Calculate Current Assets

- Examples Of Current Assets

- Do Gains & Losses Have To Be Recognized Before Appearing On An Income Statement?

- Current Asset

Even though it is found in the assets portion of the balance sheet at many small businesses, inventory has some unique properties that make it different from other assets. Accounting rules for inventory differ from other assets, and investors treat this balance differently. Understanding how inventory differs from other assets can help you ensure that you account for inventory the right way. Any inventory that is expected to sell within a year of its production is a current asset. Inventory production is typically closely correlated with demand, so it will almost always be sold within a year or being produced, making it a current asset.

- Instead of taking out a loan to fund repayments, selling assets like clothing or electronics can be a great alternative.

- As usual, for these funds to be a current asset, they must be expected to be received within a year.

- Important Financial RatioFinancial ratios are indications of a company’s financial performance.

- It can have an impact on the business’s reputation by creating a disappointing experience for your customers.

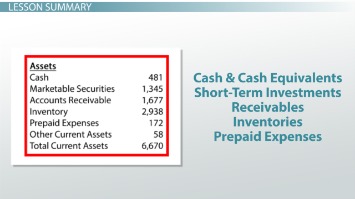

- Current assets can consist of multiple factors including cash and cash equivalents, accounts receivable, inventory, and prepaid expenses.

- Ignore merchandise inventory and you immediately squander an opportunity to enhance the health of your business.

Inventory is considered to be sold in less than 1 year and hence, is recorded as a current asset. Raw Materials InventoryRaw materials inventory is the cost of products in the inventory of the company which has not been used for finished products and work in progress inventory. Raw material inventory is part of inventory cost which is reported under current assets on the balance sheet.The liquidity of a businesses’ inventory depends on its demand, depreciation, seasonality, industry sector, and other factors. So, while you think you can offload that backstock of 10 excavators at $100,000 per-item, it won’t matter unless there’s a need for them. Managing large quantities of inventory and understanding its value can be very difficult for some businesses.

Why Is Merchandise Inventory A Current Asset?

Now use that knowledge in your in your inventory forecasting and when calculating your fill rate to make the most of your product. Financial modeling is performed in Excel to forecast a company’s financial performance.

Accounting Standards Relating To Depreciation & Inventory

Common examples are property, plants, and equipment (PP&E), intangible assets, and long-term investments. Notes receivable are also considered current assets if their lifespan is less than one year. Merchandise inventory is any product a company currently has on hand that is intended for sale. There are many examples of merchandise inventory, including shoes, books, headphones, food products, and auto parts. Remember, merchandise inventory is just one of many differences between B2B vs. B2C businesses.Some inventories, for example, Agriculture resources, have a shelf life. After a certain amount of time, the inventory becomes stale and obsolete and could not be used for further manufacture. Such shelf life is usually less than one year more, so making it be recorded as a current asset. The Company will have to dispose of off such inventory if it is not used within the shelf-life period, thus incurring losses. Therefore, the Company cannot maintain a massive inventory due to storage cost and shelf life.

Cash And Cash Equivalents

That’s because, fundamentally, merchandise inventory is goods that are intended to be resold at a higher price than they were acquired for. Manufacturing inventory, MRO inventory, and raw materials inventory are not considered merchandise inventory . The conceptual explanation for this is that raw materials, work-in-progress, and finished goods are turned into revenue.

Is inventory treated as investment?

The inventory is treated as an investment when a good amount of the money is used to buy the bulk of the inventory for the large scale of the business operations. The demand for investment in the bulk of inventories can be changed as per the accounting year and the demand and supply for the goods.It gives them all the tools they need to better manage their business and keep track of their inventory and stock. This is when a company owes money, whether it be to their creditors, suppliers, etc. Now that the term “current asset” has been defined, here are a couple of asset examples. They ensure that they have sufficient inventory in the stores so as not to disrupt their business and also that it is used such that it does not cost them storage or wastage. As can be seen in the below snapshot from the consolidated balance sheet of Apple Inc., the inventory is recorded as the Current asset. A current asset is any asset that is expected to provide economic value within one year. If a business sells something to another business, the transaction also usually takes the form of a line of credit, adding to accounts receivable.Thus, any change in the calculation of ending inventory is reflected, dollar for dollar , in net income, current assets, total assets, and retained earnings. Cash is the primary current asset and it’s listed first on the balance sheet because it’s the most liquid. It includes a business’ checking account that’s used to pay expenses and receive payments from customers. Accounts receivable represent the amounts in a company’s accounts that show money that is owed to the company by its customers, and in which they are expected to collect within a year. This type of current asset exists when a business’s customers purchase their goods or services using a line of credit. As long as the credit period is less than one year, it is considered a current asset.

Division Of Assets

The cost of any merchandise inventory sold during an accounting cycle is reported as an expenditure on the income statement for the cycle in which the sale was made. Any merchandise inventory not sold during an accounting cycle is registered as a current asset and included in the balance sheet until it’s sold. A current liability is a debt that a company needs to pay or settle with cash within 12 months. Current assets within a business are often used to help settle these liabilities. The difference between a current asset and current liability is known as working capital, representing operational liquidity available to a business. Positive working capital is needed to ensure that a company is able to maintain its business and has adequate funds to satisfy short-term debts and future expenses.

How To Calculate Current Assets

Inventory is said to be sold within the time of twelve months, and that’s why it is listed as a current asset. But businesses must maintain the level of their inventories, as excess inventories may become a liability for the business. Also, according to their shelf life, some items are perishable means they could become obsolete or can be spoilt. Since they’re long-term investments, they can’t be easily turned into cash within a year. The balance sheet reports on an accounting period, which is typically a 12-month timeframe.Since the cost of goods sold figure affects the company’s net income, it also affects the balance of retained earnings on the statement of retained earnings. On the balance sheet, incorrect inventory amounts affect both the reported ending inventory and retained earnings. Inventories appear on the balance sheet under the heading “Current Assets”, which reports current assets in a descending order of liquidity. Because inventories are consumed or converted into cash within a year or one operating cycle, whichever is longer, inventories usually follow cash and receivables on the balance sheet. Inventory is usually considered a current asset, because you normally sell through inventory in a year or less.

Examples Of Current Assets

As usual, for these funds to be a current asset, they must be expected to be received within a year. Accounts receivable are funds that a company is owed by customers that have received a good or service but not yet paid. Similar to cash equivalents, these are investments in securities that will provide a cash return within a single year. Cash equivalents are any type of liquid securities that are not in the form of cash currently, but that will be in the form of cash within a year.

Do Gains & Losses Have To Be Recognized Before Appearing On An Income Statement?

If you have too much inventory, your items could become obsolete, they could expire or spoil (e.g., food items), and you’ll spend too much money on manufacturing and storing the merchandise. And if you’re short on inventory, you’ll lose sales and likely have frustrated customers who can’t purchase your product because it’s out of stock. It also includes imprest accounts which are used for petty cash transactions. These are assets that will turn into cash within a year from the date displayed at the top of the balance sheet.Here’s a merchandise inventory quiz to reiterate some of the more important points from this post. If you want to earn that warehouse manager salary, you should be able to answer these questions. Merchandise inventory is not only reflected on the balance sheet, but also used to calculate COGS. Food items are perishable, for example, and can get spoilt or technological items that might become obsolete. To avoid these kinds of situations in your business, you must maintain your inventory by keeping a balance.It is possible to calculate current assets on our own, given you have the proper knowledge, patience, and tools. John Freedman’s articles specialize in management and financial responsibility. He is a certified public accountant, graduated summa cum laude with a Bachelor of Arts in business administration and has been writing since 1998.Tracking merchandise inventory turnover is a good way to understand how efficiently your company controls merchandise. Specifically, you should work toward establishing and maintaining high merchandise inventory turnover. Keep a close eye on inventory tracking numbers to make adjustments on the fly. Merchandise inventory turnover rate reflects a company’s ability to sell its products. It gives you a metric to focus on improving to enhance your sales pipeline.